Is Mercury General’s (MCY) Solid Operations Masking a Tougher Profitability Ceiling Ahead?

- In recent months, Mercury General highlighted practical, low-cost home security habits for policyholders, while analysts reviewed the insurer’s solid quarterly results and underlying business trends.

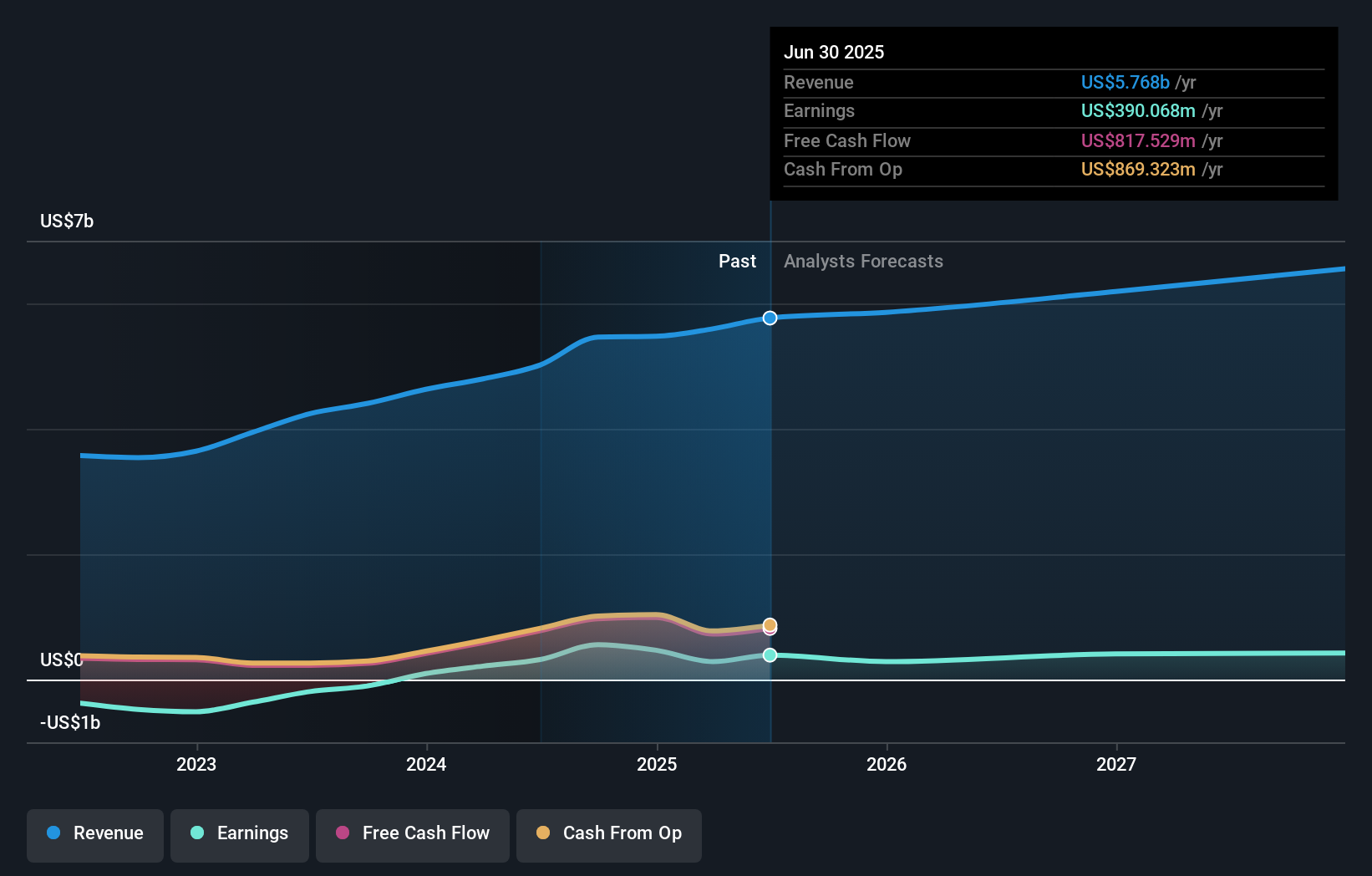

- Despite recent operational strength, analysts now flag Mercury General’s modest 2.4% revenue-growth forecast and below-industry 8.4% return on equity as key concerns.

- With analysts emphasizing slowing revenue expectations and below-industry return on equity, we’ll now examine how this shifts Mercury General’s investment narrative.

Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mercury General Investment Narrative Recap

To own Mercury General, you need to believe its core auto and home insurance franchise can continue generating dependable underwriting results while managing wildfire exposure, reinsurance costs and regulatory pressures. The latest home security guidance and recent share price strength do not materially change the near term picture, where a modest 2.4% revenue growth outlook and below industry 8.4% return on equity keep execution risk front and center.

The most relevant recent development here is Mercury General’s solid quarterly earnings, which helped the shares outperform the S&P 500 by 27% over six months. That operational performance supports the view that underlying underwriting margins can help rebuild capital and absorb catastrophe related volatility, even as analysts question how much more upside is available if revenue growth stays subdued and returns lag peers.

Yet alongside these strengths, investors also need to be keenly aware of the company’s exposure to substantial wildfire related losses...

Read the full narrative on Mercury General (it's free!)

Mercury General's narrative projects $6.7 billion revenue and $452.5 million earnings by 2028. This implies 5.1% yearly revenue growth and an earnings increase of about $62.4 million from $390.1 million today.

Uncover how Mercury General's forecasts yield a $100.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$79.55 to US$100, underscoring how differently individual investors are sizing up Mercury General’s potential. When you set those views against concerns about rising reinsurance costs and wildfire related pressures, it becomes clear why looking at several perspectives can be so important.

Explore 2 other fair value estimates on Mercury General - why the stock might be worth as much as 12% more than the current price!

Build Your Own Mercury General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury General research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mercury General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury General's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報