Societe Generale Securities: What are the new trends in mergers, acquisitions and restructuring in 2025?

The Zhitong Finance App learned that Societe Generale Securities released a research report saying that the typical case where individual stocks had the highest excess earnings after the disclosure of the 2025 merger, acquisition and restructuring announcement. In summary, the market tends to actively price the following three types of mergers, acquisitions and restructuring cases: Traditional industry companies cross borders to acquire new productivity industry companies, enter a booming circuit, open up a second growth curve, and obtain valuation reshaping. Typical examples include Guanzhong Ecology (300948.SZ), which specializes in ecological environment construction, acquires an AI finance and taxation company and transforms the AI business; traditional power company Leshan Electric Power (600644.SH) increased its capital to build a new energy storage project.

The new quality productivity industry strengthens the chain: The new quality productivity industry achieves the goal of strengthening the chain by promoting mergers and acquisitions, integrating upstream and downstream resources in the industrial chain, and quickly obtaining technology, qualifications and market resources in this field. Typical cases include Leadman's acquisition of tuberculosis screening and diagnosis company Xiansheng Rui to enter the tuberculosis prevention and control segmentation circuit; cloud computing company Pingao shares acquired domestic chip company Jiangyuan Technology to make up for shortcomings in computing power and accelerate commercialization.

ST shares “changed hands” to reverse the predicament: by providing “shell value”, they achieved value revaluation.

Societe Generale Securities's main views are as follows:

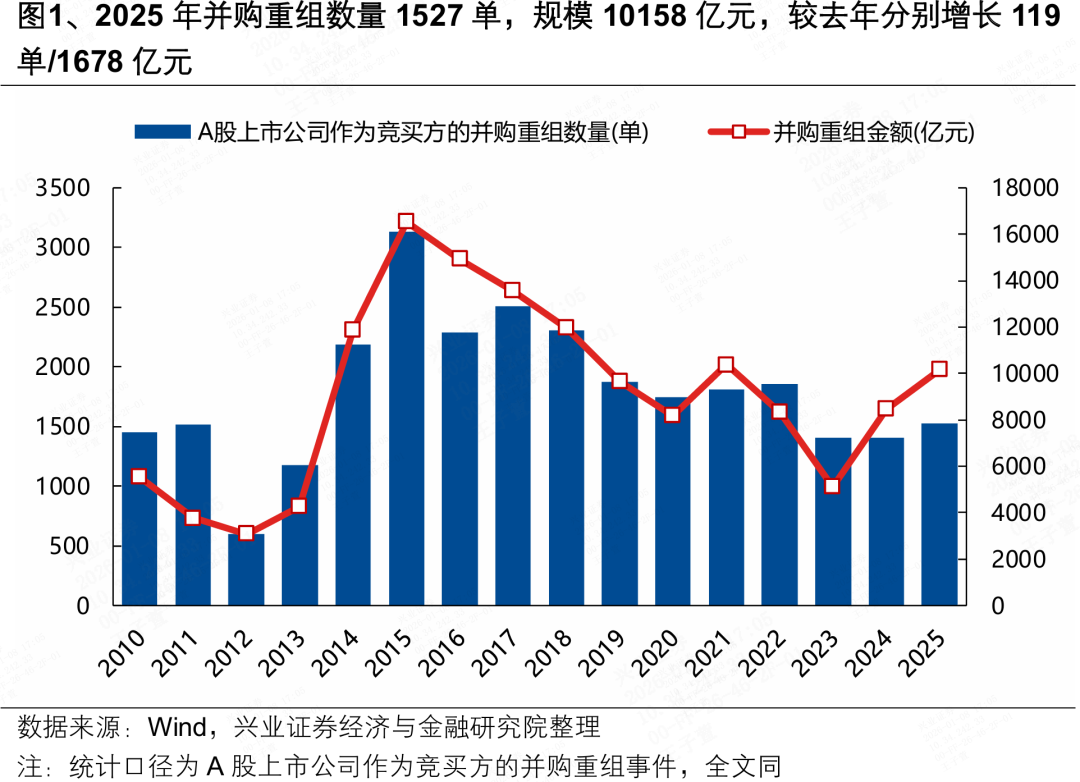

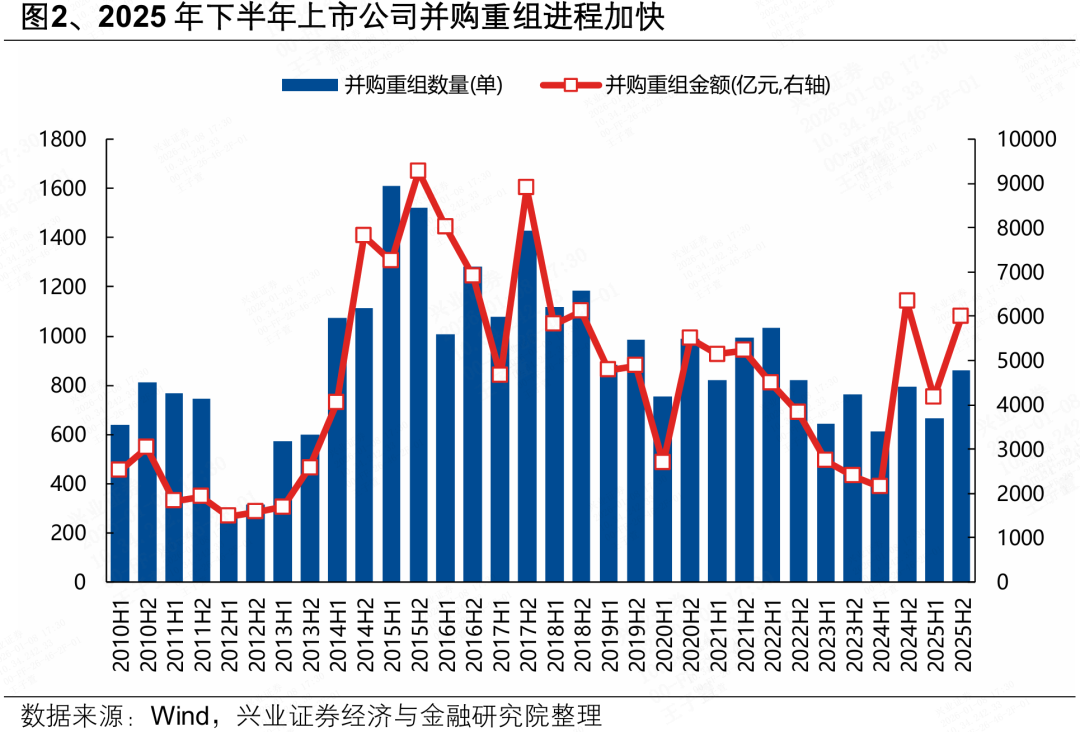

1. Scale: Reached a new high since 2022, further accelerated in the second half of the year

With policy support and the recovery of the superposition market, the M&A and restructuring market continued to be active in 2025, and the scale reached a new high since 2022. As a key way to promote resource integration under high-quality development, M&A and restructuring is represented by the “Six Rules of M&A” issued on September 24, 2024, policy support promotes the continued activity of the M&A and restructuring market. In 2025, as the capital market continues to recover and enterprise transformation accelerates, the activity of mergers, acquisitions and restructuring will further increase. In 2025, there were 1,527 mergers, acquisitions and restructuring cases involving A-share listed companies as bidders, involving a scale of 1015.8 billion yuan, a record high since 2022, an increase of 119 orders/167.8 billion yuan respectively over last year.

In terms of pace, the corporate merger, acquisition and restructuring process accelerated in the second half of 2025. In the second half of the year, the pace of recovery in the capital market accelerated, laying a good foundation for further activity in the M&A and restructuring market. The number of H1/H2 mergers and acquisitions in 2025 was 665/862, respectively, involving a scale of 4174/598.4 billion yuan, respectively.

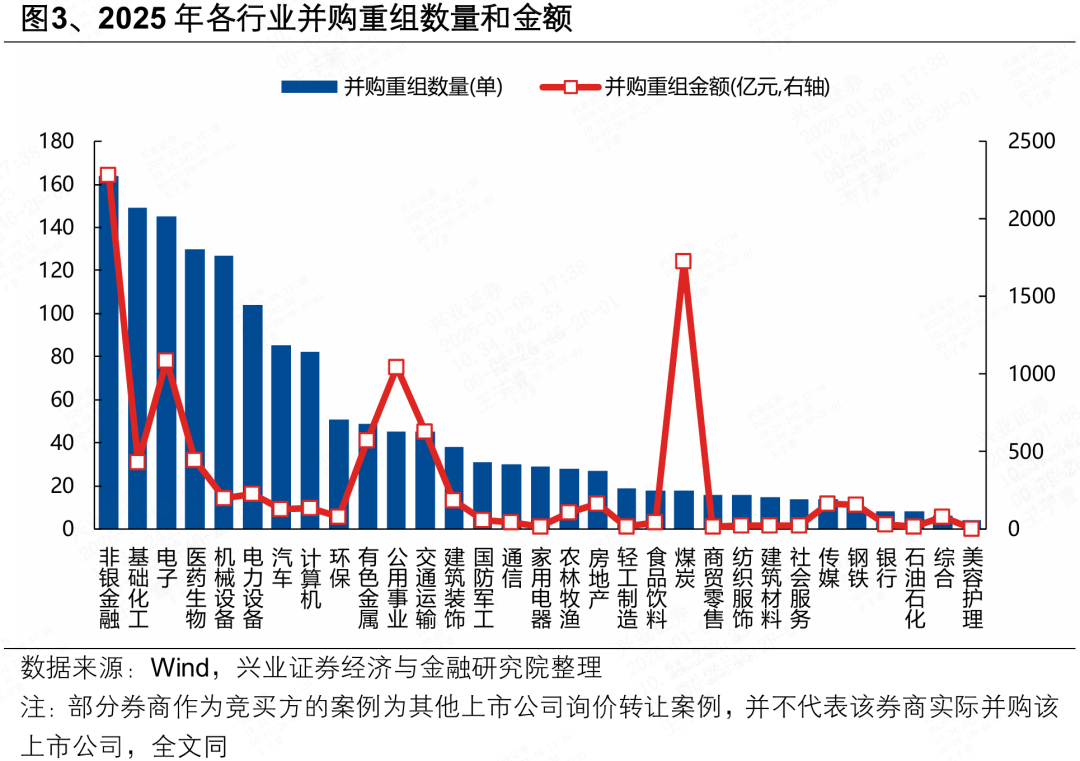

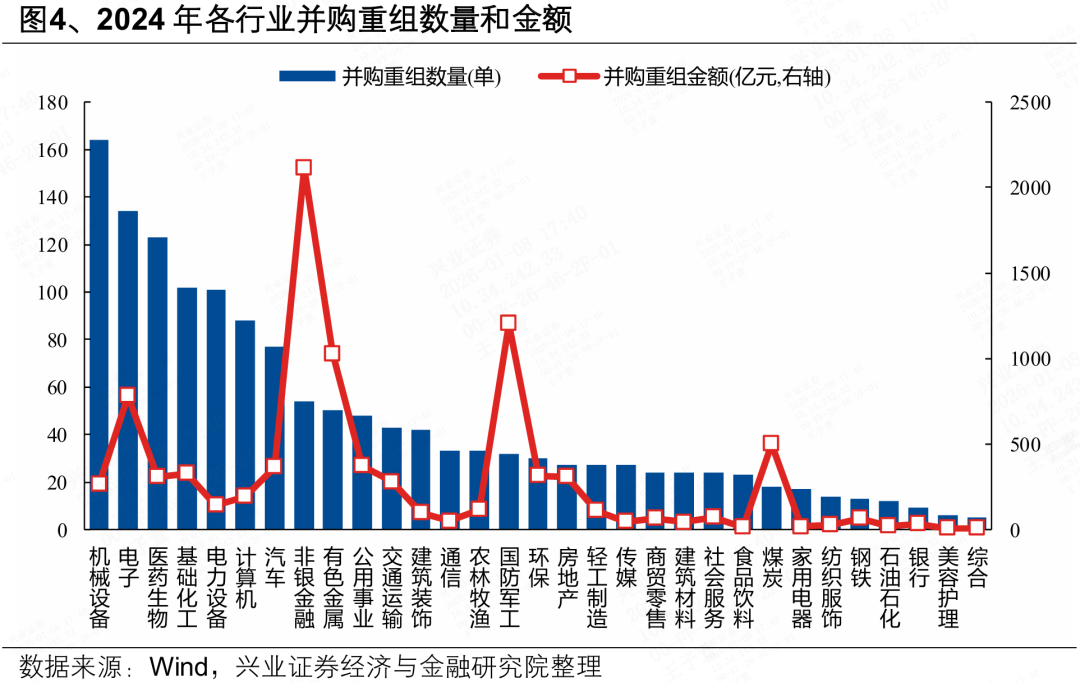

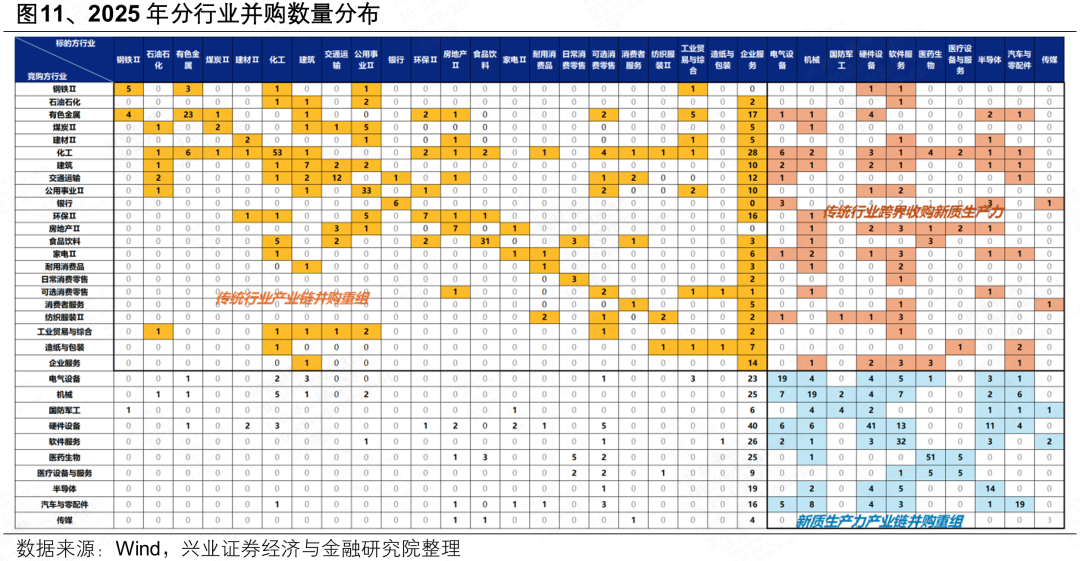

2. Industry: There are many new productivity industries, and traditional industries contribute to large-scale mergers and acquisitions

In 2025, the mergers, acquisitions and restructuring cases of A-share listed companies were mainly concentrated in the new productivity industry, and some traditional industries contributed large-scale mergers and acquisitions. In 2025, industries with a high number of mergers, acquisitions and restructuring mainly include chemicals, electronics, pharmaceuticals, machinery and equipment, power equipment, automobiles, computers, etc., mostly new productivity industries, which fully demonstrates that under the drive of new quality productivity, strong chain repair has become the core main line of the mergers, acquisitions and restructuring market. However, traditional industries mainly contribute to large-scale mergers and acquisitions, including coal, utilities, transportation, non-ferrous metals, etc.

Compared with 2024, the industries that have increased the number of mergers and acquisitions are mainly concentrated in chemicals, environmental protection, electronics, home appliances, automobiles, pharmaceuticals, etc., while industries that have increased more in scale are mainly concentrated in coal, utilities, transportation, electronics, chemicals, non-ferrous metals, etc.

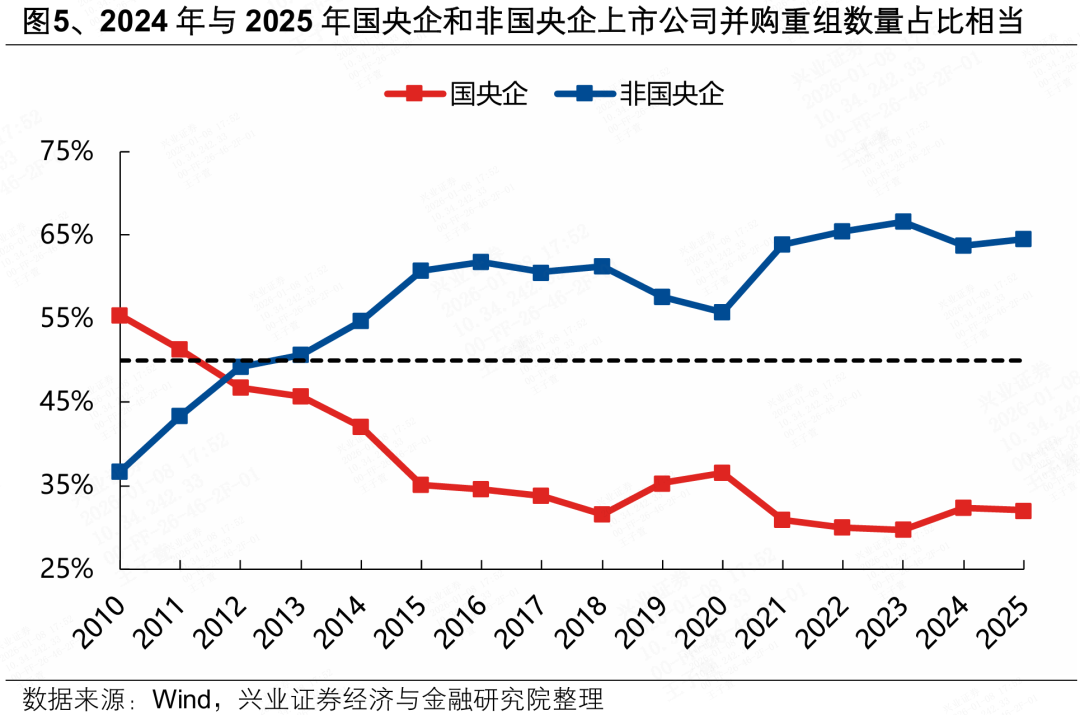

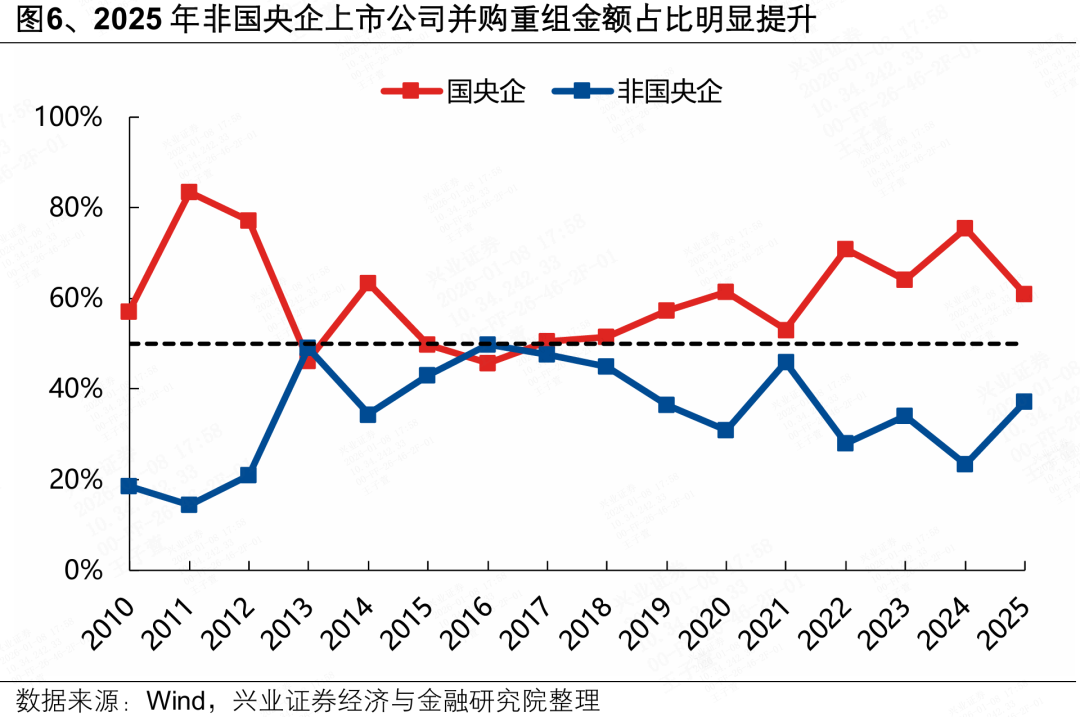

3. Corporate attributes: The share of non-state central enterprises participating in the amount has increased markedly, and the share of double innovation continues to rise

Compared with 2024, non-state central enterprises accounted for a similar proportion of mergers, acquisitions and restructuring in 2025, but the share of the amount increased markedly. From 2024-2025, the share of mergers, acquisitions and restructuring of listed companies of non-state central enterprises was basically stable, at 63.7% and 64.5% respectively; the share of the amount jumped from 23.5% to 37.2%, further indicating the characteristics of downward penetration and increased activity in the M&A and restructuring market in 2025.

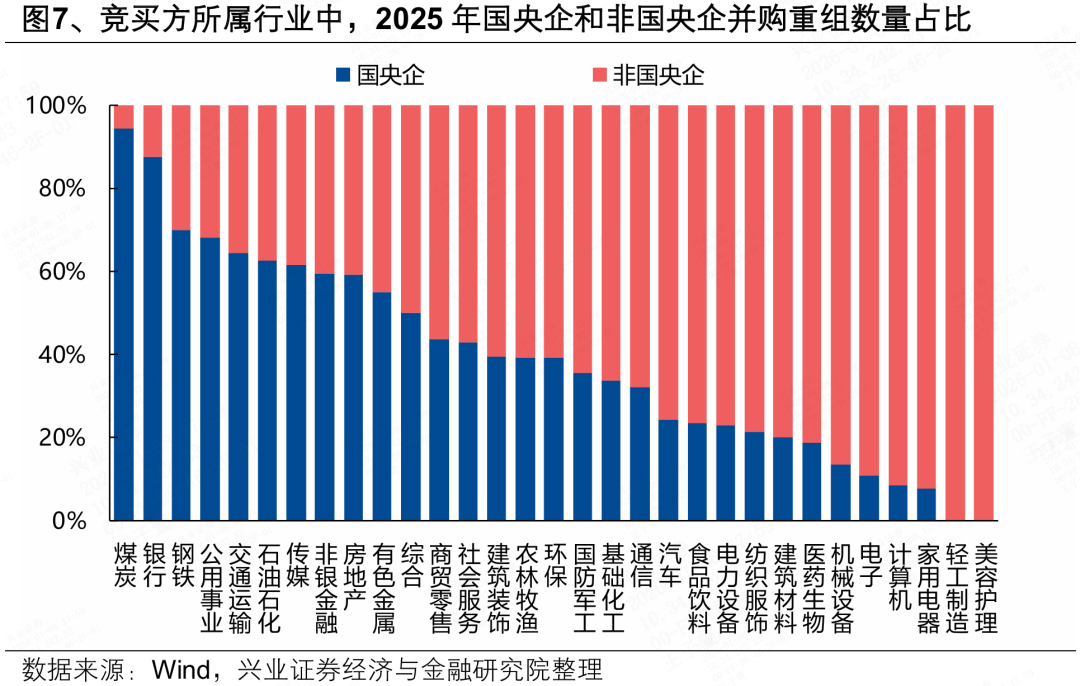

By industry, mergers, acquisitions and restructuring in traditional industries are led by central enterprises, while the new quality productivity industry is dominated by non-state central enterprises. In 2025, mergers and acquisitions in traditional industries such as coal, banking, iron and steel, utilities, transportation, petroleum and petrochemicals will be mainly led by central enterprises of the country, while new productivity industries such as computers, electronics, machinery, and pharmaceuticals will be dominated by African central enterprises. As a result, the share of African central enterprises in the amount of money increased markedly in 2025, which essentially reflects further activity in mergers, acquisitions and restructuring of the new productivity industry.

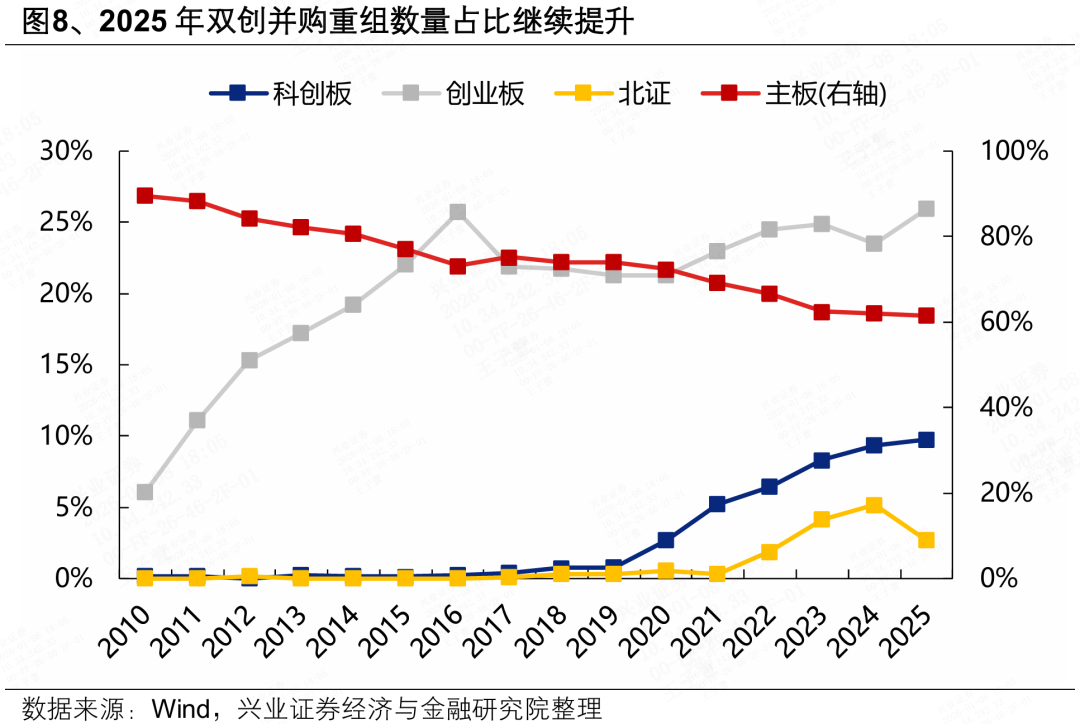

On the listing board side, the share of Shuangchuang mergers, acquisitions and restructuring continues to rise. Since 2019, as the development of new domestic productivity has accelerated, mergers, acquisitions and restructuring have continued to reflect a trend of concentration on double innovation. The share of double innovation mergers, acquisitions and restructuring in 2025 has reached 35.69%, a further increase of 2.81 pcts compared to 2024.

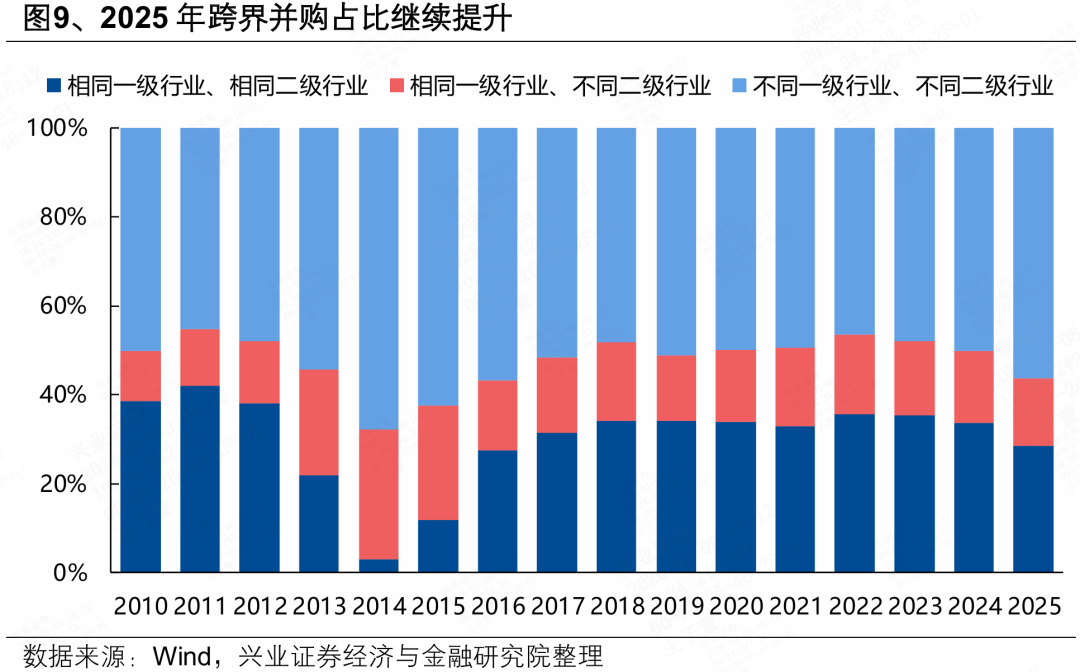

4. Merger and acquisition attributes: The proportion of cross-border mergers and acquisitions has further increased, mainly due to the integration of industrial chain resources

In 2025, the share of cross-border mergers and acquisitions increased further. Observe the primary and secondary industries to which the bidder and target party belong, and define mergers and acquisitions in which the primary and secondary industries are the same as the same level 1 and 2 industries as interindustry mergers and acquisitions, and if the level 1 and 2 industries are not the same, they are defined as cross-border mergers and acquisitions. The number of cross-border mergers and acquisitions in 2025 accounted for 56.31%, an increase of 6.2 pcts over 2024.

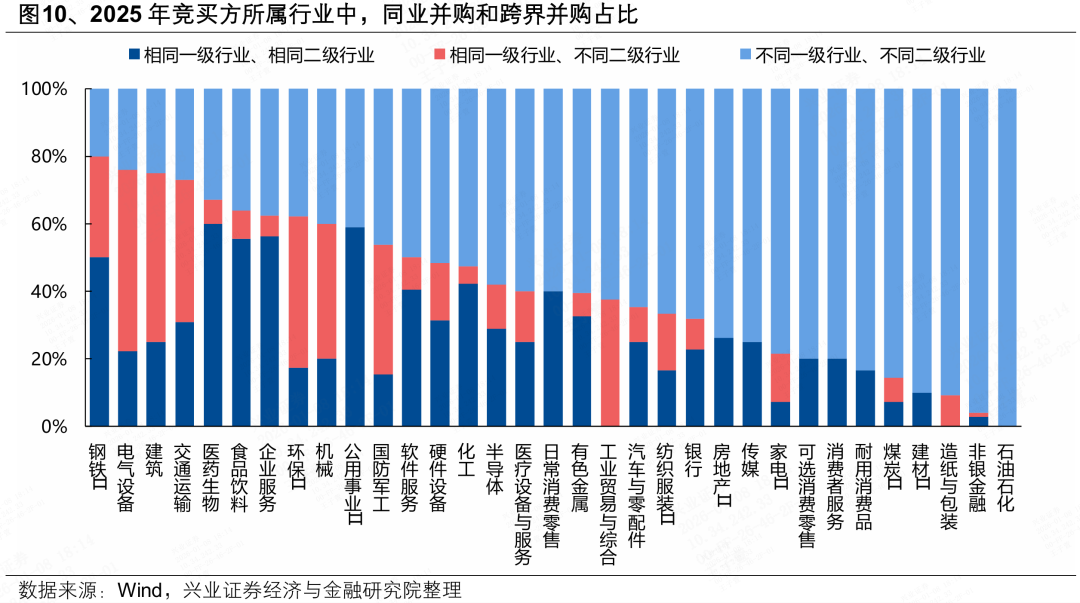

By industry, industries such as steel, electrical equipment, construction, transportation, pharmaceuticals, food and beverage account for a relatively high share of interindustry mergers and acquisitions, while industries such as petroleum and petrochemical, paper, building materials, coal, and durable consumer goods account for a relatively high share of cross-border mergers and acquisitions.

However, most of the cases of cross-border mergers and acquisitions in 2025 are resource integration within the industrial chain (including traditional industry industrial chain mergers and acquisitions & new quality productivity industry chain mergers and acquisitions), and there are few cases where traditional industries acquire new quality productivity across borders.

Specifically: Industrial chain mergers and acquisitions in traditional industries: on the one hand, improving the competitive pattern of the industry through interindustry mergers and acquisitions to build leading enterprises, such as steel, utilities, transportation, chemicals, and steel; on the other hand, there are also many cases of cross-border mergers and acquisitions to enhance the competitive advantage of the main business and carry out resource integration and mergers and acquisitions for high-quality companies upstream and downstream of the industrial chain.

New quality productivity industry chain mergers, acquisitions and restructuring: Mainly by promoting interindustry mergers and acquisitions, industrial chain resource integration and strong chain repair, including upstream mergers and acquisitions to ensure the autonomy and control of key materials or technologies, and downstream integration and expansion channels.

Cross-border acquisition of new productivity in traditional industries: mainly through cross-border mergers, acquisitions and restructuring to accelerate the pace of transformation, cultivate strategic emerging industries and future industries, and create a second growth pole, but there are not many such cases in 2025.

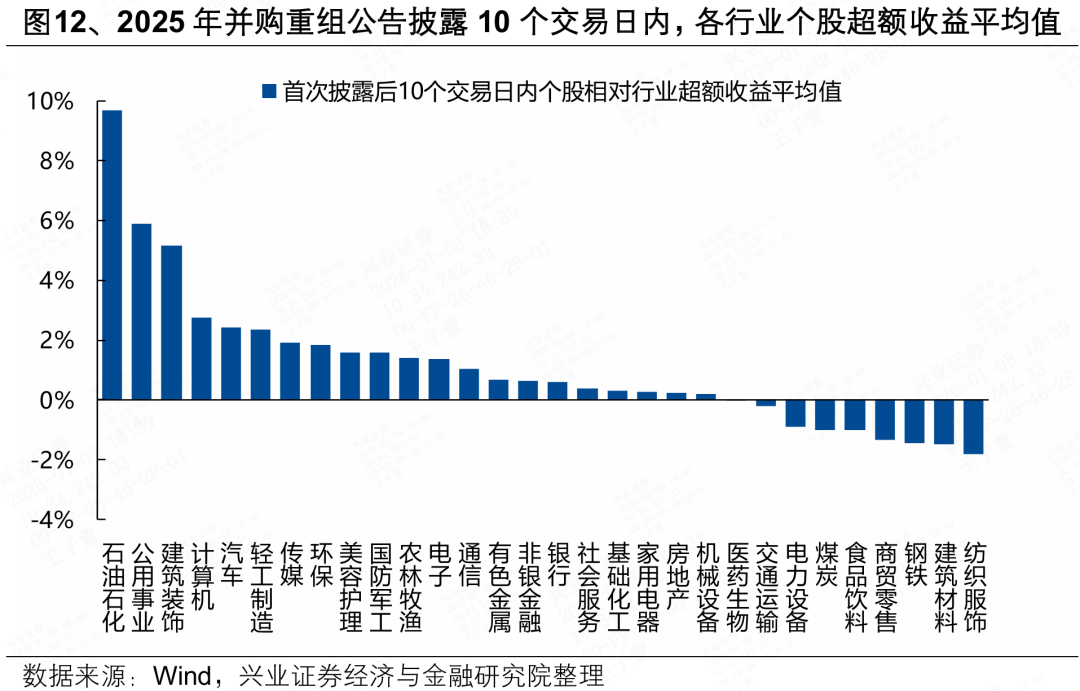

5. Stock price performance: Cases such as the transformation of traditional industries to new quality productivity, and the new quality productivity industry to strengthen the chain are popular

From an industry perspective, in an average sense, the excess earnings of individual stocks in traditional industries such as petroleum and petrochemicals, utilities, and building decoration, and in new productivity industries such as TMT, automobiles, and military industries are more obvious after participating in mergers, acquisitions, and restructuring.

Further review the typical cases where individual stocks had the highest excess earnings after the disclosure of the 2025 M&A and restructuring announcement. In summary, the market tends to positively price the following three types of mergers, acquisitions and restructuring cases:

Traditional industries transform new quality productivity: Traditional industry companies acquire new quality productivity industry companies across borders, enter a booming circuit, open up a second growth curve, and obtain valuation reshaping. Typical examples include Guanzhong Ecology, which specializes in ecological environment construction, to acquire an AI finance and taxation company to transform the AI business; traditional power company Leshan Electric Power increased its capital to build a new energy storage project.

The new quality productivity industry strengthens the chain: The new quality productivity industry achieves the goal of strengthening the chain by promoting mergers and acquisitions, integrating upstream and downstream resources in the industrial chain, and quickly obtaining technology, qualifications and market resources in this field. Typical cases include Leadman's acquisition of tuberculosis screening and diagnosis company Xiansheng Rui to enter the tuberculosis prevention and control segmentation circuit; cloud computing company Pingao shares acquired domestic chip company Jiangyuan Technology to make up for shortcomings in computing power and accelerate commercialization.

ST shares “changed hands” to reverse the predicament: by providing “shell value”, they achieved value revaluation.

Risk Alerts

It only publishes data compilation, and does not include research opinions or investment suggestions.

Nasdaq

Nasdaq 華爾街日報

華爾街日報