How Investors Are Reacting To Bayerische Motoren Werke (XTRA:BMW) Expanding Its Software-Defined Vehicle Capabilities

- In 2025, the Car Connectivity Consortium certified 115 Digital Key products worldwide and highlighted BMW among the newly certified automakers, while BMW also selected QNX technology to power safety‑critical systems in its upcoming Neue Klasse vehicle generation.

- Together, these moves show BMW deepening its push into software-defined vehicles and secure digital access, reinforcing its position in connected premium mobility.

- We’ll now explore how BMW’s integration of QNX safety software into Neue Klasse could influence the company’s existing investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Bayerische Motoren Werke Investment Narrative Recap

To own BMW today, you need to believe the group can turn its premium brand, broad line up and manufacturing scale into resilient cash generation despite softer earnings, China pressures and EV competition. The QNX and Digital Key news support the short term catalyst of BMW’s push into higher margin, software rich vehicles, but the most immediate issues still sit with margins, tariffs and the profitability of the EV transition.

Among recent developments, BMW’s decision to integrate QNX into the Neue Klasse platform stands out because it directly links to the catalyst around digitalization and higher value, tech enabled offerings. If Neue Klasse can anchor BMW’s connected and electric portfolio while capital intensity stabilizes, it could reinforce the investment case built on lower capital expenditure and stronger free cash flow, even as China and European BEV pricing remain key swing factors.

Yet against this promise, investors should be aware that BMW’s exposure to tariff volatility and structurally weaker China volumes could still...

Read the full narrative on Bayerische Motoren Werke (it's free!)

Bayerische Motoren Werke's narrative projects €150.8 billion revenue and €8.3 billion earnings by 2028. This requires 3.4% yearly revenue growth and about a €2.6 billion earnings increase from €5.7 billion today.

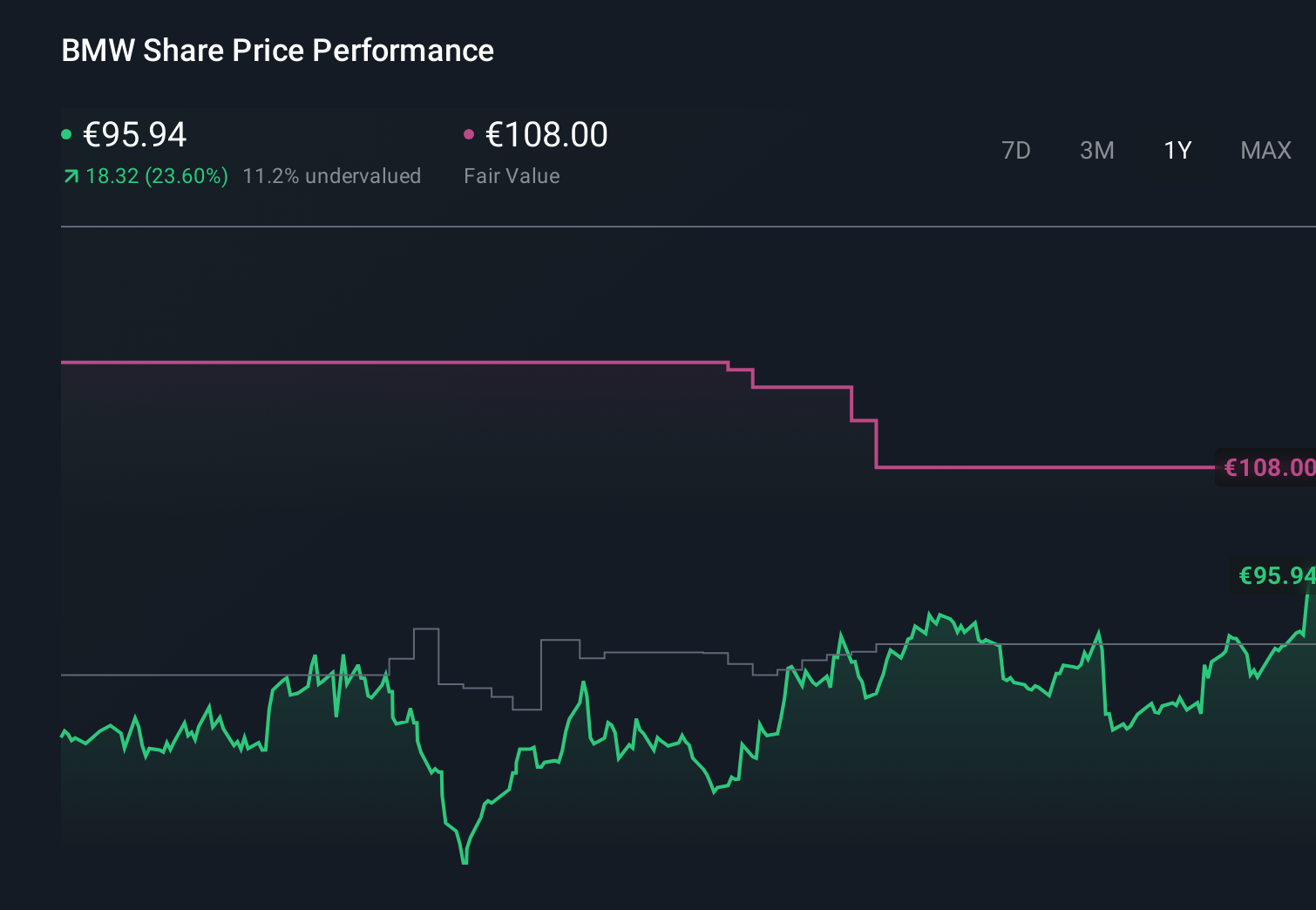

Uncover how Bayerische Motoren Werke's forecasts yield a €88.59 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for BMW range from €65.65 to €135.07, underlining how far apart private investors can be. You can weigh these views against the risk that China remains structurally pressured, with competitive intensity and dealer consolidation shaping BMW’s longer term volume and margin profile.

Explore 9 other fair value estimates on Bayerische Motoren Werke - why the stock might be worth 29% less than the current price!

Build Your Own Bayerische Motoren Werke Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bayerische Motoren Werke research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bayerische Motoren Werke research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bayerische Motoren Werke's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報