Lyft (LYFT) Valuation Check As Chicago’s New Congestion Surcharge Raises Ride Costs

Chicago’s congestion surcharge puts Lyft’s pricing and demand in focus

Chicago’s new Ground Transportation Tax TNP Congestion Zone Surcharge, which adds per-ride fees in busy areas, puts Lyft (LYFT) under closer scrutiny as investors weigh how higher rider costs could influence demand and overall economics.

See our latest analysis for Lyft.

While the Chicago surcharge has drawn attention to near term cost pressures, Lyft’s share price return over the past month shows a 12.67% decline. However, its 1 year total shareholder return of 47.01% points to stronger longer term momentum that investors are weighing against recent volatility.

If this kind of regulatory shift has you thinking about where growth might show up next, it could be worth scanning fast growing stocks with high insider ownership as a source of fresh ideas.

With Lyft’s share price down 12.67% over the past month but up 47.01% over the last year, plus an indicated intrinsic discount of 58.92%, you have to ask yourself: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 18.4% Undervalued

With Lyft’s fair value in the most followed narrative above the last close of $19.64, the story centers on how future growth might support that gap.

The analysts have a consensus price target of $17.123 for Lyft based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $10.0.

Curious what kind of revenue climb, margin shift, and future P/E this narrative leans on. The punchline is a valuation built around those three levers.

Result: Fair Value of $24.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the whole thesis can wobble if competition from larger rivals caps rider growth, or if regulatory shifts and AV setbacks push costs higher than expected.

Find out about the key risks to this Lyft narrative.

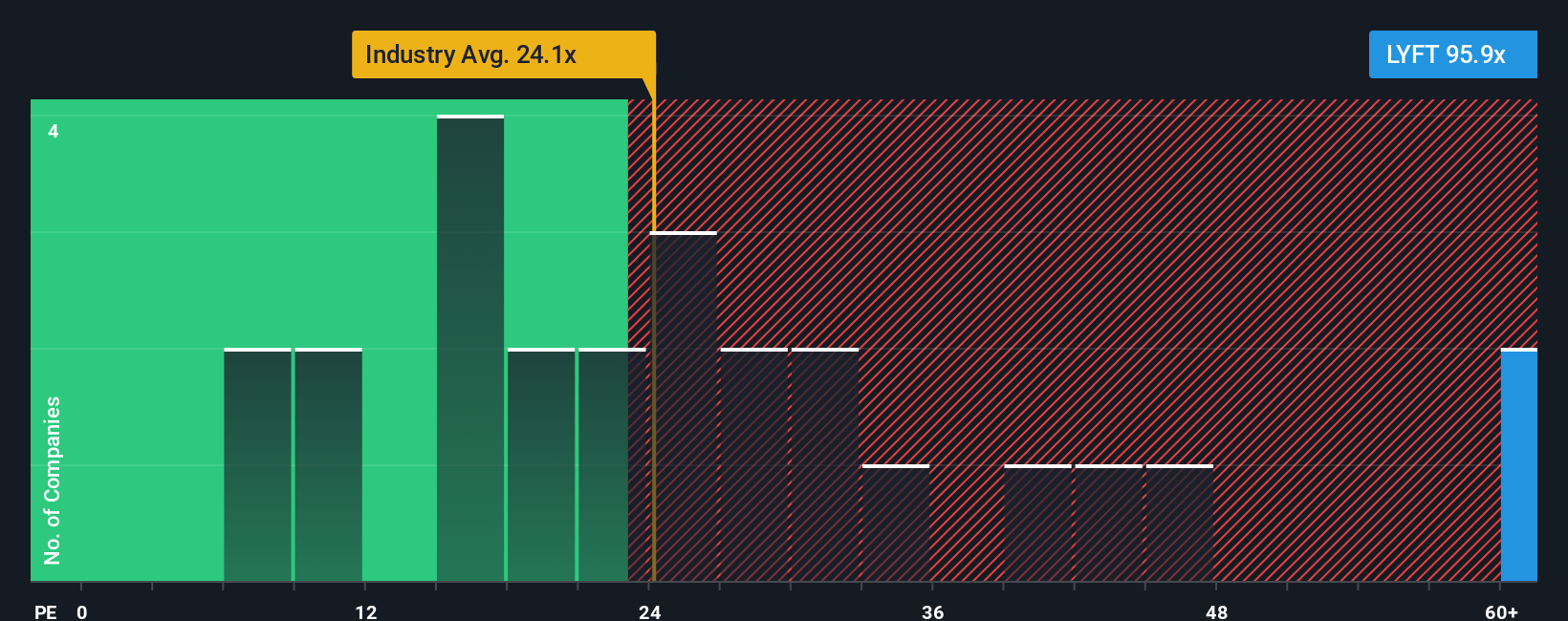

Another View: What Earnings Ratios Are Saying

The earlier fair value of US$24.07 paints Lyft as 18.4% undervalued, but the earnings multiples tell a tougher story. At a P/E of 52.1x, Lyft trades above the US Transportation industry average of 32.8x and its own fair ratio of 18.5x, even though it sits slightly below the peer average of 57.4x. That gap suggests the market is already paying up for future earnings, so the question is whether you are comfortable underwriting that kind of valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lyft Narrative

If the numbers or narratives here do not quite match your view, you can explore the data, develop your own perspective in minutes, and Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lyft.

Ready for more investment ideas?

If Lyft has you thinking more broadly about where to put your money to work, do not stop here; the next opportunity you care about could be one screen away.

- Target potential turnaround stories by scanning these 3553 penny stocks with strong financials that combine smaller market caps with fundamentals you can actually scrutinize.

- Zero in on future facing themes by filtering for these 26 AI penny stocks that tie artificial intelligence to real business models and measurable traction.

- Focus on value by searching these 886 undervalued stocks based on cash flows where current prices sit below cash flow based estimates, so you can decide if the gap looks justified.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報