A Look At Cooper Companies (COO) Valuation After New MyDay MiSight 1 Day Launch In Europe

Cooper Companies (COO) is back in focus after its CooperVision unit announced the forthcoming launch of MyDay MiSight 1 day contact lenses in the UK and select European markets, targeting childhood myopia management.

See our latest analysis for Cooper Companies.

The MyDay MiSight 1 day launch headlines come as Cooper Companies' share price has risen 7.52% over the past month and 20.29% over the past 90 days, while the 1 year total shareholder return is a decline of 8.69%. This suggests that shorter term momentum has picked up even as longer term holders remain under water.

If this kind of targeted eye care story interests you, it could be a good moment to scan the wider market of healthcare stocks for other potential ideas.

With the shares up 7.52% over 30 days but Cooper Companies still showing a 1 year total shareholder return decline of 8.69%, and trading at a modest discount to one analyst price target, is there genuine value here, or is the market already baking in future growth?

Most Popular Narrative: 7.3% Undervalued

With Cooper Companies closing at US$83.90 against a narrative fair value of US$90.50, the gap is modest but meaningful enough to study the assumptions behind it.

Free cash flow is poised to inflect higher as a multi-year capital expenditure cycle winds down following the ramp-up of MyDAY capacity, with management guiding for approximately US$2 billion in free cash flow over the next three years. This improved cash generation, tied to strong cost discipline and revenue momentum, will further benefit shareholders via debt reduction and share repurchases.

Curious how steady mid single digit revenue growth, rising margins and a richer earnings multiple combine to reach that fair value? The narrative leans heavily on improving profitability, a lower discount rate and cash returns to shareholders. The full story connects these moving parts into one valuation roadmap.

Result: Fair Value of $90.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh up issues like softer fertility and IUD markets, as well as pricing pressure in Asia Pacific, that could restrain revenue and margin progress.

Find out about the key risks to this Cooper Companies narrative.

Another View: What The P/E Ratio Is Saying

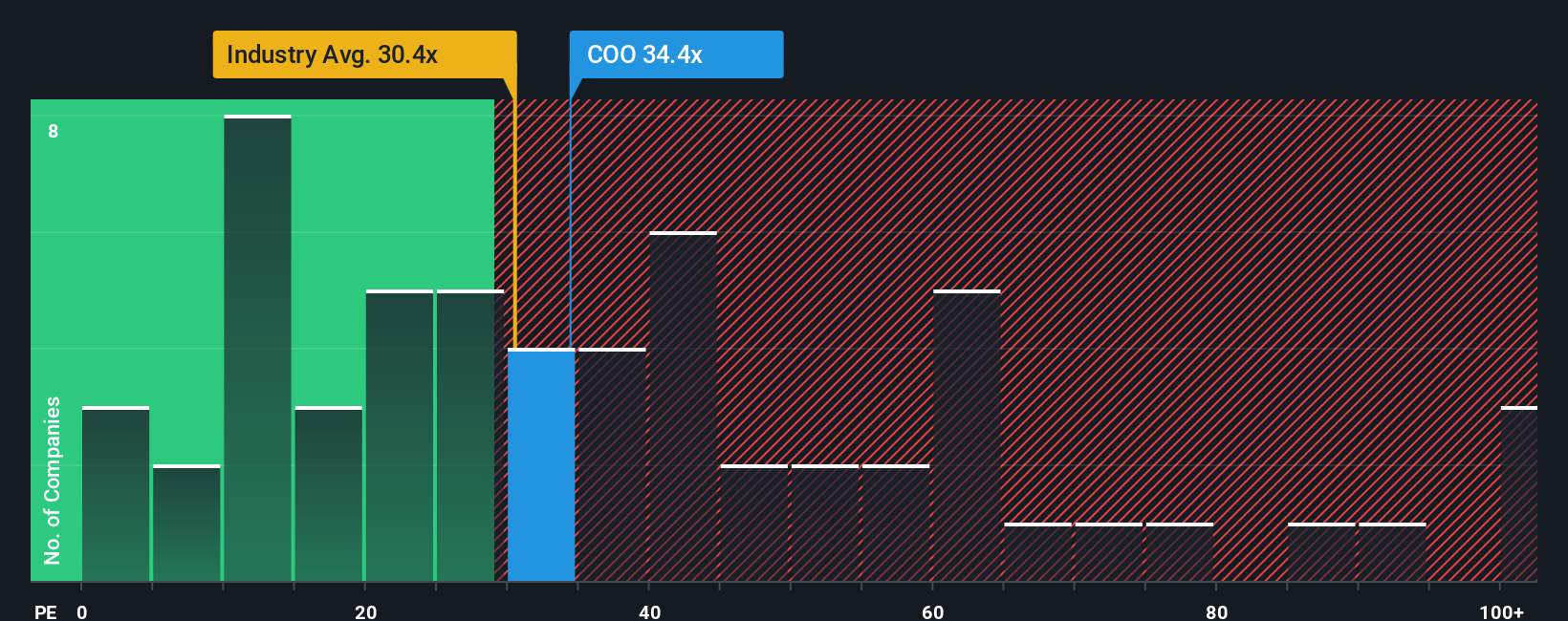

That 7.3% undervaluation story sits awkwardly next to Cooper Companies' P/E of 43.9x, which is well above the US Medical Equipment industry at 30.7x, its peer average at 28.4x, and even our fair ratio estimate of 29.6x. If the market drifts closer to that fair ratio instead, how much cushion do you really have?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cooper Companies Narrative

If you look at this and think the assumptions feel off, or you would rather test your own inputs and thesis, you can build a custom view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Looking for more investment ideas?

If Cooper Companies has you thinking bigger about your portfolio, do not stop here. The next strong idea you act on could make a real difference.

- Spot early opportunities by scanning these 3549 penny stocks with strong financials that already show solid financial foundations instead of relying on hype alone.

- Position yourself at the front of the AI wave by checking out these 26 AI penny stocks that tie artificial intelligence to real business results.

- Focus on price and cash flow discipline by reviewing these 884 undervalued stocks based on cash flows that might offer more value for every dollar you commit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報