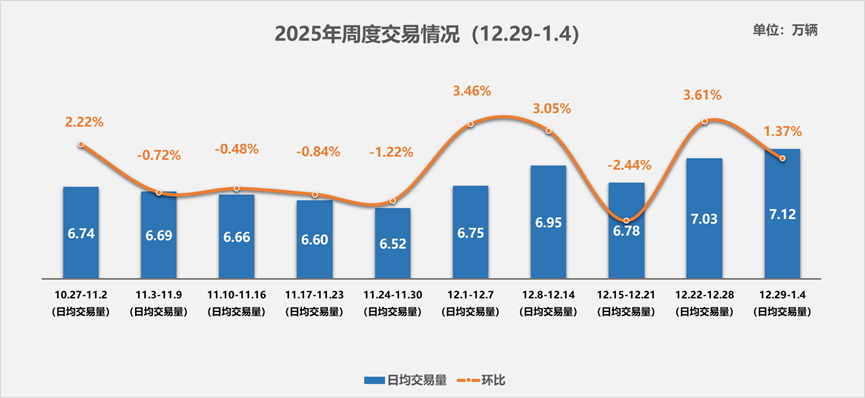

China Automobile Dealers Association: The average daily sales of used cars in the first week of the year was 712,000, up 1.4 percentage points from month to month

The Zhitong Finance App learned that the China Automobile Dealers Association published an article stating that from December 29, 2025 to January 4, 2026, the average daily trading volume of the used car market reached 712,000 vehicles, a slight increase of 1.4 percentage points over last week. Although the increase was not significant, the overall market showed a steady, moderate, positive, and gradual warming trend.

Note: The trading volume is calculated over 5 business days

Judging from corporate research feedback, the market sentiment is characterized by fragmentation and overall stability. This week, 20% of the companies surveyed said that the current market sentiment is better than last week, while over 40% believe that the market is running smoothly, reflecting the industry's relatively rational judgment on current market trends. The terminal price level shows a diversified pattern. Over 60% of companies reported that the used car price trend was stable and there were no major fluctuations. This phenomenon highlights the relative balance between supply and demand in the current market, and the market operation base is solid. At the same time, 20% of companies still mentioned that due to the pressure to clear inventory at the end of the year, some models were moderately adjusted in order to speed up the return of capital and improve inventory turnover efficiency, and prices declined slightly.

The used car market continued to maintain a steady upward trend for two weeks after December. Judging from the characteristics of the market, the end of the year is the traditional peak consumption season, and many consumers tend to complete their car purchase plans before the end of the year to meet travel needs and welcome the new year. In particular, those consumers who focus on cost performance and pursue the New Year's car exchange experience have become the core purchasing power of the market, further driving the recovery in terminal turnover. From the supply side, in order to seize the year-end window period, used car dealers, on the one hand, accelerated the pace of inventory clean-up to return funds, and on the other hand, actively expanded the scale of vehicle collection to reserve high-quality vehicle sources for sales in the first quarter of 2026, forming a parallel “clearing+preparation” operation pattern.

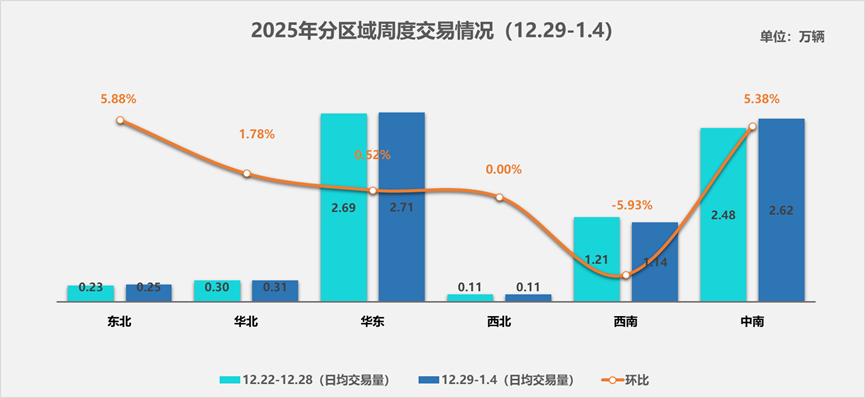

Used car weekly regional analysis

This week, the overall used car market showed a slight upward trend. Judging from the specific performance of regional markets, the average daily trading volume in Northeast China, North China, East China, and Central and South China all increased. In contrast, trading volume in the southwest region declined slightly this week, while the northwest market remained stable and showed no significant fluctuations.

Specifically, the average daily volume of used cars traded in East China was 271,000 units, an increase of 0.52% over the previous month. Judging from the market transactions in major cities, used car transactions in Hefei, Xiamen, Linyi, Jinan, Shanghai, Hangzhou, Wenzhou and other places all showed positive growth. Among them, the performance of the Hangzhou and Wenzhou markets was particularly impressive, with trading volume growing by more than 20%; the Linyi market grew by more than 15% this week; the trading volume of the Jinan market increased 13.2% month-on-month; in contrast, market trading volume in places such as Nantong, Zaozhuang, Jining, and Jinhua showed a marked decline. In particular, the Jining and Zaozhuang markets all fell by more than 20% this week, and market activity declined significantly.

The average daily volume of used cars traded in North China was 0.31 million units, an increase of 1.78% over the previous month. This week, activity in the used car market increased significantly in cities such as Shijiazhuang, Langfang, Tianjin, and Taiyuan. Among them, the growth trend in Shijiazhuang and Langfang is particularly prominent, with trading volume growth rates of over 20%; the Taiyuan market also showed clear signs of recovery this week, with trading volume up 18.7% month-on-month; while the Tianjin market rose close to 10% this week. However, the Beijing market experienced a significant decline this week, with trading volume falling by more than 20% month-on-month; the Chifeng market showed a slight downward trend this week.

The average daily volume of used cars traded in Northeast China was 0.25,000 units, an increase of 5.88% over the previous month. This week, activity in the used car market in Harbin, Changchun, Shenyang, Dalian, Jixi, Jinzhou and other cities all increased significantly. Among them, the trading volume growth rate of the Changchun market was particularly prominent, exceeding 25%; the trading volume of the Harbin and Shenyang markets both increased by more than 10% this week. In addition, markets in Jixi, Jinzhou, and Songyuan are also showing good growth trends. In contrast, the trend of the Dalian market this week appeared to be relatively stable, with no obvious fluctuations.

The average daily volume of used cars traded in the southwest region was 11,400 units, down 5.93% from the previous month. This week, the used car trading markets in major cities such as Chengdu, Chongqing, and Kunming all showed a weak trend, and trading volume declined. Among them, the decline in the Chengdu market was particularly significant, with trading volume falling by more than 20% month-on-month; the Kunming market falling 15% month-on-month; and the Chongqing market's trading volume also dropped by more than 10% this week. It is worth mentioning that the Guiyang and Lhasa markets showed signs of recovery this week. The trading volume of the Guiyang market increased by as much as 20%, and the Lhasa market grew by more than 10% this week.

The average daily volume of used cars traded in the central and southern regions was 26,200 units, an increase of 5.38% over the previous month. Used car market transactions in places such as Dongguan, Nanning, Haikou, Wuhan, Changsha, and Pingdingshan all showed an upward trend. Among them, the performance of the Dongguan market was particularly impressive this week, with trading volume growing by more than 20%; activity in the Haikou and Changsha markets also increased dramatically this week, with trading volume growing at 15% month-on-month; and the Nanning and Wuhan markets showed a slight upward trend. However, the trading volume of the Guangzhou and Jiaozuo markets declined markedly this week, both by more than 10%.

The average daily volume of used cars traded in the northwest was 0.11,000 units, which remained the same as the previous week. This week, the used car markets in Lanzhou and Xining showed significant signs of recovery. The increase in transaction volume both exceeded 20% month-on-month, and market activity increased significantly; while the markets in Xi'an, Wu Zhong, Bazhou and other places experienced significant declines, with transaction volume falling between 10% and 20%.

Nasdaq

Nasdaq 華爾街日報

華爾街日報