Assessing Barrick Mining (TSX:ABX) Valuation After Its Rebrand And Broader Gold And Copper Focus

The recent rebrand of Barrick Mining (TSX:ABX) from Barrick Gold is drawing investor attention as the company places equal emphasis on gold, copper, silver, and energy materials within its broader mining portfolio.

See our latest analysis for Barrick Mining.

That rebrand lands at a time when momentum in the shares has picked up, with a 7 day share price return of 9.55%, a 30 day return of 18.04% and a 90 day return of 41.38%, alongside a 1 year total shareholder return of 193.10%. Recent strength adds to a strong multi year record.

If this shift at Barrick has you thinking about how other miners are positioned, it could be a good moment to widen your search with fast growing stocks with high insider ownership.

With CA$65.50 per share sitting only about 1% below the average analyst price target of CA$66.38, yet an intrinsic value model indicating a much larger discount, investors are left asking: is Barrick Mining still undervalued here, or is the market already pricing in future growth?

Most Popular Narrative: 9.2% Overvalued

According to the most followed narrative from gmalan, the implied fair value of CA$60.00 sits below Barrick Mining's last close of CA$65.50, which creates a clear valuation gap for investors to weigh.

Barrick looks undervalued at CAD 48.07 with fair value closer to CAD 55, as gold’s safe-haven role comes into focus with a looming U.S. shutdown. Introduction: As investors brace for a likely U.S. government shutdown on October 1, gold is again in the spotlight as a hedge against political and financial instability. Barrick Mining (ABX:CA), one of the world’s largest gold producers, stands out as a direct beneficiary of rising safe-haven demand.

Curious how this narrative gets to a higher fair value than earlier prices yet still sits below where the shares trade now? The core ingredients are double digit earnings growth assumptions, expanding margins and a profit multiple that leans on gold exposure plus copper growth. Want to see exactly how those moving parts are stitched together into that CA$60.00 figure?

Result: Fair Value of $60.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if gold prices weaken materially or if energy and labor costs rise enough to squeeze the assumed profit margins.

Find out about the key risks to this Barrick Mining narrative.

Another View: Market Ratios Point To Value

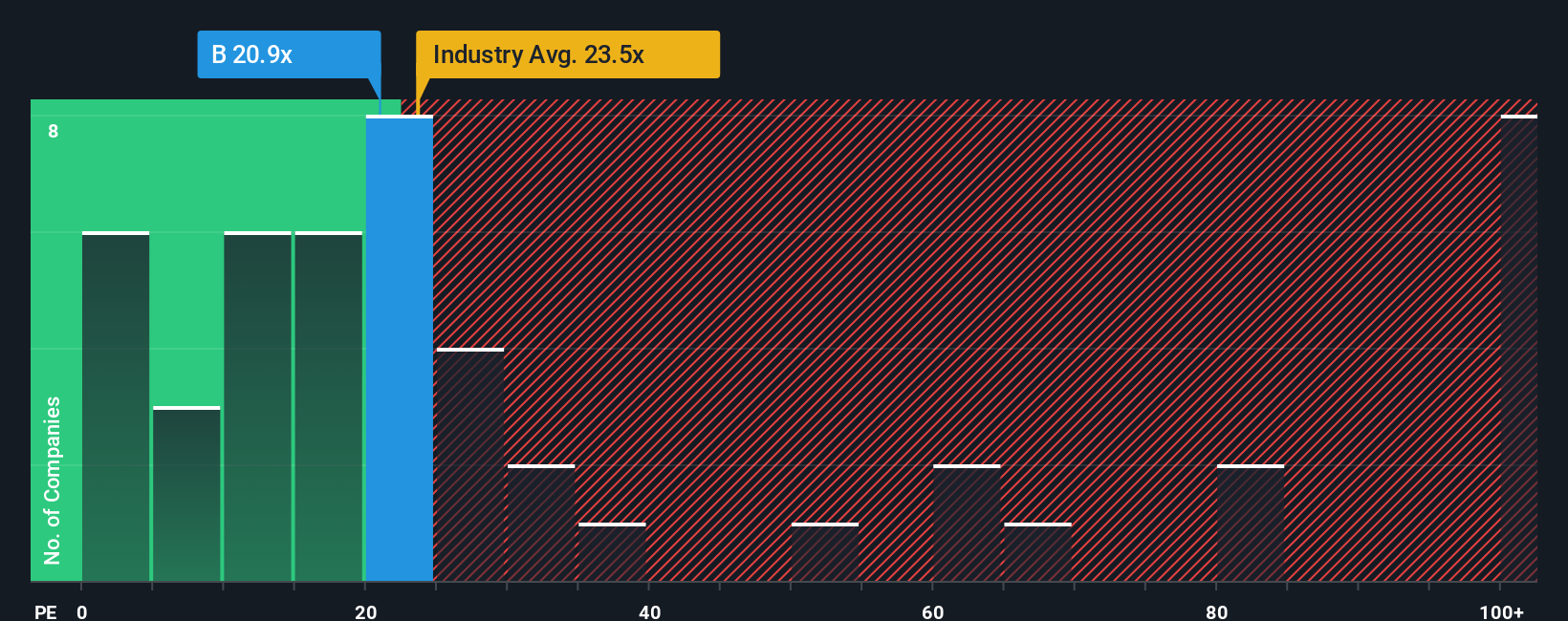

gmalan’s CA$60.00 fair value suggests Barrick Mining is overvalued at CA$65.50, but the market ratios tell a different story. At a P/E of 22.3x versus a fair ratio of 26.9x, and a peer average of 37.8x, the shares screen as cheaper than both the model and direct competitors. Is the market underestimating Barrick’s earnings power, or is the discount a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Barrick Mining Narrative

If you look at these numbers and reach a different conclusion, or prefer to test the assumptions yourself, you can build a custom thesis in minutes with Do it your way.

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Barrick has sharpened your interest in commodities and valuation, this is a smart time to widen your watchlist using focused stock ideas built from the Simply Wall St Screener.

- Spot potential mispricings early by scanning these 884 undervalued stocks based on cash flows that might align with your return and risk expectations.

- Position yourself in emerging tech trends by reviewing these 26 AI penny stocks that connect artificial intelligence themes with listed companies.

- Add income angles to your portfolio by checking these 12 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報