Is Conagra Brands (CAG) Using Project Catalyst To Quietly Redefine Its Profitability Playbook?

- In early January 2026, Conagra Brands launched “Project Catalyst,” an initiative using AI, data, and automation to reengineer its core business amid recent sales and margin pressures, while reaffirming full-year guidance and emphasizing cash flow and debt reduction over acquisitions.

- A key aspect of this shift is Conagra’s decision to prioritize internal efficiency and cost reduction rather than growth via acquisitions, signaling a meaningful change in how it aims to protect profitability.

- We’ll now examine how Project Catalyst’s focus on AI-driven cost efficiencies could influence Conagra Brands’ existing investment narrative and risk profile.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Conagra Brands Investment Narrative Recap

To own Conagra Brands today, you need to believe the company can stabilize volumes and margins in a tough packaged-food market while managing a heavy balance sheet. Project Catalyst, with its AI and automation push, directly targets the key short term catalyst of cost productivity, but the recent price target cuts reinforce that demand softness and margin pressure remain the biggest near term risk.

The launch of Project Catalyst is the clearest recent development tied to this earnings reset, as it explicitly aims to lower costs and expand margins after a quarter that included a US$968.0m non cash impairment and a swing to a net loss. How effectively this program converts into sustainable savings will matter for both Conagra’s cash flow priorities and the timing of any recovery in profitability.

Yet while management leans into cost savings, investors should be aware that ongoing sales and margin pressure could still...

Read the full narrative on Conagra Brands (it's free!)

Conagra Brands' narrative projects $11.4 billion revenue and $905.9 million earnings by 2028. This implies a 0.5% yearly revenue decline and an earnings decrease of about $300 million from $1.2 billion today.

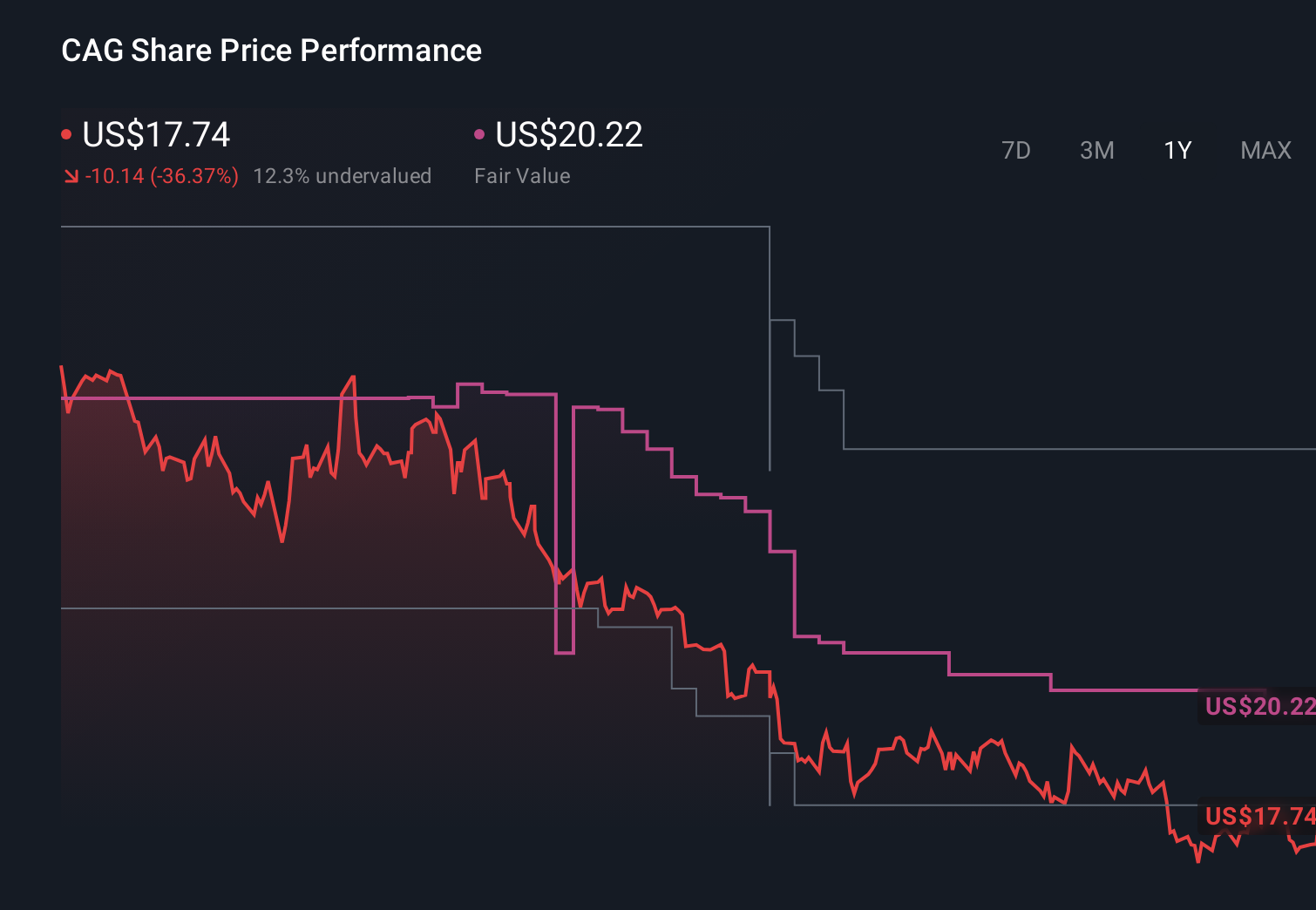

Uncover how Conagra Brands' forecasts yield a $20.22 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span a wide range, from US$16.50 up to about US$74.61, showing how far apart views can be. Set that against the current focus on AI driven productivity gains, and it becomes clear you should compare several perspectives before forming an opinion on Conagra’s longer term earnings power.

Explore 10 other fair value estimates on Conagra Brands - why the stock might be worth just $16.50!

Build Your Own Conagra Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Conagra Brands research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Conagra Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Conagra Brands' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報