Assessing Verint Systems (VRNT) Valuation After New TrustRadius Buyer’s Choice Awards Recognition

TrustRadius awards put Verint Systems (VRNT) in focus

Verint Systems (VRNT) recently picked up two TrustRadius 2026 Buyer’s Choice awards, including recognition in the Contact Center category. The awards have brought fresh attention to how its AI powered customer experience tools might relate to the stock.

See our latest analysis for Verint Systems.

Despite the TrustRadius recognition, Verint Systems’ share price return has been weak over the year, with a year to date share price return decline of 23.33% and a 1 year total shareholder return decline of 16.59%, suggesting recent AI related headlines have not yet shifted longer term sentiment.

If awards in customer experience tech have caught your eye, it could be a good moment to scan high growth tech and AI stocks for other names shaping this space.

With Verint trading around US$20.51, an intrinsic value estimate that sits at a 62% discount and a value score of 5 raise the big question for you: is this a mispriced AI CX player, or is future growth already baked in?

Most Popular Narrative: Fairly Valued

With Verint closing at US$20.51 and the most followed narrative fair value at US$20.50, the story sits almost exactly on today’s price, putting the focus squarely on the assumptions behind that match.

The analysts have a consensus price target of $20.5 for Verint Systems based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $193.2 million, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 9.5%.

Want to see what has to happen for that earnings jump, margin shift and lower future P/E to line up perfectly with today’s “about right” price? The key ingredients are already laid out in the narrative projections, including how recurring revenue and profitability are expected to evolve from here. Curious which of those levers needs to do most of the heavy lifting to keep US$20.50 looking reasonable? Read on and weigh those assumptions against your own view of Verint’s AI customer engagement story.

Result: Fair Value of $20.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can shift quickly if AI adoption slows or competitors win key deals, which could challenge those margin and earnings assumptions.

Find out about the key risks to this Verint Systems narrative.

Another View: Multiples Point To A Different Story

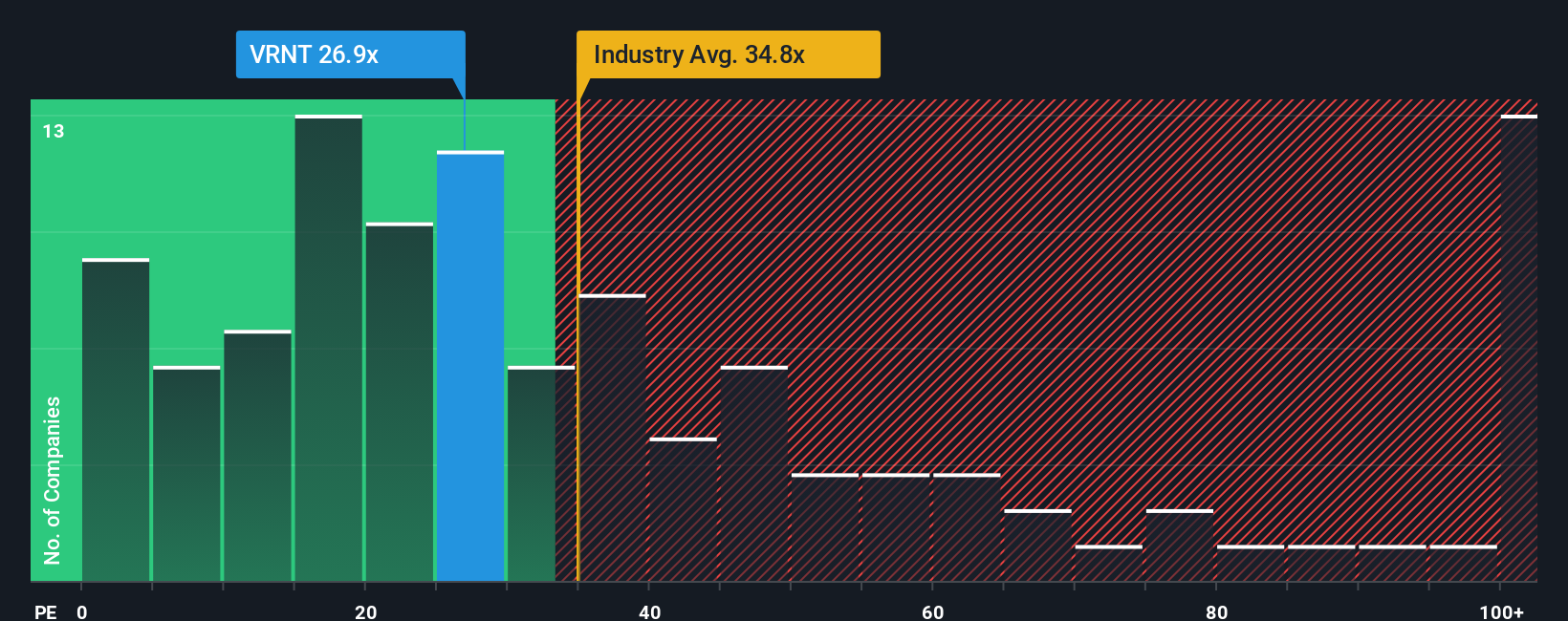

So far the narrative sits on a fair value of about US$20.50. Yet on plain earnings multiples, Verint appears cheaper. The current P/E of 27.2x is well below peers at 56x and below a fair ratio of 42.7x. This could suggest that the market is pricing in extra risk or discounting the AI story more heavily. Is that a margin of safety or a warning sign in your view?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verint Systems Narrative

If the consensus story does not quite fit how you see Verint, you can shape your own view using the same data in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Verint Systems.

Looking for more investment ideas?

If Verint has sharpened your thinking, do not stop here. The next move could come from spotting a fresh idea before everyone else starts talking about it.

- Spot potential value early by scanning these 3553 penny stocks with strong financials that pair smaller market caps with stronger financial foundations than you might expect.

- Focus your AI thesis with these 26 AI penny stocks and see which names already align with the kind of growth and adoption story you are looking for.

- Hunt for pricing gaps using these 886 undervalued stocks based on cash flows and compare how projected cash flows line up against current market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報