Is It Time To Reconsider UPS (UPS) After Recent Share Price Rebound?

- If you are wondering whether United Parcel Service (UPS) looks like value at its current share price, this article walks through what the numbers are actually saying about the stock.

- UPS shares recently closed at US$105.41, with returns of 6.3% over the last 7 days, 10.3% over the last 30 days, 4.3% year to date, and a 11.1% decline over the last year, alongside longer term returns of a 32.6% decline over 3 years and a 20.6% decline over 5 years.

- Investors have been watching UPS closely as parcel volumes, global trade flows, labor developments, network investments and competitive pressures across delivery and logistics continue to shape sentiment. These themes often sit in the background when prices move, so it is useful to keep them in mind as we compare UPS to what traditional valuation models suggest it might be worth.

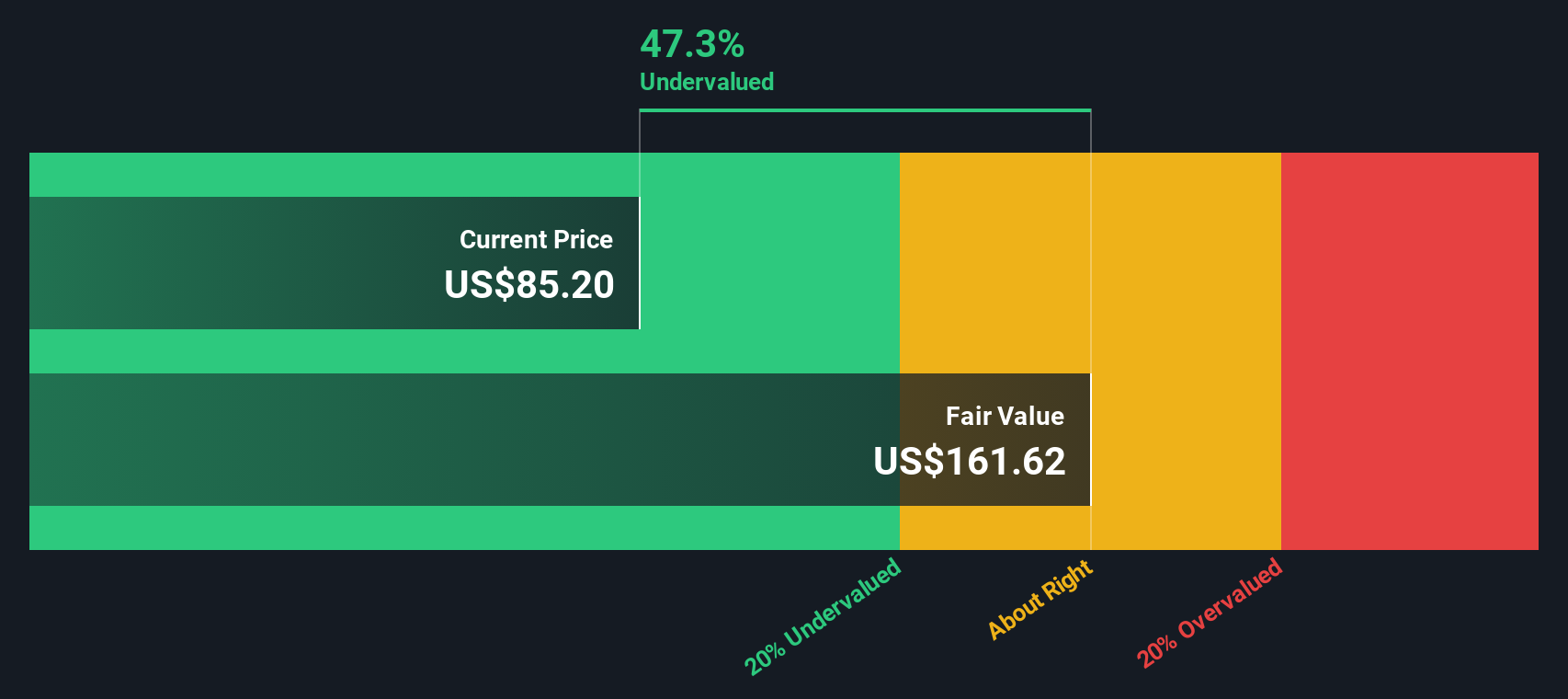

- On our framework, UPS currently holds a valuation score of 4 out of 6, indicating it screens as undervalued on four checks. The sections ahead will look at how methods such as discounted cash flow, earnings multiples and asset based comparisons line up with that score, before rounding out with a broader way to think about valuation that goes beyond any single model.

Find out why United Parcel Service's -11.1% return over the last year is lagging behind its peers.

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business could be worth by projecting its future cash flows and discounting them back to today, so everything is expressed in present value terms.

For United Parcel Service, the model uses last twelve month free cash flow of about $3.71b as the starting point, then applies a 2 Stage Free Cash Flow to Equity approach. Analyst estimates and extrapolations feed into projections that reach a future free cash flow of $7.95b in 2035, with interim years such as $5.27b in 2026 and $6.24b in 2029. These projected cash flows are discounted using the model’s required return, which produces a present value stream for each year.

On this basis, the DCF model arrives at an estimated intrinsic value of $133.94 per share. Compared with the recent share price of $105.41, this implies the stock screens as around 21.3% undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 21.3%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: United Parcel Service Price vs Earnings

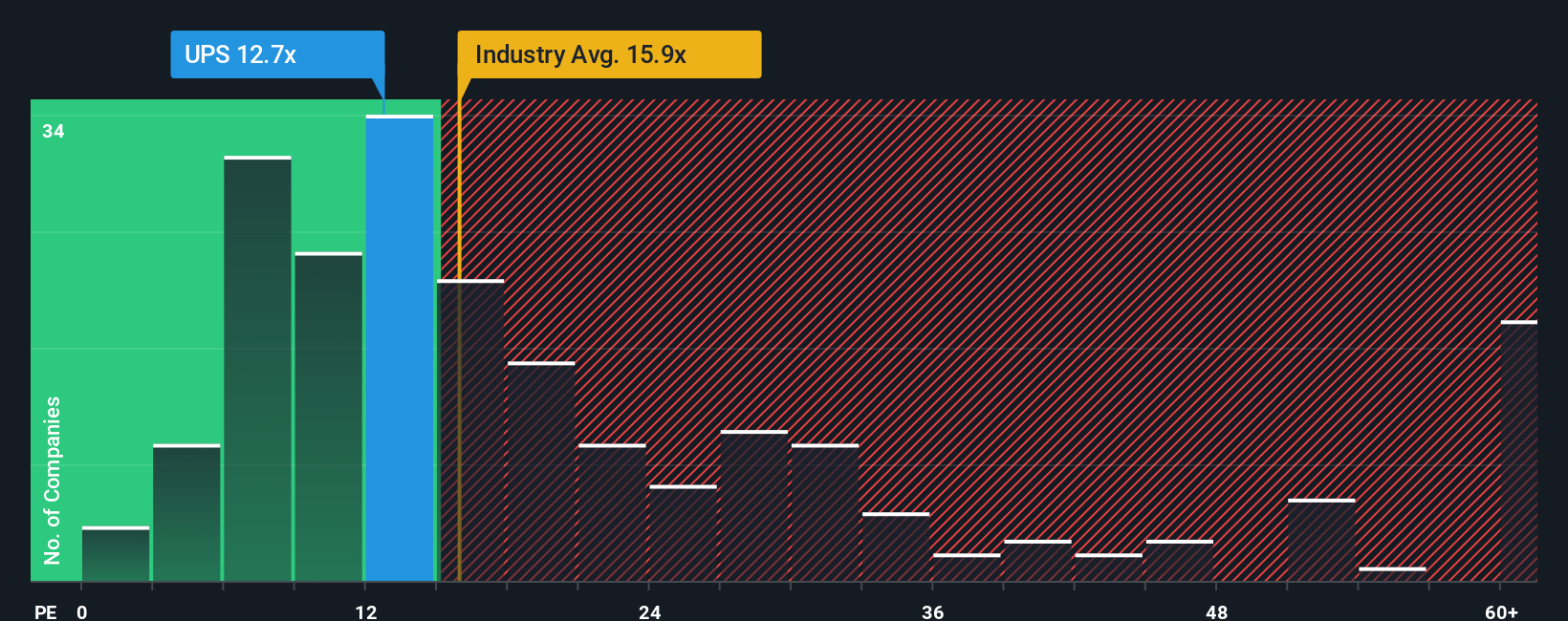

For a profitable business like United Parcel Service, the P/E ratio is a useful way to think about what you are paying for each dollar of earnings. It ties the share price directly to current earnings, which many investors watch closely when they compare companies in the same industry.

What counts as a “normal” P/E depends on what the market expects for growth and how risky those earnings appear. Higher expected growth or lower perceived risk can support a higher multiple, while slower growth or higher risk usually calls for a lower one.

UPS currently trades on a P/E of 16.25x, which is close to the Logistics industry average of about 16.25x and below the peer group average of 21.93x. Simply Wall St’s Fair Ratio for UPS is 20.02x. This Fair Ratio is a proprietary estimate of what a balanced P/E might look like after factoring in earnings growth characteristics, the company’s industry, profit margins, market cap and its specific risk profile.

Because it folds these company specific drivers into one number, the Fair Ratio can be more informative than a simple comparison to peers or the industry. With UPS on 16.25x versus a Fair Ratio of 20.02x, the stock screens as undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you connect your story about United Parcel Service to specific forecasts for revenue, earnings, margins and a fair value. You can then compare that fair value to today’s price and see how it changes when new news or earnings arrive. For example, one investor might build a cautious UPS Narrative with a fair value of US$95.21 that leans on cost pressures and labor issues. Another might build a more optimistic UPS Narrative with a fair value of US$132.37 that leans on automation and healthcare logistics. You can easily see where your view fits between the lowest price target of US$75.00 and the highest of US$133.00.

For United Parcel Service, we will make it really easy for you with previews of two leading United Parcel Service Narratives:

🐂 United Parcel Service Bull Case

Fair value: US$122.00

Implied discount to this fair value vs the recent US$105.41 price: about 13.6% undervalued

Revenue growth assumption: 2.14% a year

- Focuses on cost efficiencies, automation and network reconfiguration, with an emphasis on margin improvement and cash flow from programs such as Efficiency Reimagined and higher automation across the network.

- Sees healthcare logistics, cold chain, pharma and small and medium business healthcare as a large, higher margin opportunity, supported by technology and acquisitions such as Andlauer.

- Factors in both competitive and regulatory risks, but ties the bullish view to analyst assumptions for higher earnings, wider profit margins and a higher future P/E multiple than today.

🐻 United Parcel Service Bear Case

Fair value: US$95.21

Implied premium to this fair value vs the recent US$105.41 price: about 10.7% overvalued

Revenue growth assumption: 1.75% a year

- Emphasizes higher costs, balance sheet leverage, union and shareholder tensions and questions whether large cost cutting and network overhaul plans can be executed without disrupting operations.

- Highlights pressures from new debt issuance, higher expected interest costs and recent shareholder and labor disputes that weigh on sentiment and could limit financial flexibility.

- Builds a cautious earnings path using moderate revenue and margin assumptions and a future P/E that sits below the industry, which together point to a lower fair value than the bullish view.

Both narratives use the same company, but different assumptions about growth, margins, risks and the multiple investors might be willing to pay. If you recognise your own thinking in one of these, that can be a useful anchor for how you interpret the current UPS share price, the valuation models above and what would need to change in the story for your view to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for United Parcel Service? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報