First Horizon (FHN) Valuation Check After Choppy Trading And Ongoing Share Price Momentum

Why First Horizon is on investors’ radar today

First Horizon (FHN) has caught investor attention after recent share price moves, with the stock showing mixed short term returns and stronger figures over the past year, prompting fresh interest in its valuation.

See our latest analysis for First Horizon.

Recent trading has been a bit choppy, with a 1 day share price return of 0.32% decline at US$24.59, but a 30 day share price return of 7.95% and a 1 year total shareholder return of 22.54% suggest momentum has been building rather than fading.

If First Horizon has you rethinking your watchlist, this could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With First Horizon trading at US$24.59 and an analyst price target of about US$26.41, plus an estimated intrinsic value gap of roughly 23%, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 2.6% Undervalued

The most followed narrative pegs First Horizon’s fair value around US$25.25 per share versus the last close at US$24.59, framing a modest discount that hinges on specific growth and earnings assumptions.

Analysts expect earnings to reach $965.0 million (and earnings per share of $2.03) by about September 2028, up from $816.0 million today. The analysts are largely in agreement about this estimate.

Curious how a measured step up in revenue, slightly slimmer margins, and a future earnings multiple combine into that fair value? The narrative leans on a detailed path for earnings, share count, and an assumed valuation level years out. Want to see how those pieces fit together and what has to go right for the numbers to hold?

Result: Fair Value of $25.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh rising provision expenses and net charge offs, along with softer fee income, which could pressure margins and challenge this undervalued story.

Find out about the key risks to this First Horizon narrative.

Another Angle on Valuation

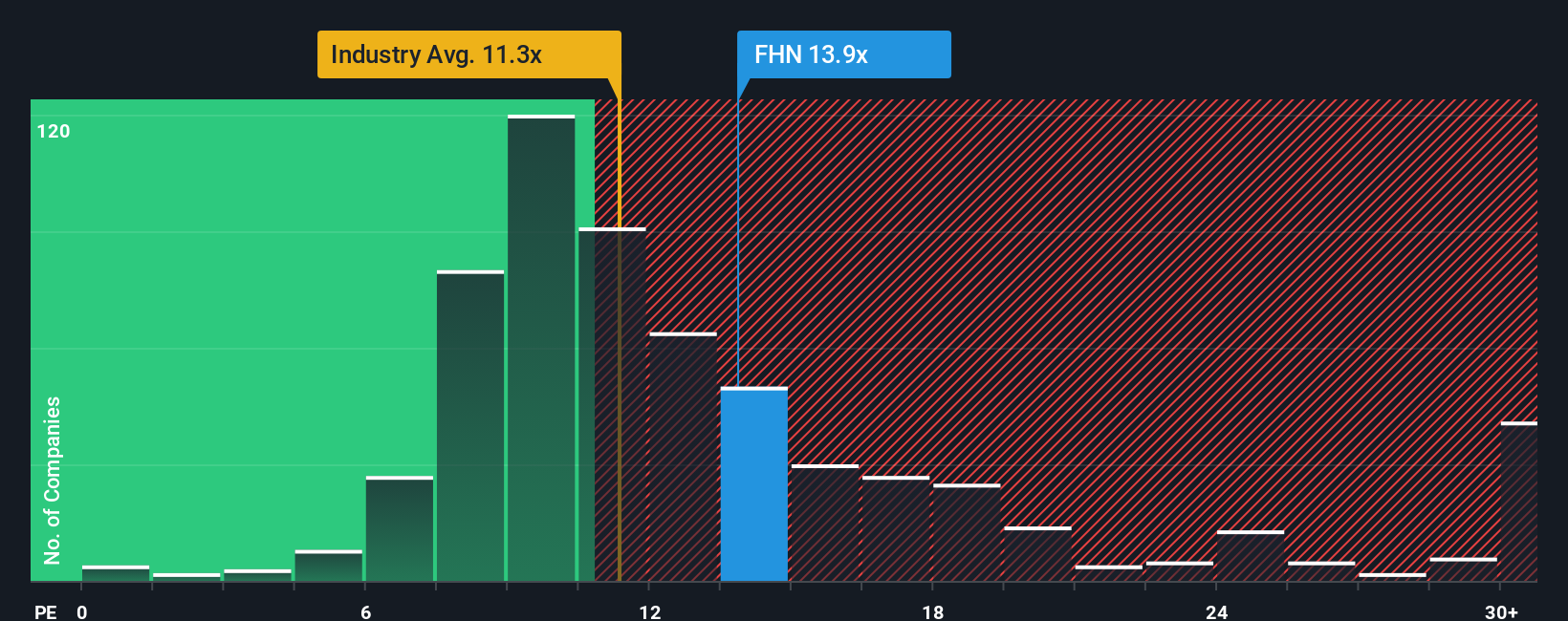

The narrative points to First Horizon as modestly undervalued, yet its 14.1x P/E sits above both the US Banks industry at 11.9x and a fair ratio of 13.3x. That premium suggests less room for error if earnings or sentiment soften, so how comfortable are you paying above the pack?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Horizon Narrative

If you see the story differently, or prefer to test the assumptions yourself, you can build your own view in minutes with Do it your way.

A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If First Horizon has sharpened your thinking, do not stop here, the right next idea could be sitting in plain sight if you know where to look.

- Spot potential high reward opportunities early by scanning these 3552 penny stocks with strong financials that already show stronger financial footing than many expect at this end of the market.

- Ride fast moving themes in artificial intelligence by checking out these 26 AI penny stocks that are directly exposed to demand for data, automation, and new software tools.

- Put value first by focusing on these 887 undervalued stocks based on cash flows where current prices do not fully reflect their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報