Assessing Magnite (MGNI) Valuation After Recent Share Price Rebound

Magnite overview and recent share performance

Magnite (MGNI) has drawn attention after a mixed stretch in its share performance, with a gain of about 12.7% over the past month but a roughly 9.4% decline over the past 3 months.

See our latest analysis for Magnite.

Magnite’s recent share price return has improved, with a 12.7% 30 day gain and 4.6% year to date share price return. The 1 year total shareholder return of 2.1% and 3 year total shareholder return of 58.9% point to a mixed but overall positive longer run, suggesting momentum has been rebuilding after earlier weakness.

If Magnite’s move has caught your eye, this could be a moment to see what else is setting up for potential growth across tech and AI, including high growth tech and AI stocks.

With Magnite trading at $16.80 and sitting at what looks like a sizeable discount to both analyst targets and some intrinsic value estimates, you have to ask: is this a genuine buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 37.4% Undervalued

Magnite’s most followed narrative points to a fair value of about $26.86 per share, compared with the last close of $16.80, implying a sizable valuation gap.

The analysts have a consensus price target of $28.192 for Magnite based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $24.0.

Curious what justifies a higher value than the consensus target, even with only modest revenue and margin assumptions and a discount rate under 7%? The full narrative explains how future earnings, profitability shifts and a rich earnings multiple are combined to arrive at that figure.

Result: Fair Value of $26.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh real pressure points, such as heavy dependence on big CTV partners and the risk that expected gains from Google antitrust actions disappoint.

Find out about the key risks to this Magnite narrative.

Another View On Magnite’s Valuation

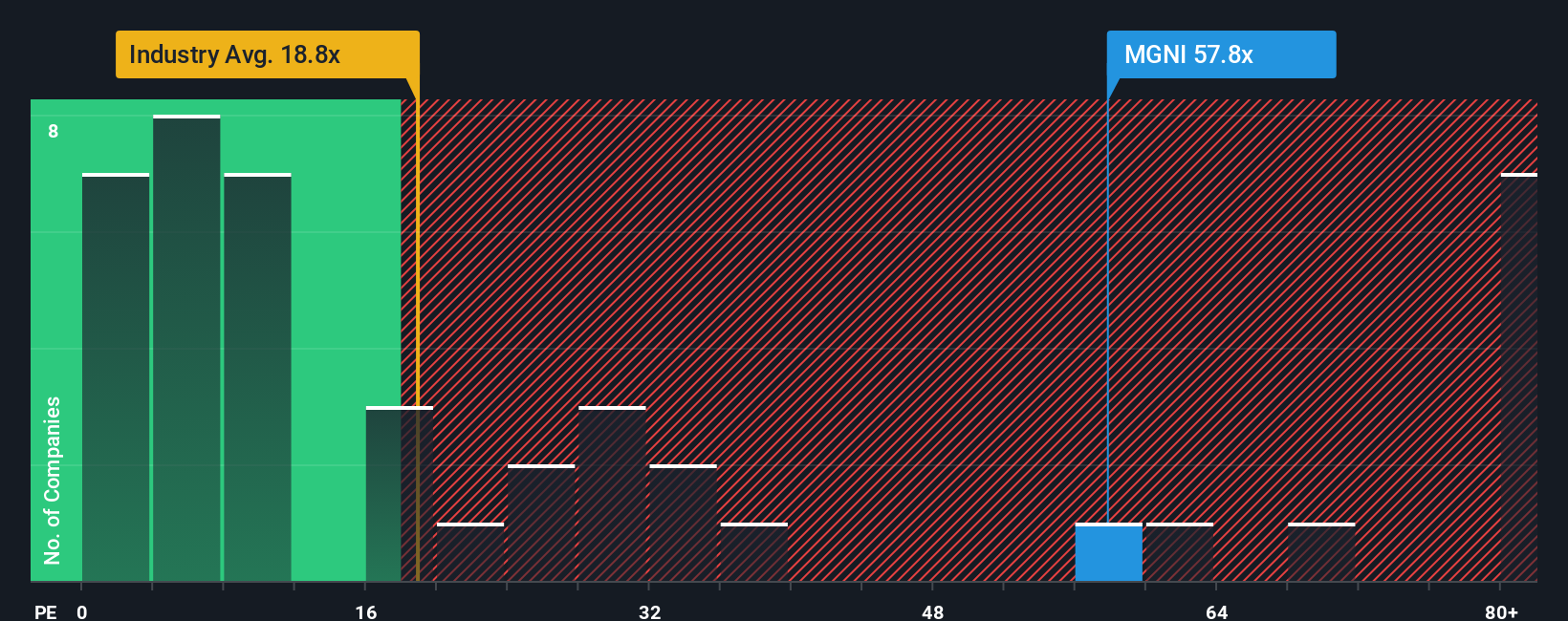

The narrative fair value points to Magnite as undervalued, but the P/E ratio tells a different story. At 41.6x earnings, the shares trade well above the US Media industry on 14.6x and a fair ratio of 18.5x, while still below peers at 76.9x.

That kind of gap can indicate that the market is already paying a premium for future progress, even if analysts see more upside. The question for you is whether the current price already reflects most of the positive expectations, or whether the fair ratio represents a level the market could still move toward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magnite Narrative

If you see the numbers differently or want to test your own assumptions against the data, you can build a fresh Magnite storyline in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Magnite.

Looking for more investment ideas?

If Magnite has sharpened your interest, do not stop here. Widen your search to other focused stock ideas where the numbers and story might line up even better.

- Spot early stage opportunities with strong fundamentals by scanning these 3550 penny stocks with strong financials that already show more than just hype.

- Target companies at the front line of machine learning and automation by checking out these 26 AI penny stocks that could benefit if demand for AI solutions continues to build.

- Zero in on potential value candidates by reviewing these 884 undervalued stocks based on cash flows that trade at a discount to their cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報