Enovix (ENVX) Valuation After Q3 2025 Revenue Growth And Ongoing Production Challenges

Enovix (ENVX) is back in focus after Q3 2025 results showed revenue of US$8 million, an 85% increase year over year, while production delays prompted at least one analyst to trim expectations.

See our latest analysis for Enovix.

At a share price of US$8.08, Enovix has seen a 10.53% 7 day share price return but a 35.62% 90 day share price decline, while the 1 year total shareholder return of 33.93% decline highlights how sentiment has cooled despite Q3 revenue progress and recent production related concerns.

If you are looking beyond Enovix and want to see what else is gaining attention in batteries and electronics, this could be a useful moment to scan high growth tech and AI stocks.

So, with Q3 revenue at US$8 million, a share price of US$8.08, and a wide gap to the quoted analyst price target, is Enovix currently on sale or is the market already pricing in all the future growth?

Most Popular Narrative: 70% Undervalued

With Enovix last closing at US$8.08 against a narrative fair value of US$26.90, the valuation gap is built around some ambitious growth and margin assumptions.

The analysts have a consensus price target of $26.909 for Enovix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $10.0.

Want to see how revenue forecasts, margin lift and a premium future P/E all work together here? The narrative ties them into one bold valuation story.

Result: Fair Value of $26.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that smartphone qualification or high volume production slips again, or that heavy manufacturing spend stretches cash longer than expected.

Find out about the key risks to this Enovix narrative.

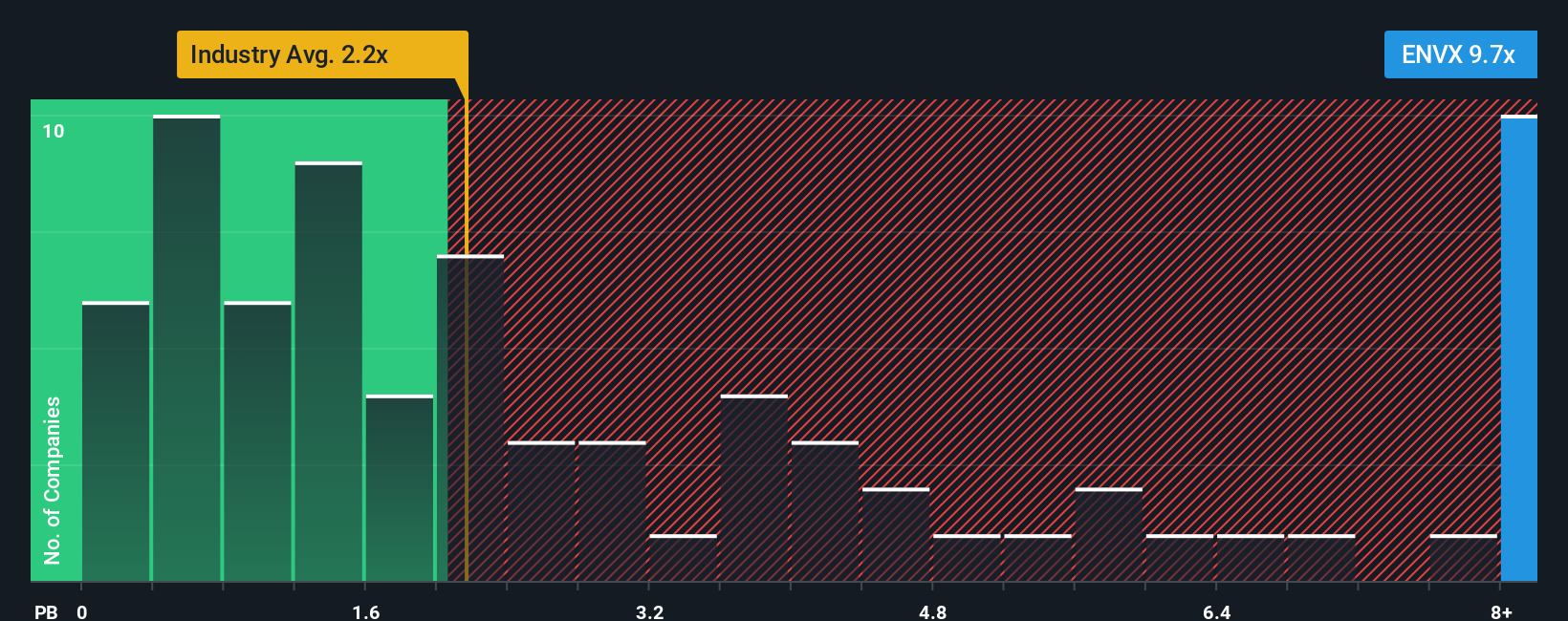

Another View: Valuation Tension From P/B

The narrative fair value suggests Enovix is heavily undervalued, but the P/B ratio tells a different story. At 5.8x P/B versus 5.1x for peers and 2.6x for the wider US Electrical industry, the shares look expensive on assets. This raises a simple question: how much execution risk are you willing to accept for that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enovix Narrative

If you see the assumptions differently or simply prefer to test the numbers yourself, you can build a tailored view in just a few minutes by using Do it your way.

A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Enovix has caught your eye, do not stop there. Use the Simply Wall St Screener to spot other opportunities that might fit even better with your goals.

- Target income potential with these 12 dividend stocks with yields > 3% that focus on reliable payouts above 3% and help you build a steadier stream of cash flow.

- Ride the AI wave early by checking out these 26 AI penny stocks that focus on companies tied to artificial intelligence themes across different parts of the market.

- Hunt for price gaps using these 884 undervalued stocks based on cash flows that highlight stocks where current prices sit below their estimated cash flow based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報