A Look At Antero Resources (AR) Valuation As Natural Gas Demand Outlook Strengthens

Industry backdrop and why Antero is on investors’ radar

Fresh commentary on the U.S. exploration and production space is spotlighting more durable natural gas demand tied to LNG exports and power generation, putting Antero Resources (AR) in focus for investors who monitor income and cash flow stability.

See our latest analysis for Antero Resources.

Antero’s recent moves have come against a mixed trading backdrop, with a 1 day share price return of 1.77% and a 30 day share price return decline of 11.90%. The 5 year total shareholder return of 346.47% points to very strong long term compounding, suggesting shorter term momentum has cooled even as the long run story remains intact.

If gas focused names are on your radar, it can also be a good time to see what else is out there through fast growing stocks with high insider ownership.

With shares down over the past year despite annual revenue and net income growth, and trading at a discount to the average analyst price target, investors now face a key question: Is Antero a mispriced gas play, or is the market already baking in future growth?

Most Popular Narrative: 22% Undervalued

With Antero Resources closing at US$32.86 against a narrative fair value of about US$42.14, the current pricing sits well below that narrative estimate and sets up a valuation story built around growth, margins and capital returns.

Ongoing capital efficiency gains including declining maintenance capital requirements, longer well laterals, and falling well costs year over year are reducing per unit operating costs, boosting net margins, and freeing up additional cash for debt reduction and shareholder returns. Low leverage, disciplined capital allocation, and a flexible return of capital approach (including share buybacks below intrinsic value) are described as increasing potential for future accretive EPS growth as the company deleverages and builds balance sheet strength.

Curious how a mid teens revenue growth profile, thicker margins, and shrinking share count combine into that higher fair value? The narrative leans on a confident earnings path and a richer future earnings multiple usually seen in faster growing sectors. Want to see which cash flow and profitability assumptions have to hold up for that pricing to make sense?

Result: Fair Value of $42.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story also depends on risks, including tighter climate regulation and potential pipeline constraints that could pressure margins and limit Antero’s growth options.

Find out about the key risks to this Antero Resources narrative.

Another view on valuation

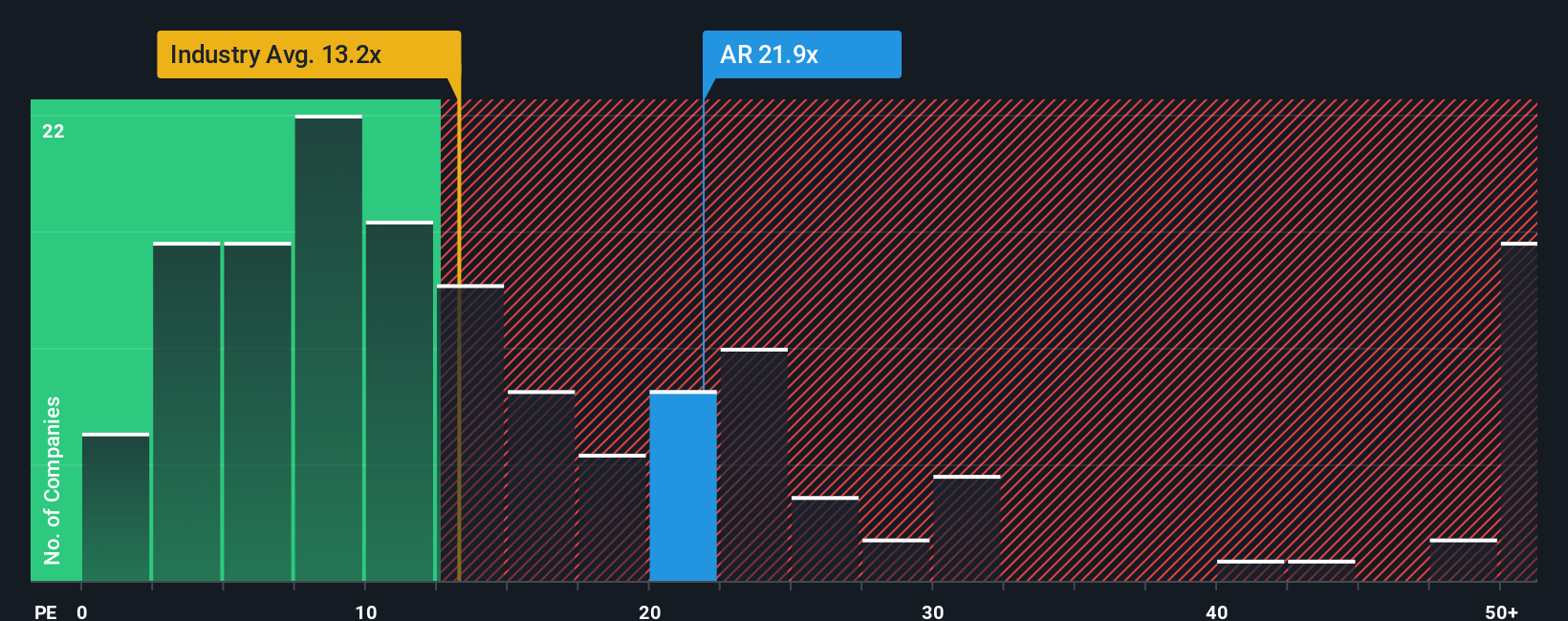

While the fair value narrative points to a 22% discount, the current P/E of 17.2x sketches a different picture. It sits above the US Oil and Gas industry at 13.1x, but below peers at 38.9x and under a fair ratio of 19.1x, which raises a simple question: is this a cushion or a warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Resources Narrative

If you see the story differently or just prefer to test the numbers yourself, you can build a custom thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Antero Resources.

Looking for more investment ideas?

If Antero has sharpened your thinking, do not stop here. Broaden your watchlist now so you are not late to the next opportunity.

- Spot potential value early by checking out these 3550 penny stocks with strong financials that pair low share prices with stronger balance sheets and fundamentals than many investors expect.

- Focus your research on real use cases in machine learning and automation with these 26 AI penny stocks that already tie revenue to AI driven products and services.

- Zero in on price tags that look appealing relative to cash generation using these 884 undervalued stocks based on cash flows and quickly see which names merit a deeper look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報