Schneider Electric (ENXTPA:SU) Valuation Check After $700 Million U.S. Expansion And Data Center Cooling Push

Schneider Electric (ENXTPA:SU) is back on investor radars after committing more than $700 million to its U.S. operations, and it has also been named a key supplier in the growing data center cooling market for spaceport facilities.

See our latest analysis for Schneider Electric.

These U.S. expansion plans and exposure to data center cooling arrive while investor sentiment has been mixed, with a 4.1% 7 day share price return and a 3.1% year to date share price return set against a 1 year total shareholder return close to flat and a much stronger 3 year total shareholder return.

If Schneider Electric’s data center and energy themes have caught your attention, it could be a good moment to widen your watchlist and look at fast growing stocks with high insider ownership.

With the shares roughly flat over 1 year but far ahead over 3 and 5 years, plus a price target above the current €244.45 level, the key question is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 9.6% Undervalued

With Schneider Electric’s fair value in the narrative set above the €244.45 last close, the gap to that estimate revolves around long term earnings power.

The company's transition toward software and recurring digital services (notably EcoStruxure, AVEVA SaaS, and EcoCare), now representing 60% of revenues and growing at double digit rates, should drive higher margins and recurring earnings, with further upside potential as AVEVA's SaaS conversion completes by 2027.

Want to see what is baked into that earnings ramp? Revenue compounding, margin uplift, and a premium future P/E all sit behind this fair value math.

Result: Fair Value of €270.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to keep an eye on pressure points such as weaker Industrial Automation and currency swings, which could unsettle margins and earnings expectations.

Find out about the key risks to this Schneider Electric narrative.

Another View: Multiples Paint A Richer Picture

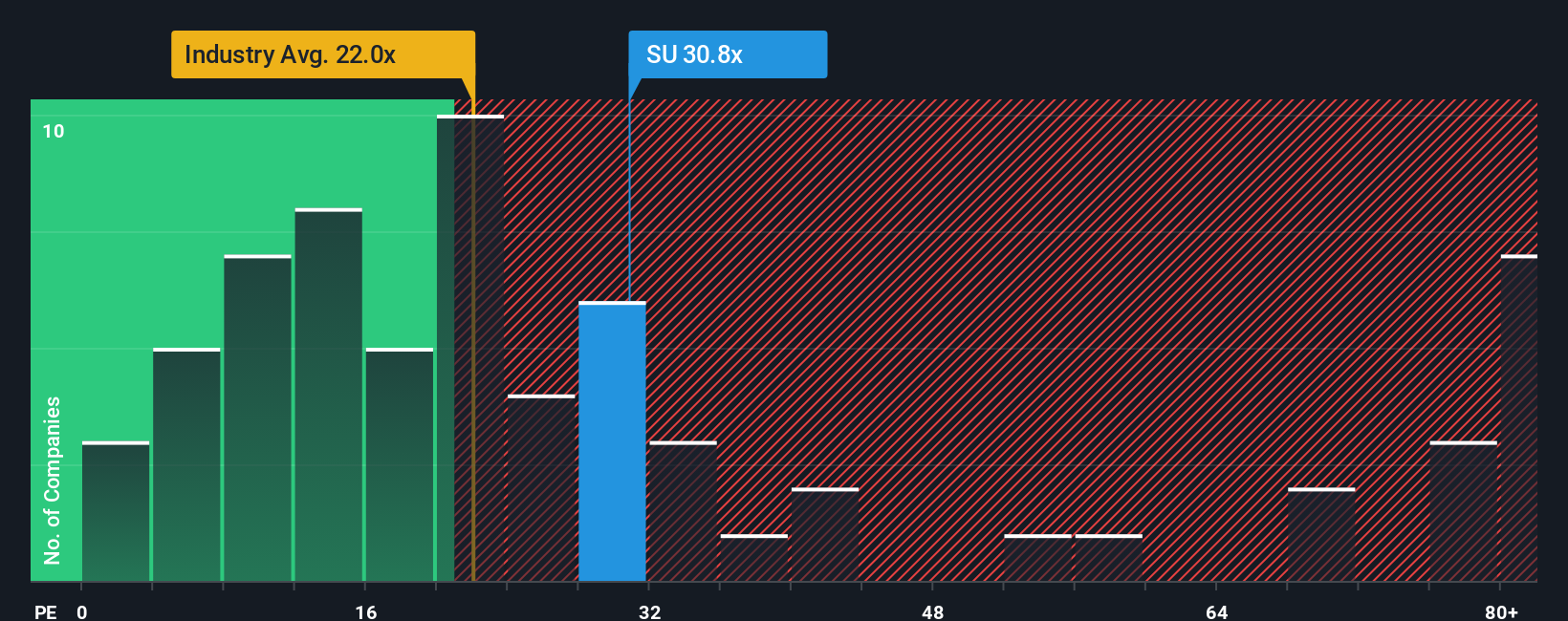

The popular narrative sees Schneider Electric as 9.6% undervalued, but the P/E data sends a different signal. The shares trade on 32x earnings versus 25.8x for peers and 23.2x for the wider European Electrical industry, while the fair ratio is 33.9x. That suggests quality is already priced in, so the key question is how much margin of safety you feel you have.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider Electric Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a complete Schneider Electric view in minutes with Do it your way.

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Schneider Electric is on your radar, do not stop there. Broaden your opportunity set now so you are not looking back at missed ideas later.

- Spot potential value early by scanning these 3550 penny stocks with strong financials that pair smaller size with solid financial footing.

- Position your portfolio for the AI trend by checking out these 26 AI penny stocks shaping everything from automation to digital infrastructure.

- Target mispriced opportunities using these 886 undervalued stocks based on cash flows that screen for companies trading below their cash flow based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報