Celtic And 2 More Undiscovered Gems In The United Kingdom

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns about global economic recovery. Amidst this backdrop, identifying promising stocks that can weather such uncertainties becomes crucial; these companies often exhibit strong fundamentals and resilience in volatile conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Foresight Environmental Infrastructure | NA | -24.80% | -27.25% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Celtic (AIM:CCP)

Simply Wall St Value Rating: ★★★★★★

Overview: Celtic plc, along with its subsidiaries, runs a professional football club in the United Kingdom and has a market cap of £189.18 million.

Operations: Celtic plc generates revenue primarily from three segments: Football and Stadium Operations (£61.20 million), Multimedia and Other Commercial Activities (£52.33 million), and Merchandising (£30.06 million).

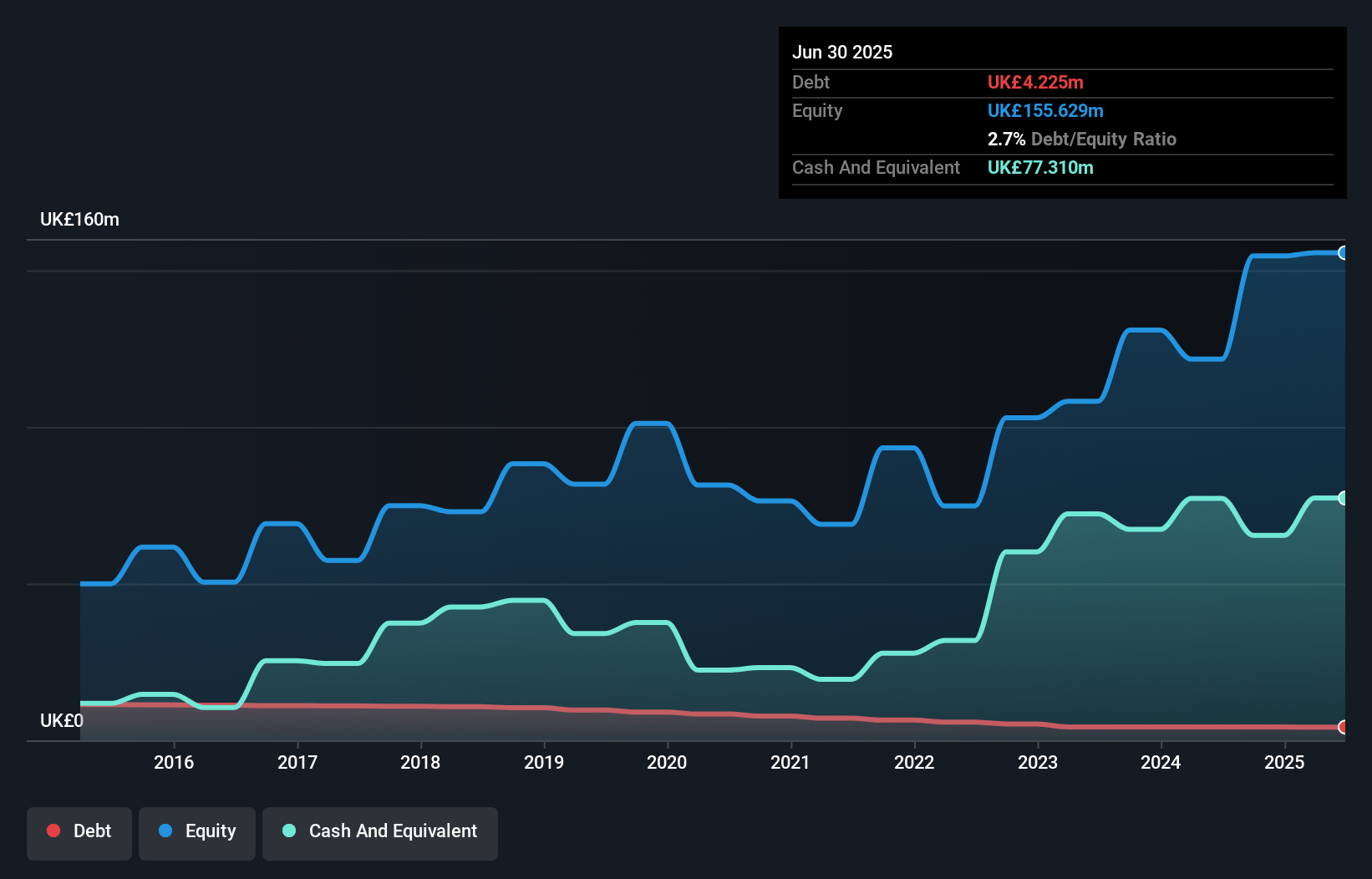

Celtic, a notable player in the UK market, has shown impressive earnings growth of 153.5% over the past year, outpacing the Entertainment industry average of 22.2%. Its price-to-earnings ratio stands at 5.6x, significantly below the broader UK market's 16.5x, suggesting potential undervaluation. The company has successfully reduced its debt-to-equity ratio from 10.3 to 2.7 over five years and maintains more cash than total debt, highlighting financial prudence and stability despite recent executive changes with Peter Lawwell stepping down as Chairman at year-end and Brian Wilson stepping in as interim Chairman.

- Click to explore a detailed breakdown of our findings in Celtic's health report.

Evaluate Celtic's historical performance by accessing our past performance report.

AEP Plantations (LSE:AEP)

Simply Wall St Value Rating: ★★★★★★

Overview: AEP Plantations Plc, along with its subsidiaries, focuses on owning, operating, and developing oil palm plantations in Indonesia and Malaysia with a market capitalization of £542.93 million.

Operations: AEP Plantations generates revenue primarily through the cultivation of oil palm plantations, amounting to $436.63 million. Its business operations are concentrated in Indonesia and Malaysia, with a market capitalization of £542.93 million.

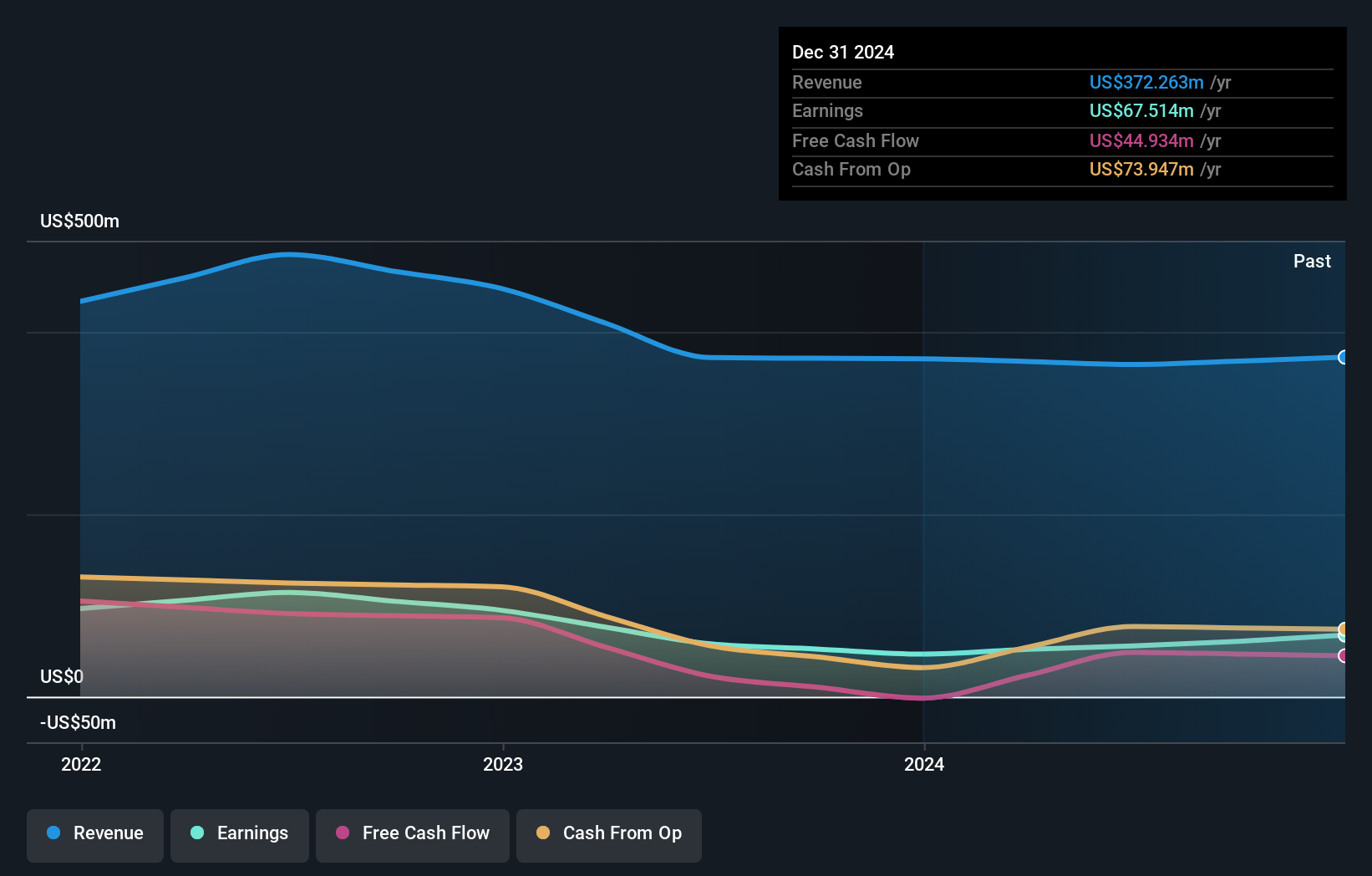

AEP Plantations, a small cap player in the UK market, has shown robust earnings growth of 63.4% over the past year, outpacing the Food industry's 22.6%. The company is debt-free now compared to a debt to equity ratio of 0.6% five years ago and trades at an appealing value, 16.2% below its estimated fair value. Recent developments include a name change effective November 2025 and increased fresh fruit bunch production by 7%, boosting total CPO production by 8%. However, forecasts suggest earnings may decline by an average of 10.1% annually over the next three years.

- Navigate through the intricacies of AEP Plantations with our comprehensive health report here.

Understand AEP Plantations' track record by examining our Past report.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Law Debenture Corporation p.l.c. is an investment trust offering independent professional services globally to a diverse clientele, with a market capitalization of £1.45 billion.

Operations: The company generates revenue primarily from its Investment Portfolio (£38.42 million) and Independent Professional Services (£63.99 million). The net profit margin for the most recent period was 25%.

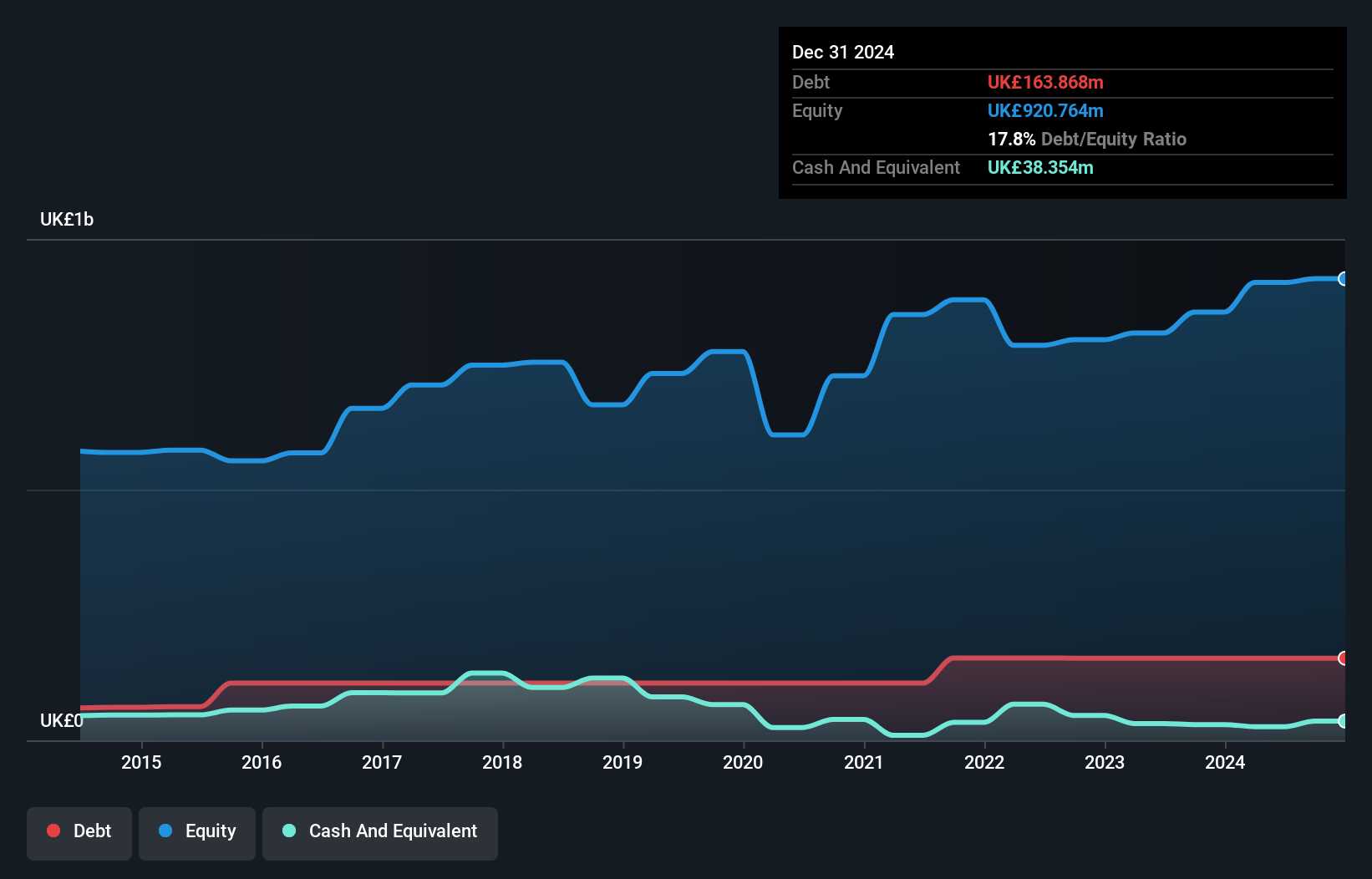

Law Debenture, a standout in the UK market, boasts an impressive 20.9% earnings growth over the past year, outpacing the Capital Markets industry's 2.4%. With a net debt to equity ratio of 15.2%, its financial health seems robust, especially with interest payments covered 28.6 times by EBIT. The company has effectively reduced its debt from 18.7% to 15.4% over five years and offers high-quality earnings alongside positive free cash flow of £48.82 million as of mid-2025. Additionally, it declared a third interim dividend increase of 4.7%, reflecting strong shareholder returns and confidence in future prospects.

- Take a closer look at Law Debenture's potential here in our health report.

Gain insights into Law Debenture's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 55 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報