A Look At CoStar Group (CSGP) Valuation After New 2026 Guidance And US$1.5b Buyback Plan

Why CoStar's latest guidance and capital plan matter for shareholders

CoStar Group (CSGP) has put fresh 2026 guidance on the table, pairing revenue and earnings targets with a new US$1.5b share repurchase plan and lower planned spending on Homes.com.

For 2026, the company is guiding to revenue between US$3.78b and US$3.82b, and net income of US$175m to US$215m, or US$0.42 to US$0.52 per diluted share based on 416 million shares.

Management also outlined an expansion in Adjusted EBITDA expectations for 2026 and beyond, alongside corporate governance updates that received unanimous approval from the Board of Directors and Capital Allocation Committee.

On capital deployment, the new US$1.5b buyback authorization follows completion of a prior US$500m program and indicates an intention to return a meaningful amount of capital to shareholders over time.

The company plans to reduce net investment in Homes.com by over US$300m in 2026 and is positioning that platform as a future contributor to Adjusted EBITDA and overall stockholder value rather than a heavy investment line.

See our latest analysis for CoStar Group.

The latest guidance and capital plan arrive after a difficult stretch for shareholders, with a 90 day share price return of 20.46% decline and a 1 year total shareholder return of 13.57% loss. As a result, the market reaction to CoStar's updated growth and Homes.com investment plans may influence whether this weak momentum starts to stabilize or continues to fade.

If CoStar's update has you reassessing opportunities in real estate and data driven businesses, it could be a good time to broaden your search and check out fast growing stocks with high insider ownership.

With the stock at US$61.66 after a 1 year total shareholder return loss of 13.57%, and with fresh 2026 guidance plus a US$1.5b buyback in play, is this weakness a potential entry point or is future growth already priced in?

Most Popular Narrative Narrative: 32.9% Undervalued

With CoStar Group last closing at US$61.66 versus a most popular narrative fair value of US$91.94, the current share price sits well below that estimate.

Continued digitalization and demand for high-quality, data-driven real estate platforms are associated with significant user growth, engagement, and record net new bookings across CoStar's core and expansion businesses, which in turn support ongoing double-digit revenue growth and higher recurring earnings. Market and regulatory trends continue to increase the need for transparency, fee disclosure, and real-time data. This helps solidify CoStar's role as a trusted industry standard and supports sustainable pricing power, which may contribute to further margin expansion.

Want to see what kind of revenue trajectory and margin profile can justify that gap to fair value? The narrative focuses on rapid earnings scaling, richer profitability, and a premium future P/E multiple based on the idea that CoStar continues extending its lead in data heavy real estate platforms. Curious how those moving parts could fit together over the next few years? The full narrative lays out the assumptions in detail without you needing to build the model yourself.

Result: Fair Value of $91.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear swing factors, including ongoing legal disputes around Homes.com data licensing and the risk that heavy investment fails to translate into the expected profit margins.

Find out about the key risks to this CoStar Group narrative.

Another Angle on CoStar's Valuation

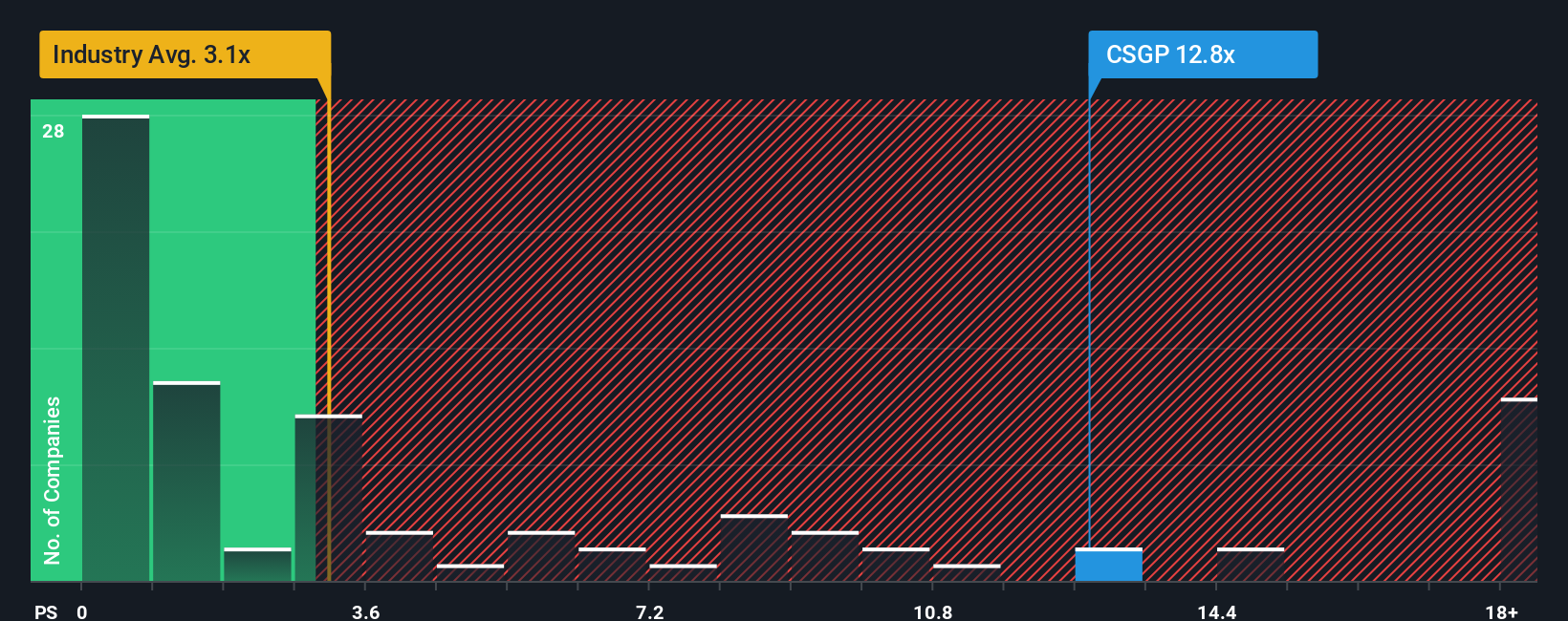

While the most popular narrative points to a fair value of US$91.94 and calls CoStar Group undervalued, the market is currently paying a rich P/S ratio of 8.5x. That is well above both the US Real Estate industry average of 2.1x and an estimated fair ratio of 5.7x, which suggests investors are already accepting extra valuation risk if growth or margins do not play out as expected. With that kind of gap, are you comfortable paying up for the story, or do you prefer to wait for the ratio to move closer to the fair ratio first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If you want to stress test these assumptions with your own numbers instead of relying on the crowd view, you can build a personalized narrative in just a few minutes, starting with Do it your way.

A great starting point for your CoStar Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one stock when you can quickly scan entire groups of companies and spot opportunities that fit your goals before everyone else does.

- Zero in on potential value candidates by reviewing these 885 undervalued stocks based on cash flows that might offer more attractive price tags based on cash flow metrics.

- Position yourself early in potential growth themes by checking out these 26 AI penny stocks riding advances in artificial intelligence across multiple industries.

- Strengthen your income focus by scanning these 12 dividend stocks with yields > 3% that already offer yields above 3% and could complement a return focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報