Assessing Photronics (PLAB) Valuation After Earnings Optimism And Sector Tailwinds

Photronics (PLAB) recently drew investor attention after its shares rose 5.4% in afternoon trading, following more optimistic earnings expectations and supportive news across the semiconductor sector, including stronger revenue guidance from peer Microchip Technology.

See our latest analysis for Photronics.

Those upbeat earnings expectations sit against a share price of $34.86 and a strong recent run, with a 30-day share price return of 38.06% and a 1-year total shareholder return of 43.93%. This suggests momentum has been building despite leadership changes and upcoming investor outreach at the Needham Growth Conference.

If semiconductor strength has your attention, it could be a good moment to scan high growth tech and AI stocks for other tech and AI names catching similar interest from the market.

With shares up strongly over the past year, revenue at $849.294m and net income at $136.405m, the question now is simple: is Photronics still priced at a discount, or is the market already baking in future growth?

Most Popular Narrative: 19.9% Undervalued

With Photronics closing at $34.86 against a narrative fair value of $43.50, the current price sits below what this widely followed framework suggests.

Strategic investments in U.S. capacity and cutting-edge production (multi-beam mask writer and Texas facility expansion) position Photronics to benefit as major semiconductor fabrication and reshoring initiatives are realized, supporting future revenue growth and margin expansion.

Curious what underpins that higher value estimate? Revenue building steadily, margins edging higher, and a richer future earnings multiple all play central roles. Want the full picture?

Result: Fair Value of $43.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those expectations could be knocked off course if high capital spending pressures cash flow, or if geopolitical trade restrictions further unsettle chip demand in key Asian markets.

Find out about the key risks to this Photronics narrative.

Another View: Earnings Ratio Signals Caution

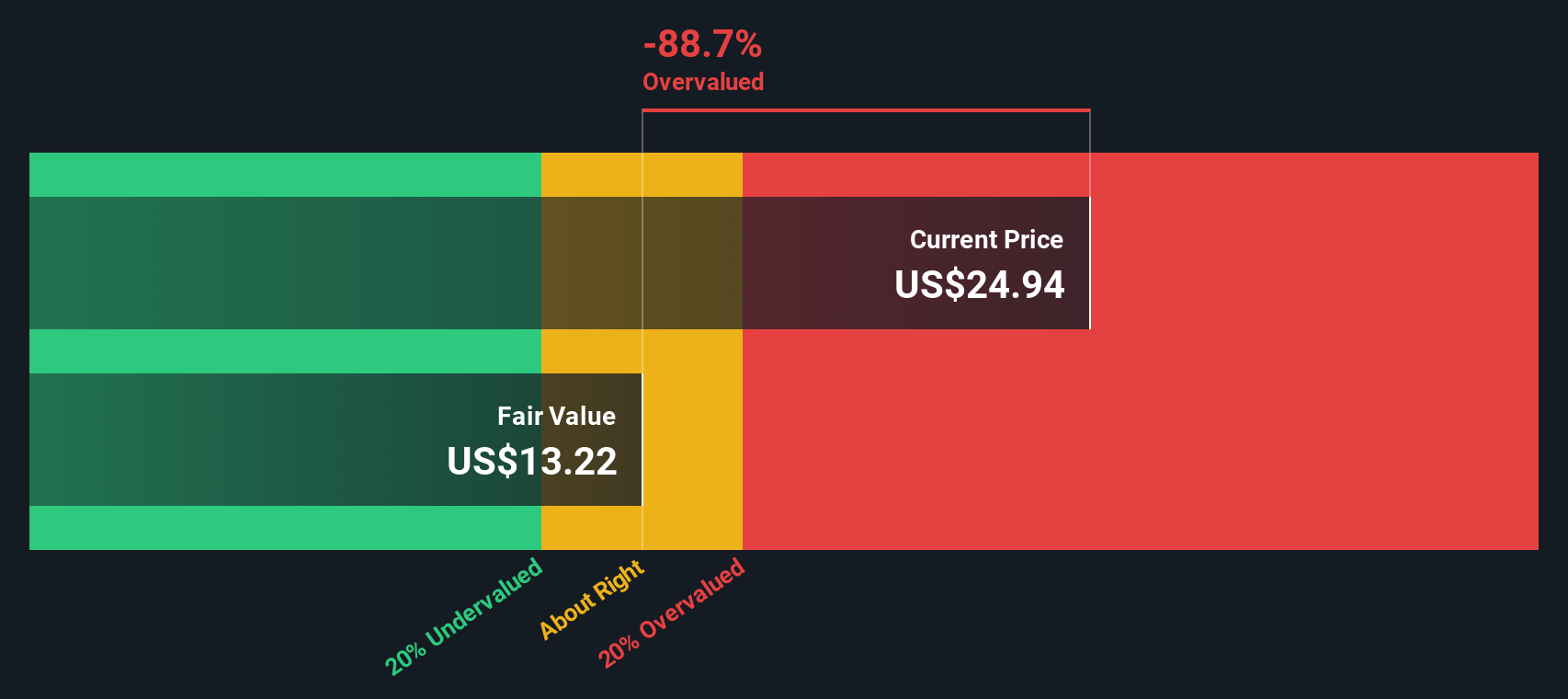

That 19.9% narrative discount sits alongside a very different signal. On our SWS DCF model, Photronics' fair value sits at about $19.05 per share, compared with the current price of $34.86, which screens as overvalued. It is the same company, evaluated with two models. Which one do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Photronics?

If you stop with one stock, you risk missing other opportunities that fit your style, so take a moment to compare a few focused idea lists side by side.

- Target potential mispricings by scanning these 885 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

- Ride the AI wave with these 26 AI penny stocks that connect cutting edge technology to real business models.

- Secure your income focus by reviewing these 12 dividend stocks with yields > 3% that combine payouts above 3% with listed financial data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報