Market Cool On Digitalist Group Plc's (HEL:DIGIGR) Revenues Pushing Shares 26% Lower

Unfortunately for some shareholders, the Digitalist Group Plc (HEL:DIGIGR) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

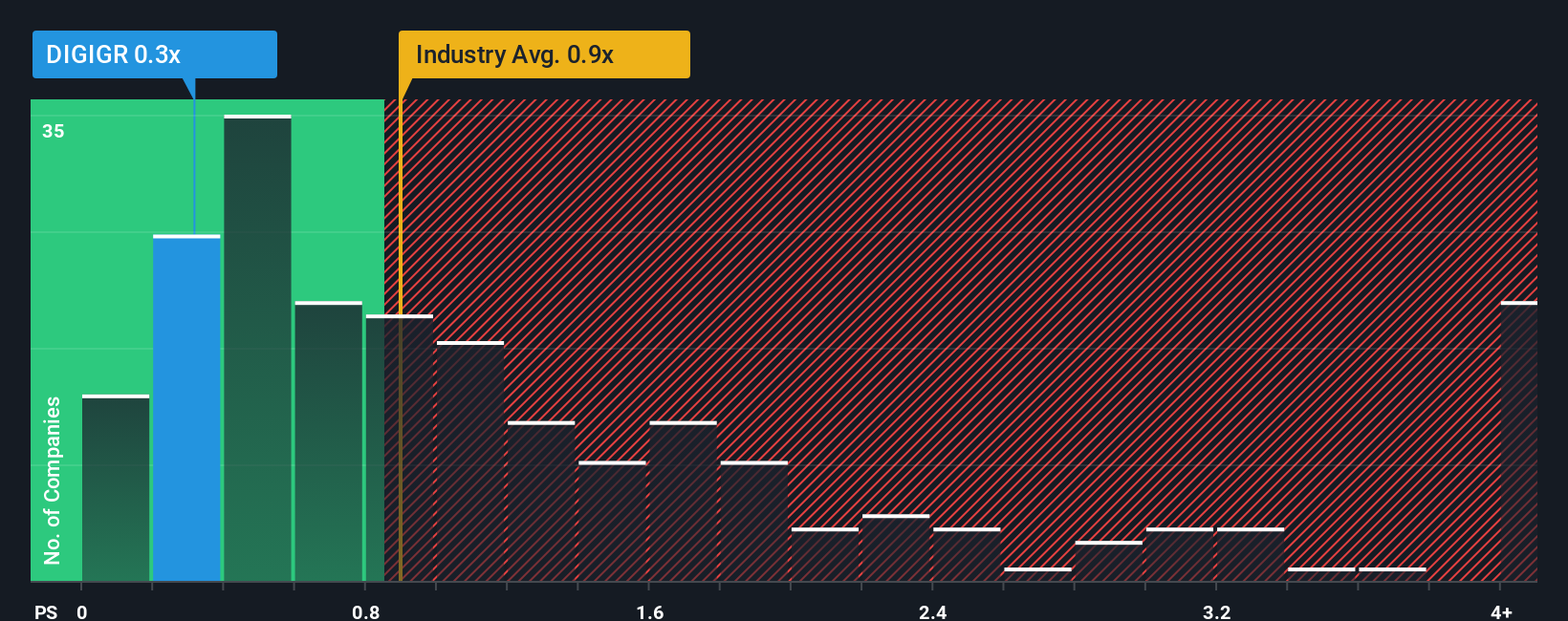

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Digitalist Group's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the IT industry in Finland is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Digitalist Group

How Digitalist Group Has Been Performing

Revenue has risen firmly for Digitalist Group recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Digitalist Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Digitalist Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Digitalist Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Still, lamentably revenue has fallen 10% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 25% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing but explainable that Digitalist Group's P/S matches closely with its industry peers. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

With its share price dropping off a cliff, the P/S for Digitalist Group looks to be in line with the rest of the IT industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Digitalist Group currently trades on a slightly lower than expected P/S if you consider its recent three-year revenues aren't as bad as the forecasts for a struggling industry. When we see less revenue decline than the industry but a P/S that's only on par, we assume potential risks are what might be placing pressure on the P/S ratio. Perhaps investors have reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 5 warning signs for Digitalist Group (4 don't sit too well with us!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報