Improved Earnings Required Before Mahanagar Gas Limited (NSE:MGL) Shares Find Their Feet

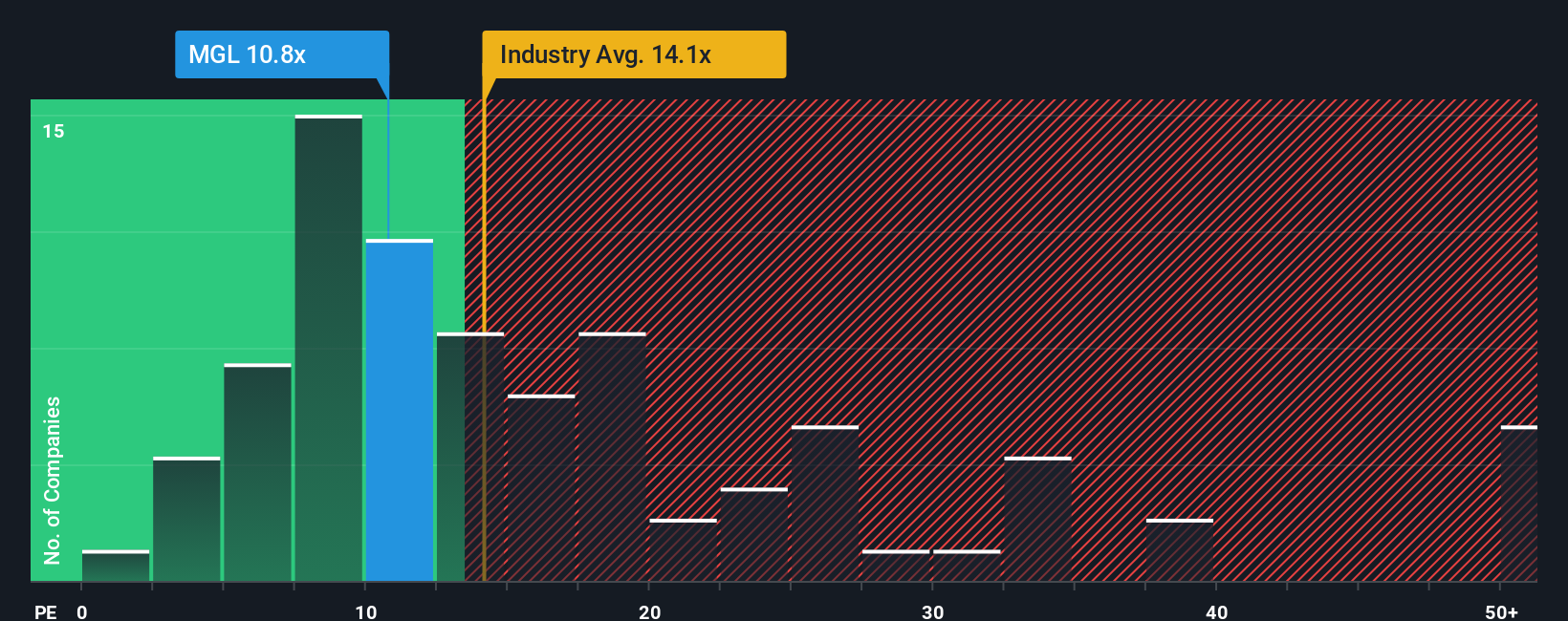

Mahanagar Gas Limited's (NSE:MGL) price-to-earnings (or "P/E") ratio of 10.8x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 26x and even P/E's above 50x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Mahanagar Gas could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Mahanagar Gas

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Mahanagar Gas' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 81% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 4.4% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% per annum, which is noticeably more attractive.

In light of this, it's understandable that Mahanagar Gas' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Mahanagar Gas' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Mahanagar Gas' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Mahanagar Gas is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If you're unsure about the strength of Mahanagar Gas' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報