The Bull Case For InterDigital (IDCC) Could Change Following Chinese License Renewal And Amazon Patent Dispute - Learn Why

- InterDigital, Inc. recently renewed a five-year, worldwide, non-exclusive, royalty-bearing license with a major Chinese vendor covering its smartphones and other cellular-enabled devices under InterDigital’s standard essential cellular, WiFi, and HEVC patents.

- This renewal underlines the importance of long-term licensing agreements for InterDigital just as investors are also weighing insider share sale plans and unresolved patent litigation with Amazon.

- We’ll now examine how the renewed Chinese license, alongside litigation and insider sale concerns, may influence InterDigital’s investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

InterDigital Investment Narrative Recap

To own InterDigital, you have to believe in the durability of its patent licensing model and its ability to keep key device makers under license. The renewed five-year Chinese agreement supports that thesis, but in the near term the more immediate swing factors still appear to be the unresolved Amazon video patent litigation and market reaction to insider share sale plans. The new license helps underpin the licensing base, yet it does not remove those headline risks.

The company’s upcoming presentation at the 28th Annual Needham Growth Conference is particularly relevant here, as it gives management a platform to address how renewals like the new Chinese license fit alongside ongoing disputes and capital allocation decisions. For investors tracking catalysts, this event may offer additional color on how InterDigital frames its licensing momentum against litigation uncertainty and insider activity, which could influence sentiment even if fundamentals remain grounded in long-term contracts.

Yet behind the renewed Chinese license, investors should still be aware of how the unresolved Amazon dispute could...

Read the full narrative on InterDigital (it's free!)

InterDigital's narrative projects $633.9 million revenue and $173.4 million earnings by 2028.

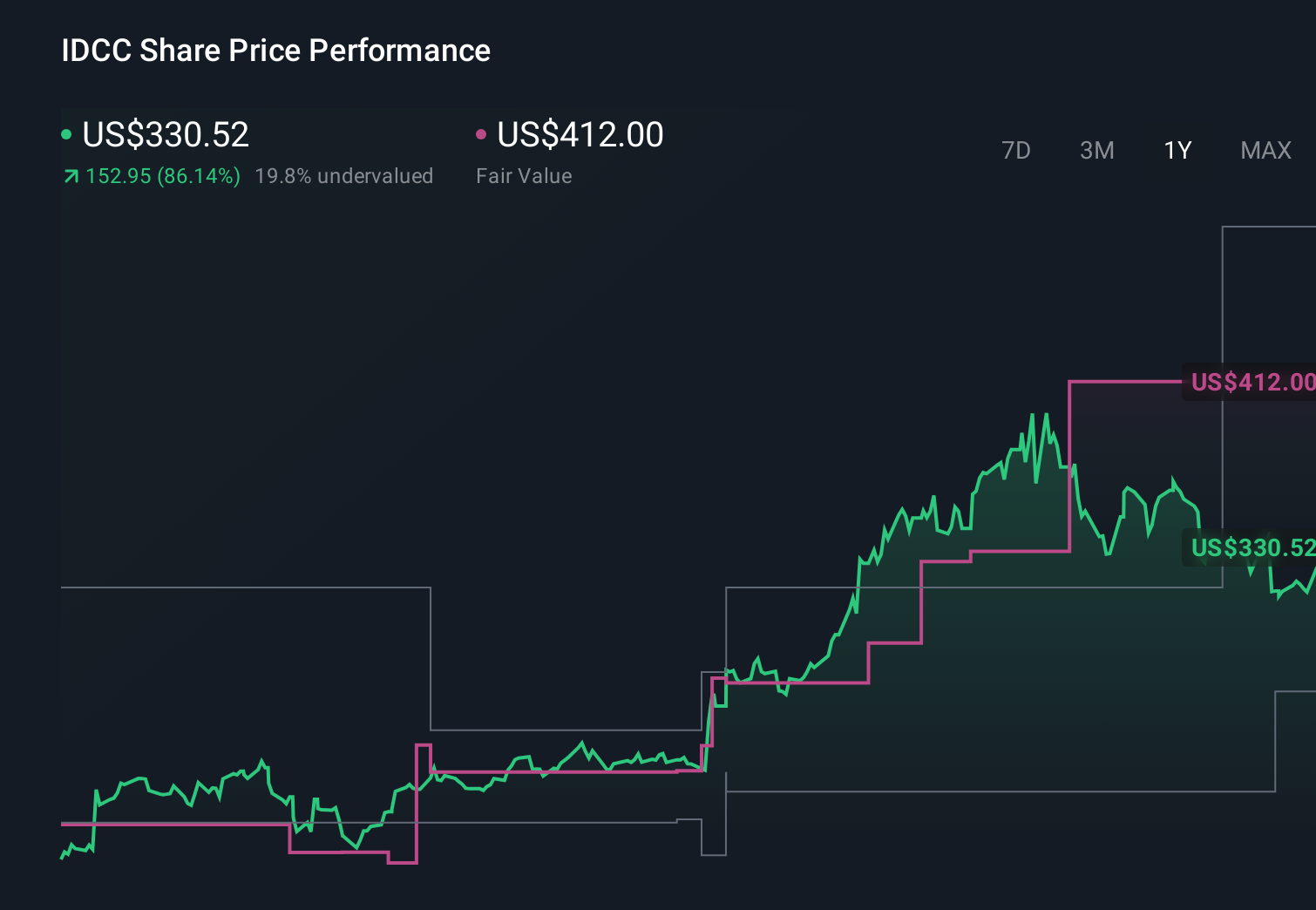

Uncover how InterDigital's forecasts yield a $412.00 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$71 to US$412, reflecting sharply different views on InterDigital’s upside. Against that backdrop, the renewed Chinese license and ongoing Amazon litigation both become central to how you interpret those competing expectations for future performance.

Explore 5 other fair value estimates on InterDigital - why the stock might be worth less than half the current price!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

No Opportunity In InterDigital?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報