A Look At Capstone Copper (TSX:CS) Valuation As Mantoverde Strike Curbs Production

Why the Mantoverde strike matters for Capstone Copper stock

Capstone Copper (TSX:CS) has drawn fresh attention after Union #2 at its Mantoverde Mine in Chile started strike action, prompting a gradual reduction of activities and production levels to as low as 30% of normal.

See our latest analysis for Capstone Copper.

The strike news arrives after a choppy period for the stock, with a 1 day share price return of 7% decline contrasted against a 1 year total shareholder return of 56.7%. This suggests long term momentum has been strong even as near term risk perceptions shift.

If labor uncertainty has you reassessing your exposure to single names, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With a 56.7% 1 year total return, annual revenue growth of 13.9% and net income growth of 20.8%, together with a CA$13.79 share price that sits below the average analyst target, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 10.6% Undervalued

With Capstone Copper last closing at CA$13.79 against a fair value estimate of CA$15.42, the most followed narrative sees more value than the current price implies.

The company's strengthened balance sheet, with net debt/EBITDA now at 1x and growing free cash flow, enables self funded organic growth and deleveraging. This reduces financing risk and expected interest expenses and positions Capstone to return capital to shareholders as cash generation accelerates.

Curious how that balance sheet story feeds into the fair value? The narrative leans heavily on faster earnings growth, wider margins and a future earnings multiple that assumes meaningful execution. Want to see exactly how those moving parts stack up over time?

Result: Fair Value of $15.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to factor in real pressure points, including Mantoverde labor disruption and hefty funding needs at Santo Domingo, which could challenge this upbeat story.

Find out about the key risks to this Capstone Copper narrative.

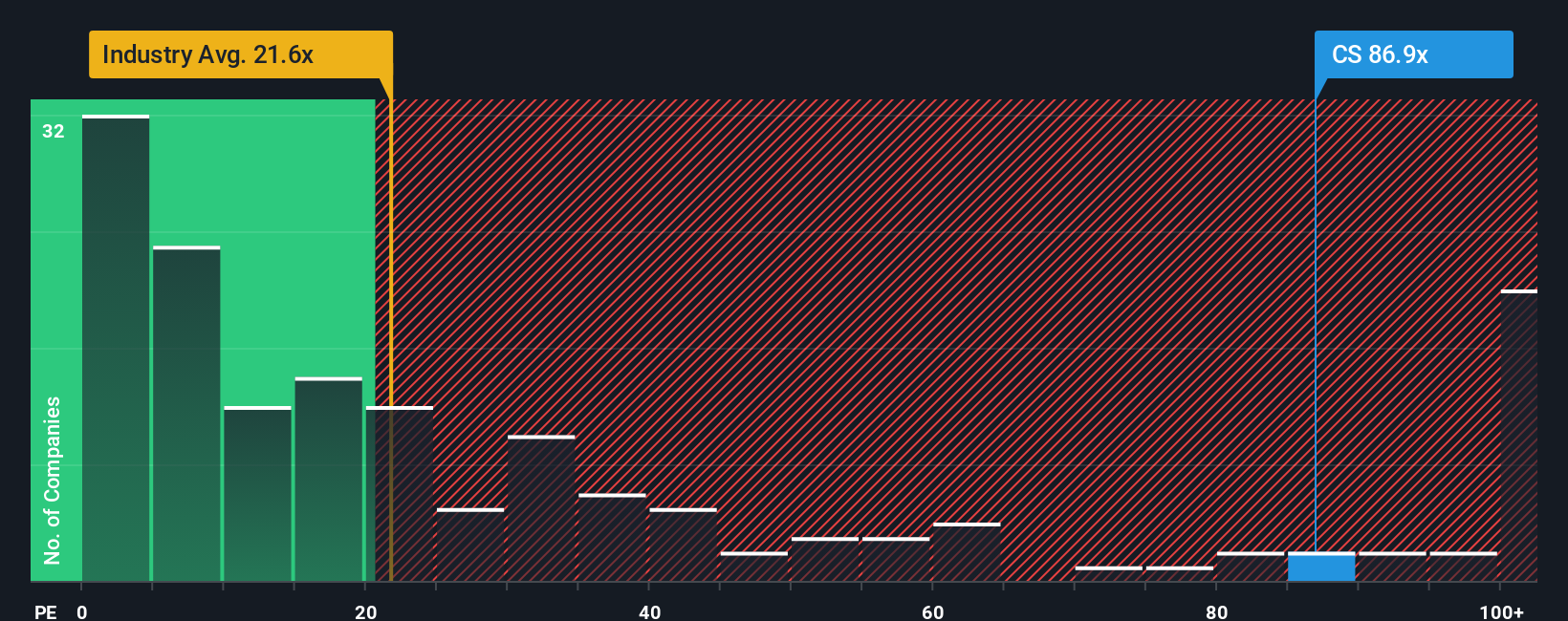

Another View: What P/E Says About Capstone Copper

The fair value narrative points to upside, but the P/E picture is less generous. At 24.4x earnings, Capstone Copper trades above its fair ratio of 23.6x and above the Canadian Metals and Mining average of 23.3x, even though it sits below a 35.3x peer average. Does that premium feel comfortable given the strike risk and funding needs?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capstone Copper Narrative

If you see the story differently or prefer to weigh the numbers yourself, you can shape a fresh view in just a few minutes, Do it your way.

A great starting point for your Capstone Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Capstone Copper is only one piece of your portfolio puzzle, now is the time to widen your search and line up your next potential ideas.

- Zero in on potential value opportunities by scanning these 884 undervalued stocks based on cash flows that appear cheap relative to their cash flows.

- Capitalise on structural themes in healthcare by focusing on these 29 healthcare AI stocks at the intersection of medicine and machine learning.

- Tap into the fast evolving world of digital assets with these 79 cryptocurrency and blockchain stocks that are building businesses around blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報