Rumble (RUM) Valuation Check After Weak 1 Year Return And Premium Sales Multiple

Context for Rumble’s recent trading

Rumble (RUM) has drawn fresh attention after recent share price moves, with the stock down over the past month and past 3 months, while still positive year to date. This has prompted investors to reassess its video platform and cloud ambitions.

See our latest analysis for Rumble.

Rumble’s latest share price of US$6.61 sits slightly above where it started the year, with a 3.8% year to date share price return. However, its 1 year total shareholder return of a 43.3% decline points to fading momentum after earlier enthusiasm around its video and cloud expansion.

If Rumble’s recent swings have you thinking about where else growth stories might emerge, it could be a good moment to scan high growth tech and AI stocks for other potential opportunities.

So with the share price modestly ahead year to date, a 1 year total return decline, and analysts’ targets sitting much higher, you have to ask whether Rumble is undervalued today or if the market already prices in future growth.

Most Popular Narrative: 70% Undervalued

With Rumble last closing at US$6.61 against a most-followed fair value of US$22.00, the valuation gap is wide and rooted in detailed growth assumptions.

Accelerated investment in AI and cloud infrastructure, including a potential acquisition of Northern Data, positions Rumble to capitalize on the secular trend toward scalable, decentralized compute and alternative cloud solutions. This may potentially unlock high-value enterprise and government client segments and enhance long-term gross margins and earnings.

Curious how a loss-making video platform ends up with that kind of valuation? The narrative leans heavily on rapid revenue expansion, margin lift, and a steep future earnings multiple. Want to see exactly how those moving parts fit together and what assumptions sit under that US$22.00 figure?

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the whole story hinges on heavy AI and cloud spending paying off, and on regulators and advertisers avoiding constraints on Rumble’s more contentious content model.

Find out about the key risks to this Rumble narrative.

Another View: What Today’s Sales Multiple Is Telling You

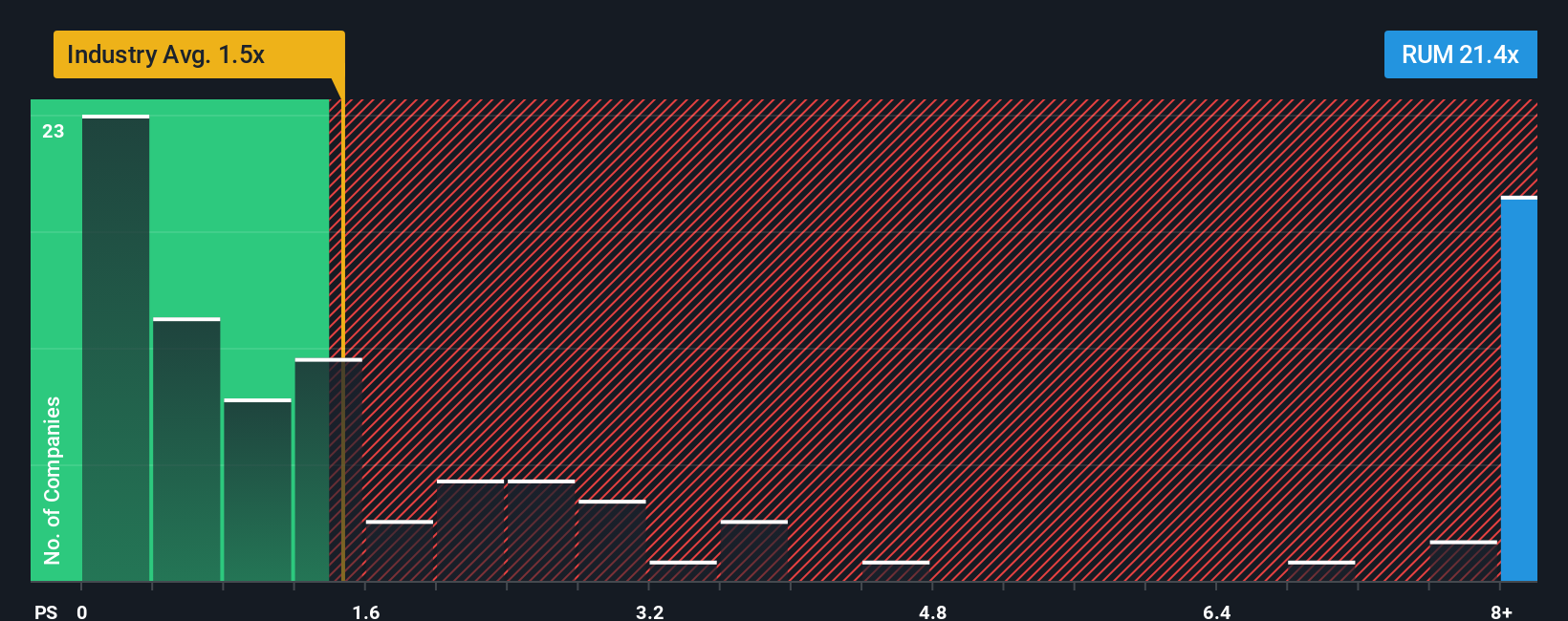

If you step away from the US$22 fair value narrative and focus solely on current sales, the picture is very different. Rumble trades on a P/S of 21.6x, compared with about 1x for the US Interactive Media and Services industry, 2.2x for peers, and a fair ratio of 4.1x. That is a substantial premium, which raises a simple question for you as an investor: are you comfortable paying several times the sales multiple that the market could move towards if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rumble Narrative

If you are not on board with this view or simply prefer to weigh the assumptions yourself, you can build a fresh thesis in just a few minutes by starting with Do it your way.

A great starting point for your Rumble research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Rumble has sparked your interest, do not stop there. Take a few minutes now to line up other ideas that could suit your style before the market moves on.

- Target future growth themes by scanning these 26 AI penny stocks that tie into long term shifts in automation and data driven business models.

- Strengthen your cash flow focus by checking these 884 undervalued stocks based on cash flows that may trade below what their fundamentals suggest.

- Add higher income candidates to your watchlist by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報