January 2026's Top Growth Companies With Insider Confidence

As the United States market navigates a mixed landscape with the Dow Jones Industrial Average reaching new highs while the Nasdaq faces pressure from data-storage shares, investors are keenly observing sectors that demonstrate resilience and growth potential. In this environment, companies with high insider ownership can signal strong confidence from those who know the business best, making them attractive considerations for growth-focused portfolios.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 32.2% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FirstSun Capital Bancorp (FSUN) | 37.1% | 42.9% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 43.6% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Here we highlight a subset of our preferred stocks from the screener.

BillionToOne (BLLN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BillionToOne, Inc. is a precision diagnostics company that focuses on quantifying biology to develop molecular diagnostics, with a market cap of $4.34 billion.

Operations: The company generates revenue primarily from its Medical Labs & Research segment, amounting to $254.14 million.

Insider Ownership: 11.2%

BillionToOne, Inc. is experiencing significant growth with strong insider buying and no substantial selling in the past three months. The company is trading below its estimated fair value, with analysts predicting a 51.3% stock price increase. BillionToOne's revenue growth outpaces the market at 23% annually, and it recently achieved profitability with US$1.51 million net income for Q3 2025. Additionally, their innovative liquid biopsy platform was selected for a major Japanese cancer study, enhancing its clinical credibility and market potential.

- Dive into the specifics of BillionToOne here with our thorough growth forecast report.

- According our valuation report, there's an indication that BillionToOne's share price might be on the cheaper side.

Frontline (FRO)

Simply Wall St Growth Rating: ★★★★☆☆

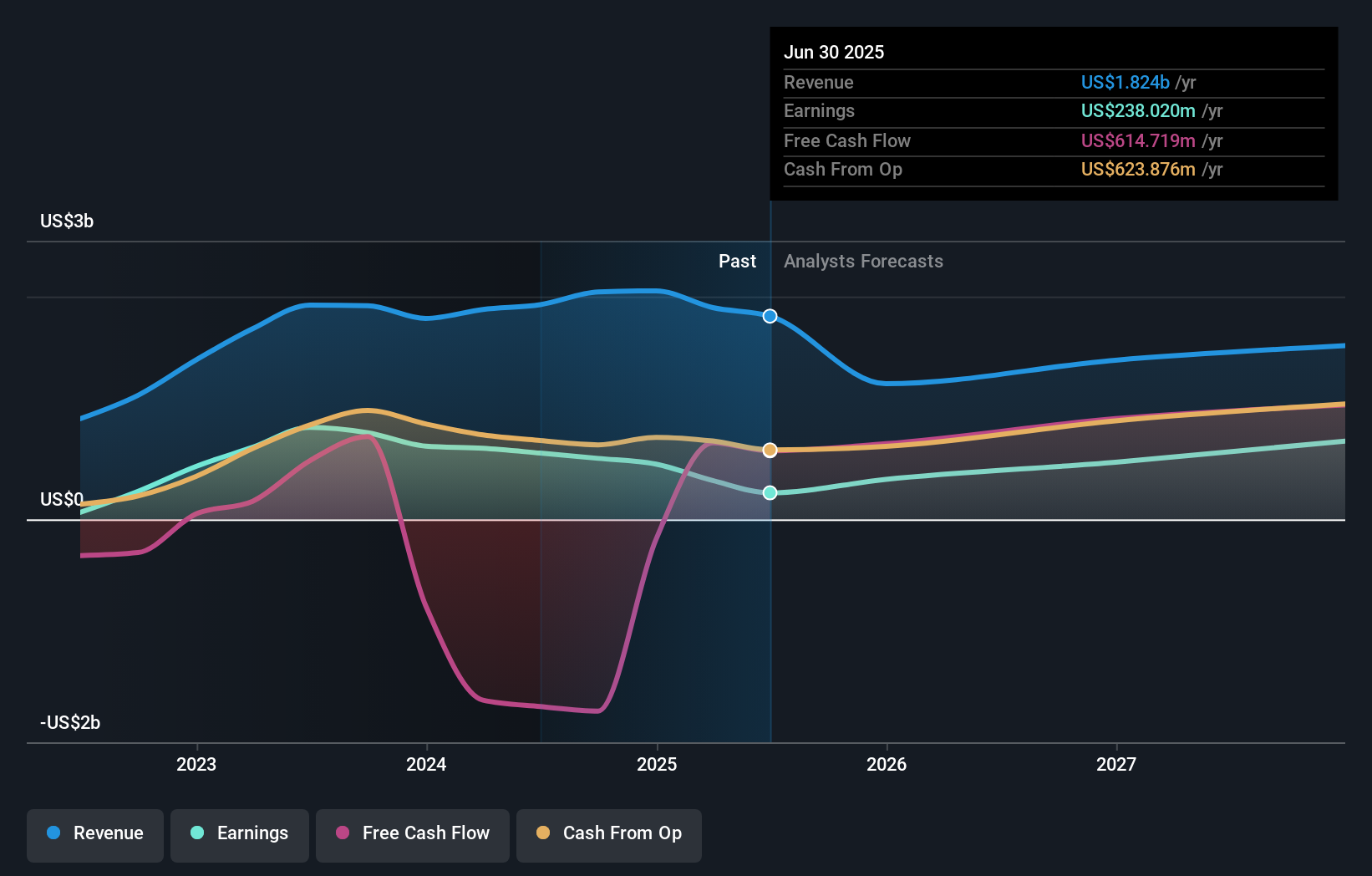

Overview: Frontline plc is a shipping company that owns and operates oil and product tankers globally, with a market cap of $4.81 billion.

Operations: The company generates revenue of $1.77 billion from its tanker operations worldwide.

Insider Ownership: 35.9%

Frontline's insider ownership aligns with its expected annual earnings growth of 37.7%, surpassing the US market average. However, revenue is forecasted to decline by 2.7% annually over the next three years. The company trades at a significant discount to its estimated fair value, though profit margins have decreased from last year due to large one-off items impacting results. Recent board changes and dividend reductions reflect ongoing strategic adjustments amidst financial challenges.

- Get an in-depth perspective on Frontline's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Frontline's current price could be quite moderate.

Workiva (WK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workiva Inc. provides cloud-based reporting solutions globally and has a market cap of approximately $4.86 billion.

Operations: The company's revenue is derived from its Data Processing segment, which generated $845.52 million.

Insider Ownership: 10.5%

Workiva's insider ownership is accompanied by a forecasted annual earnings growth of 124.7%, significantly higher than the US market average. Despite recent insider sales, the company's revenue is expected to grow at 14.1% annually, outpacing the broader market and indicating robust potential. Executive changes, including a new CFO and Chief Revenue Officer, aim to enhance strategic execution as Workiva focuses on expanding its AI-powered platform globally while trading below estimated fair value.

- Click to explore a detailed breakdown of our findings in Workiva's earnings growth report.

- Our valuation report here indicates Workiva may be undervalued.

Key Takeaways

- Delve into our full catalog of 211 Fast Growing US Companies With High Insider Ownership here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報