A Look At W. R. Berkley (WRB) Valuation After Major Insider Buying By Mitsui Sumitomo

W. R. Berkley (WRB) is back on investors’ radar after major shareholder Mitsui Sumitomo bought a large block of shares, lifting its stake materially and drawing attention to the insurer’s valuation and upcoming catalysts.

See our latest analysis for W. R. Berkley.

The recent insider buying comes after a mixed stretch for W. R. Berkley’s share price. The 30 day share price return of 2.82% has been offset by a 90 day decline of 11.65%, while the 1 year total shareholder return of 21.05% suggests longer term momentum has held up better than the shorter term pullback.

If this kind of insurance name has caught your attention, it could be a good moment to widen your watchlist with fast growing stocks with high insider ownership.

With W. R. Berkley trading near recent highs, showing a 42.23% intrinsic discount estimate and only a 6.58% discount to analyst targets, the key question is whether shares are mispriced value or already reflecting future growth.

Most Popular Narrative: 6.3% Undervalued

The most followed narrative sees W. R. Berkley’s fair value at US$73.06 versus the last close of US$68.49, putting modest upside on the table and hinging that view on how margins and earnings hold up through the next few years.

Prudent capital management, shown by a growing investment portfolio benefitting from higher new money yields and conservative reserving, is increasing investment income and book value per share. This is laying a foundation for higher long term earnings and the potential for resumed share buybacks.

Curious what has to happen with revenue, margins and the future P/E for that valuation to make sense? The narrative sets out a tight earnings path, specific profitability tweaks and a higher multiple than the broader insurance group. Want to see exactly which assumptions hold this fair value together?

Result: Fair Value of $73.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view could be challenged if softer sales trends persist, or if sector pricing pressure and rising loss costs squeeze margins harder than analysts currently expect.

Find out about the key risks to this W. R. Berkley narrative.

Another View: Premium P/E Raises Questions

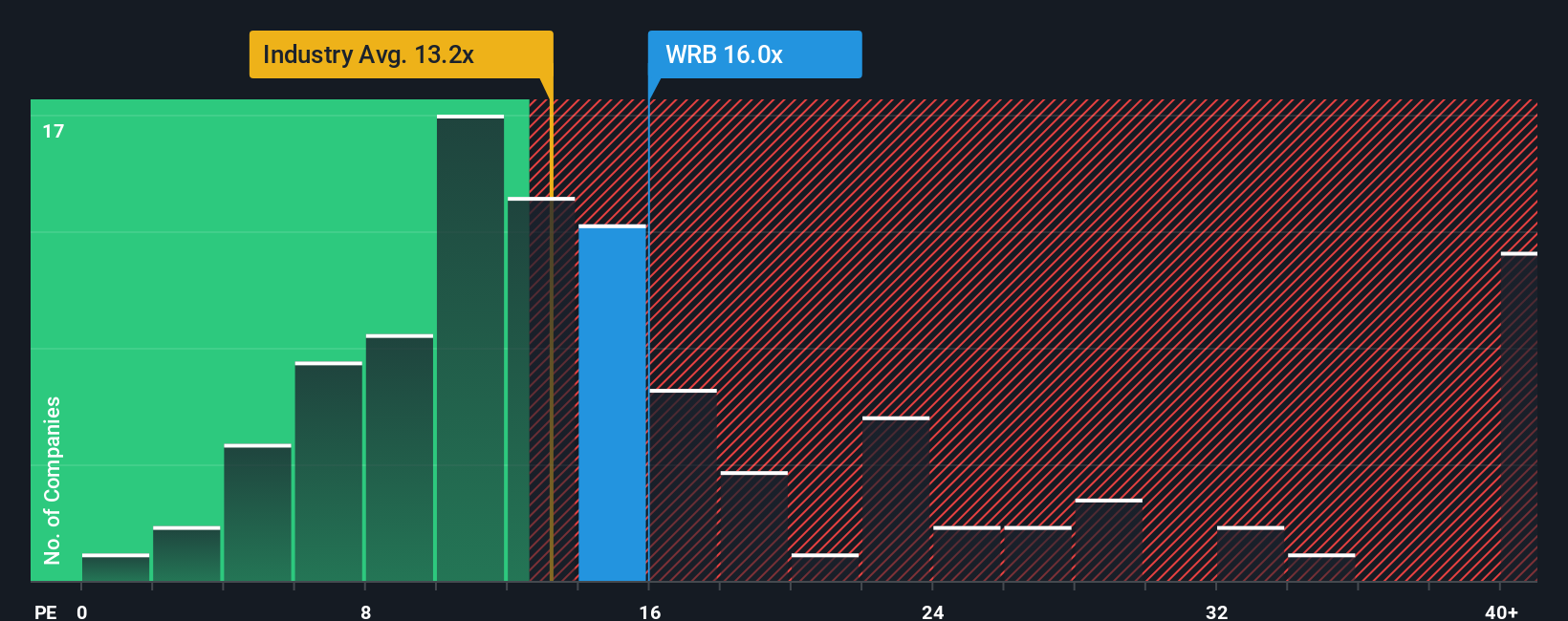

Our DCF work shows W. R. Berkley at a 42.2% discount to an estimated fair value, which points to an undervalued story. Yet the shares trade on a 13.7x P/E versus a 13x fair ratio and 12.9x for the US insurance group. That premium raises the question of whether the market is already pricing in a lot of good news.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W. R. Berkley Narrative

If you see the numbers differently or simply prefer to test the assumptions yourself, you can build a full W. R. Berkley story in minutes by starting with Do it your way.

A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a few minutes to scan fresh opportunities with focused screeners, so you do not miss companies that better match your goals.

- Spot potential turnaround stories by checking out these 3553 penny stocks with strong financials that already show stronger balance sheets and healthier fundamentals.

- Explore the next wave of computing by reviewing these 29 quantum computing stocks that are working on real world quantum applications.

- Strengthen your income watchlist with these 12 dividend stocks with yields > 3% that pair higher yields with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報