3 Penny Stocks With Market Caps Under $700M

Major U.S. stock indexes have recently pulled back after setting fresh all-time highs, reflecting a complex economic landscape influenced by geopolitical events and fluctuating oil prices. In this climate, investors often seek opportunities in lesser-known areas of the market where potential growth can be found. Penny stocks, despite their somewhat outdated name, represent such an opportunity by offering affordability and potential for growth when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $3.04 | $602.2M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.87 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8639 | $144.24M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.08 | $533.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.28 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.36 | $578.98M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.48 | $375.33M | ✅ 3 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.971762 | $7.13M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.84 | $87.45M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 334 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Nautilus Biotechnology (NAUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nautilus Biotechnology, Inc. is a development stage life sciences company focused on creating a platform technology to quantify and unlock the complexity of the proteome, with a market cap of $236.19 million.

Operations: Nautilus Biotechnology, Inc. currently does not report any revenue segments.

Market Cap: $236.19M

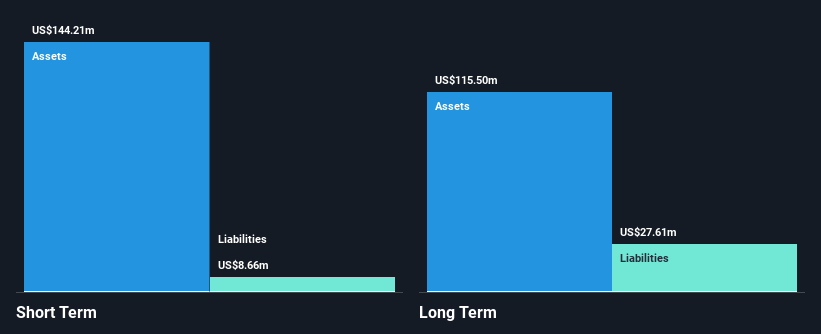

Nautilus Biotechnology, a pre-revenue company with no significant revenue streams, maintains a strong financial position with short-term assets of US$134.3 million exceeding both its short and long-term liabilities. Despite being unprofitable and experiencing increased losses over the past five years, Nautilus remains debt-free and has a sufficient cash runway for more than two years. Recent developments include the successful deployment of its first external field evaluation unit at the Buck Institute, marking progress in its proteomics platform's application to neurodegenerative disease research. However, earnings are forecasted to decline by 1.6% annually over the next three years.

- Click to explore a detailed breakdown of our findings in Nautilus Biotechnology's financial health report.

- Learn about Nautilus Biotechnology's future growth trajectory here.

ProKidney (PROK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ProKidney Corp. is a clinical-stage biotechnology company focused on developing a cell therapy platform for treating multiple chronic kidney diseases in the United States, with a market cap of approximately $676.88 million.

Operations: ProKidney currently does not report any revenue segments.

Market Cap: $676.88M

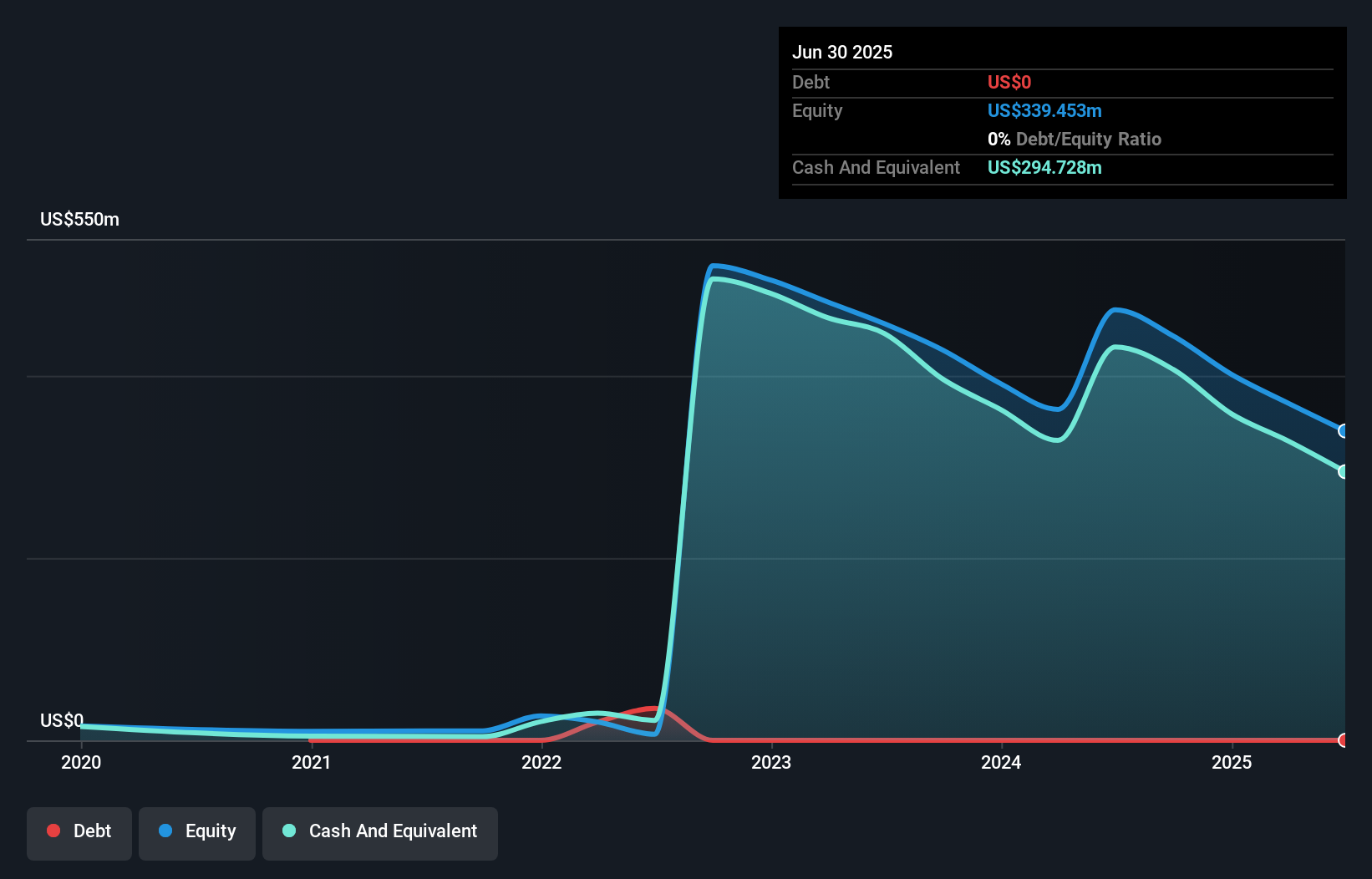

ProKidney Corp., a pre-revenue biotech company with a market cap of approximately US$676.88 million, focuses on developing cell therapy for chronic kidney diseases. Despite being unprofitable, ProKidney's short-term assets of US$300 million exceed its liabilities, and it remains debt-free with a cash runway sufficient for 1.5 years. The company's recent Phase 2 trial results for rilparencel showed promising improvements in kidney function and were presented at the ASN Kidney Week 2025, supporting ongoing Phase 3 trials. However, the stock remains highly volatile with significant insider selling noted recently.

- Get an in-depth perspective on ProKidney's performance by reading our balance sheet health report here.

- Examine ProKidney's earnings growth report to understand how analysts expect it to perform.

Neumora Therapeutics (NMRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neumora Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing treatments for brain diseases and neuropsychiatric and neurodegenerative disorders in the United States, with a market cap of $309.29 million.

Operations: Neumora Therapeutics, Inc. currently does not report any revenue segments as it is a clinical-stage biopharmaceutical company focused on developing treatments for brain diseases and neuropsychiatric and neurodegenerative disorders in the United States.

Market Cap: $309.29M

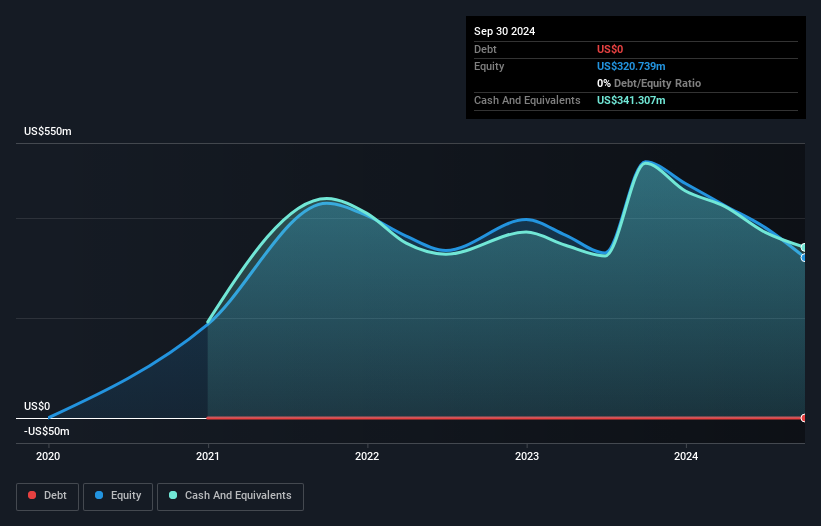

Neumora Therapeutics, with a market cap of US$309.29 million, is a pre-revenue biopharmaceutical company focused on brain diseases. Despite its unprofitability and high share price volatility, the company maintains strong financial health with short-term assets exceeding liabilities and more cash than debt. Recent developments include positive Phase 1b results for NMRA-511 in Alzheimer's agitation and pipeline updates for key drugs like navacaprant and NMRA-215, indicating potential therapeutic advancements. However, challenges remain with an inexperienced management team and limited cash runway projected at just over a year if current spending trends persist.

- Click here to discover the nuances of Neumora Therapeutics with our detailed analytical financial health report.

- Gain insights into Neumora Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Dive into all 334 of the US Penny Stocks we have identified here.

- Curious About Other Options? We've found 12 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報