Assessing CrowdStrike (CRWD) Valuation After Cantor Reiterates Overweight On Stronger Growth Outlook

CrowdStrike Holdings (CRWD) is back in focus after Cantor Fitzgerald reiterated an Overweight rating, highlighting what it sees as accelerating business momentum and a more constructive financial outlook for the cybersecurity vendor.

See our latest analysis for CrowdStrike Holdings.

The recent reaffirmed rating comes after a choppy stretch, with a 30 day share price return of a 7.04% decline and a 90 day share price return of a 5.94% decline. However, the 1 year total shareholder return of 33.51% and a very large 3 year total shareholder return of around 4x together point to longer term momentum still in place despite a softer patch for the stock.

If you are watching how AI driven security names are trading, this could be a useful moment to scan other high growth tech and AI opportunities through high growth tech and AI stocks and see what stands out to you.

With shares around $478.91, a recent pullback, rapid revenue and net income growth, and a premium valuation, the real question is whether current prices leave any upside or if the market already reflects CrowdStrike’s future growth.

Most Popular Narrative: 10.2% Undervalued

The most followed narrative puts CrowdStrike Holdings' fair value at US$533.26 per share, compared with the last close of US$478.91. This frames the stock as trading at a discount based on long term cash flow assumptions and profitability targets.

The strategic focus on Next-Gen SIEM, cloud-native security, and large-scale partnerships, along with CrowdStrike's expansive data capabilities for AI development, positions the company for robust demand growth, which can drive revenue and contract value higher in future periods.

Want to see what sits behind that fair value gap? The narrative leans heavily on compounding revenue growth, margin expansion, and a rich future earnings multiple. Curious which assumptions really move the needle here? The full breakdown lays out the projected earnings runway, profitability shift, and the valuation multiple that has to hold for this price to make sense.

Result: Fair Value of $533.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can shift if execution on newer products or acquisitions disappoints, or if competitive pressure in core and adjacent security markets squeezes margins.

Find out about the key risks to this CrowdStrike Holdings narrative.

Another View: Rich Price Tag On Sales

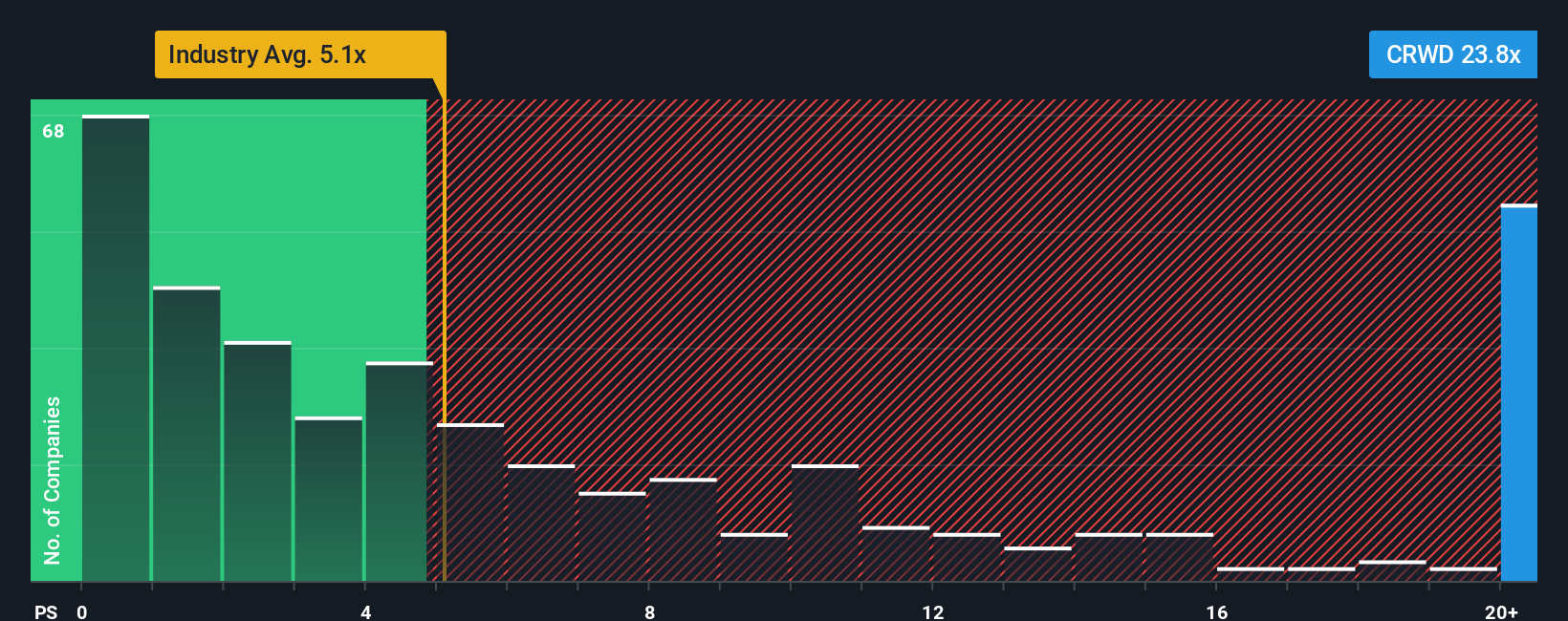

The popular narrative suggests CrowdStrike Holdings trades below fair value, but its P/S ratio of 26.4x tells a different story. That compares with 4.8x for the wider US Software industry, 12.1x for peers, and a fair ratio of 15.5x. This points to valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CrowdStrike Holdings Narrative

If you read these views and feel they do not quite match your own thinking, you can pull the same data, test your assumptions, and shape a CrowdStrike story that fits your outlook in just a few minutes, starting with Do it your way.

A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If CrowdStrike has sharpened your thinking, do not stop here. Use the same disciplined approach to scan fresh ideas that could better fit your watchlist.

- Spot potential high risk, high reward setups by checking out these 3553 penny stocks with strong financials that already clear basic financial quality hurdles.

- Tap into the AI theme by reviewing these 26 AI penny stocks that tie advanced data capabilities to real business models, not just hype.

- Focus on price versus fundamentals by scanning these 885 undervalued stocks based on cash flows that screen as cheaper based on cash flow assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報