LifeStance Health Group (LFST) Valuation Check After Recent Share Price Momentum

Why LifeStance Health Group Is On Investors’ Radar

LifeStance Health Group (LFST) has drawn attention after recent share price moves, with the stock closing at US$7.30. That puts fresh focus on how its growth profile and valuation currently line up.

See our latest analysis for LifeStance Health Group.

The recent 30 day share price return of 13.88% and 90 day share price return of 36.19% suggest momentum has been building. However, the 1 year total shareholder return shows a decline of 5.19%, in contrast with the 3 year total shareholder return of 43.42%.

If LifeStance’s move has you looking across the sector, this could be a useful moment to scan other US-listed healthcare stocks that match your criteria.

With revenue of US$1.37b, a small net loss of US$9.12m and a value score of 1, the question is whether LifeStance is still cheap or if the recent share price run already reflects expectations for the business.

Most Popular Narrative Narrative: 13.4% Undervalued

With LifeStance Health Group’s fair value set above the recent US$7.30 close, the widely followed narrative leans toward upside based on long term fundamentals.

The continued and accelerating demand for mental health services in the U.S., driven by increasing public awareness and access to insurance coverage, is expected to expand LifeStance's addressable market and support sustained double-digit revenue growth in the coming years.

Curious what kind of revenue and margin profile could justify that view, and what earnings level this narrative is working toward over time? The full set of assumptions, including how future profits and the chosen discount rate interact to reach that fair value, sits inside the complete valuation story.

Result: Fair Value of $8.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh up risks such as heavier competition and reimbursement pressure, which could squeeze visit volumes, pricing power, and future margins.

Find out about the key risks to this LifeStance Health Group narrative.

Another View On Valuation

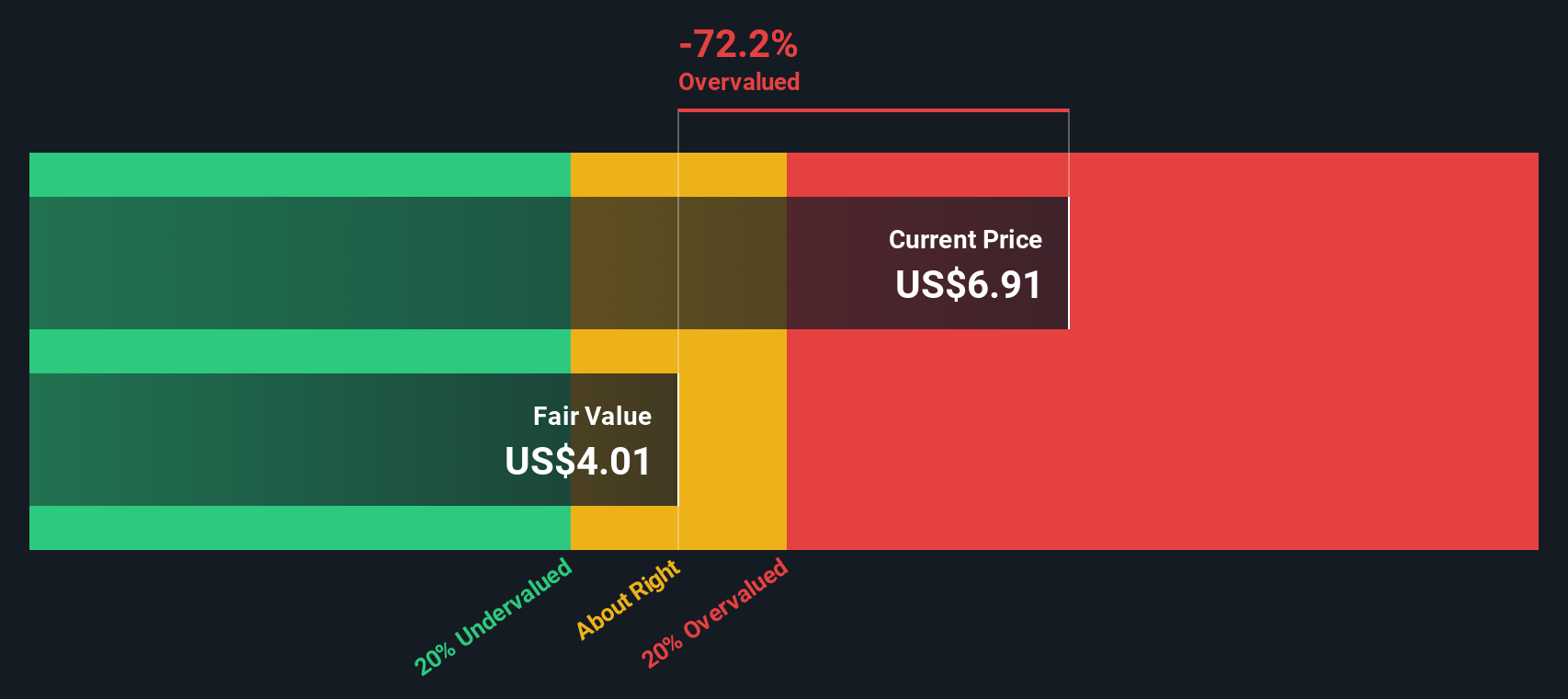

While the popular narrative points to a fair value of US$8.43 and sees LifeStance as 13.4% undervalued, our DCF model tells a different story. On that method, the fair value sits at US$4.01, which makes the current US$7.30 share price look expensive. Which set of assumptions do you find more realistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LifeStance Health Group Narrative

If you see the numbers differently or prefer to work through the assumptions yourself, you can build a customised view in minutes with Do it your way.

A great starting point for your LifeStance Health Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking For More Investment Ideas?

If LifeStance has sharpened your thinking, do not stop here. Use the Screener to spot more focused opportunities tailored to the kind of portfolio you want to build.

- Target potential mispricings by checking out these 884 undervalued stocks based on cash flows that align with your return and risk preferences.

- Spot emerging themes by scanning these 26 AI penny stocks that tap into artificial intelligence across different parts of the market.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that might suit a yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報