Assessing Texas Instruments (TXN) Valuation After Recent Share Price Swings And Modest Long Term Returns

What Texas Instruments’ Recent Performance Signals for Investors

Texas Instruments (TXN) has been drawing attention after a mixed pattern of recent returns, including a 0.03% daily decline, modest gains over the past week and month, and a slightly positive total return over the past year.

See our latest analysis for Texas Instruments.

With the latest share price at US$185.71, Texas Instruments has seen a 3.33% 1 day share price decline after a 7.04% 7 day share price return and a 4.61% year to date share price return. The 5 year total shareholder return of 24.88% points to steadier long term compounding, suggesting short term momentum has cooled after a recent upswing.

If Texas Instruments has you looking more closely at chips and computing, this is a good moment to widen the search to high growth tech and AI stocks and see what else stands out.

So with Texas Instruments trading around US$185.71, modest recent gains and an intrinsic value estimate that sits above the current price, is there still a sensible entry point here, or is the market already pricing in future growth?

Most Popular Narrative: 1.7% Undervalued

Texas Instruments’ fair value in the most widely followed narrative sits close to the last close of US$185.71, with only a small implied upside. This puts the focus on the assumptions embedded in that model rather than a large valuation gap.

Management is signaling that the benefits of recent U.S. tax incentives and R&D/capex expensing will materially lower future cash tax rates, bolstering free cash flow and enabling increased capital returns (dividends/buybacks). This is expected to contribute to long-term earnings per share expansion even in periods of muted sales growth.

Curious what kind of revenue growth, margin profile and future P/E multiple are baked into that fair value, and how a double digit discount rate still supports it? The full narrative lays out a detailed earnings path, a specific profitability target and the valuation multiple needed to tie it all together.

Result: Fair Value of $188.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on chip demand holding up. Weaker industrial or automotive orders and tougher China competition could quickly pressure margins and undercut that fair value case.

Find out about the key risks to this Texas Instruments narrative.

Another Angle On Valuation

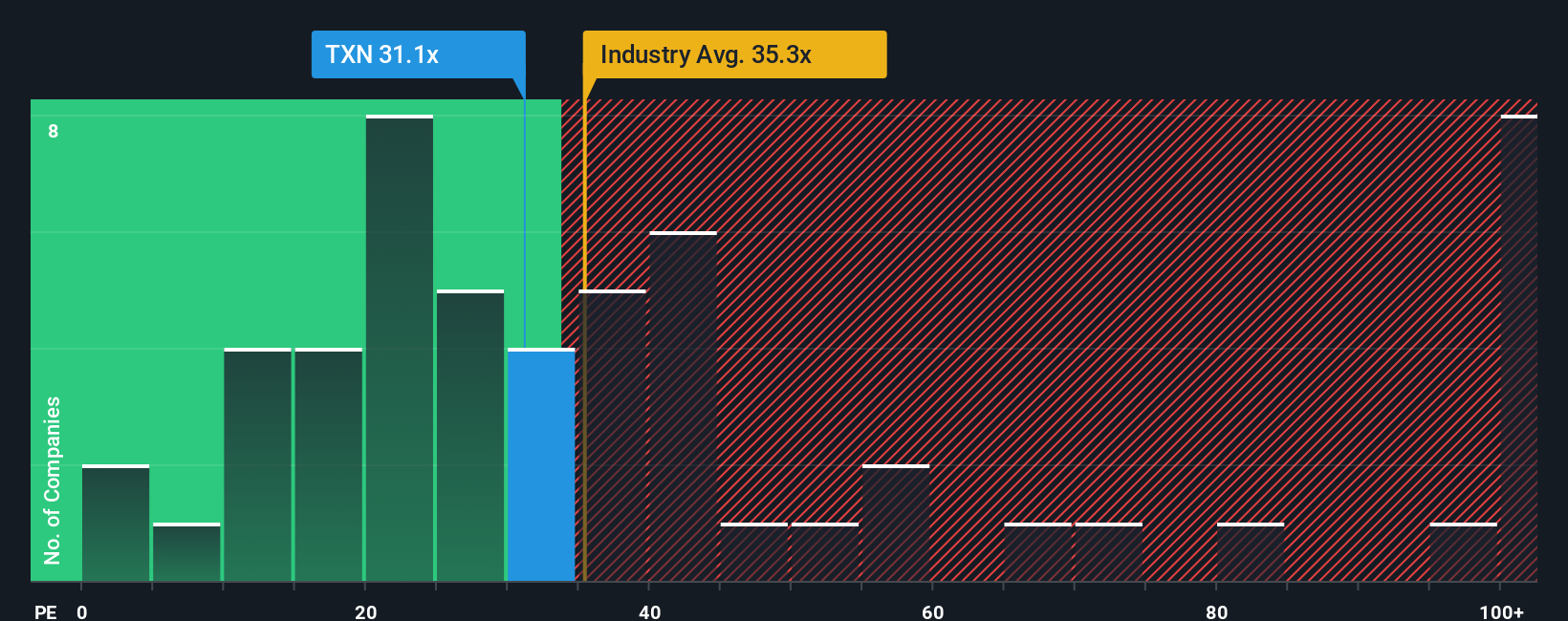

That 1.7% undervaluation story sits alongside a very different signal from earnings multiples. Texas Instruments trades on a 33.6x P/E, above its own fair ratio of 29.8x, which points to the shares looking expensive even though the P/E is lower than the US Semiconductor average of 41.2x and the 68.7x peer average. For you, the question is whether that premium acts as a cushion or instead represents a source of valuation risk if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Instruments Narrative

If this storyline does not quite fit how you see Texas Instruments, you can pull up the same data, test your own assumptions, and Do it your way in just a few minutes.

A great starting point for your Texas Instruments research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Hunt for Your Next Idea?

If you stop with just one stock, you risk missing opportunities that fit your style even better, so keep going and let the data work for you.

- Spot companies the market may be overlooking by checking out these 885 undervalued stocks based on cash flows built around cash flow based signals.

- Tap into the growth story in artificial intelligence with these 26 AI penny stocks focused on businesses exposed to this theme.

- Position your portfolio for recurring income by scanning these 12 dividend stocks with yields > 3% that meet a minimum yield hurdle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報