Takeda Pharmaceutical (TSE:4502) Valuation Check After Recent Share Price Momentum

What recent performance might be telling you

Takeda Pharmaceutical (TSE:4502) has caught investor attention after a recent stretch of positive returns, with the share price up over the past week, month, past 3 months and year to date.

That shorter term strength sits alongside a 1 year total return figure and multi year total return track record. This has prompted some investors to compare those gains with Takeda’s reported revenue, net income and current valuation metrics.

See our latest analysis for Takeda Pharmaceutical.

The recent 13.2% 1 month share price return and 20.5% 3 month share price return, alongside a 27.9% 1 year total shareholder return and multi year gains, suggest momentum has been building rather than fading around the current ¥5,087 level.

If Takeda’s move has you rethinking the sector, this could be a good moment to widen your watchlist across other pharma stocks with solid dividends that combine income potential with large cap stability.

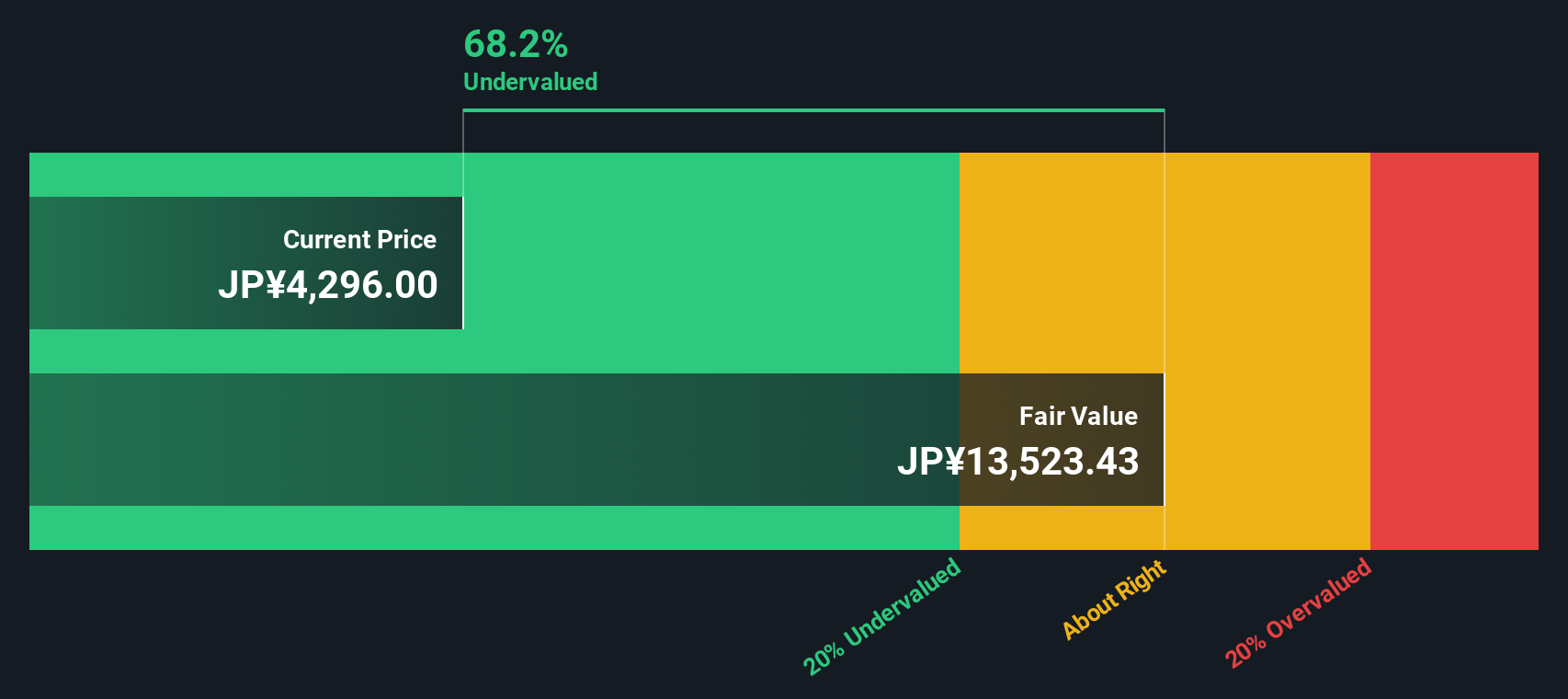

With the share price sitting around ¥5,087 and an intrinsic value estimate implying a roughly 59% discount, the key question now is whether Takeda still trades below its fundamentals or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 2.8% Overvalued

Takeda’s last close at ¥5,087 sits slightly above the narrative fair value of about ¥4,946, which frames a relatively tight valuation gap built on detailed earnings and margin forecasts.

The analysts have a consensus price target of ¥5056.071 for Takeda Pharmaceutical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5900.0, and the most bearish reporting a price target of just ¥4500.0.

Want to see what justifies paying more than today’s earnings might suggest? The narrative leans on higher future margins, steadier revenue and a richer earnings multiple. Curious how those pieces fit together into that fair value line? Read on to unpack the full playbook behind these projections.

Result: Fair Value of ¥4,946 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that tougher generic competition or weaker than expected trial results could quickly challenge the current earnings and valuation story.

Find out about the key risks to this Takeda Pharmaceutical narrative.

Another view on valuation

While the narrative fair value of ¥4,946 points to Takeda looking 2.8% overvalued, our DCF model lands in a very different place, with a fair value estimate of ¥12,446.65 against the current ¥5,087 price. That gap suggests a very different risk reward trade off. Which story do you trust more: the near term narrative or the longer term cash flow view?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Takeda Pharmaceutical Narrative

If parts of this story do not sit right with you, or you would rather weigh the numbers yourself, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Takeda is already on your radar, do not stop there. The screener can surface more focused ideas that match your style and keep you ahead.

- Scan for income opportunities by checking out these 12 dividend stocks with yields > 3% that may suit investors who want regular cash returns alongside potential capital gains.

- Hunt for mispriced opportunities with these 882 undervalued stocks based on cash flows, where current market prices sit below estimated cash flow based values.

- Spot potential growth themes early by reviewing these 27 AI penny stocks that sit at the intersection of technology and long term structural trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報