Herbalife (HLF) Valuation Check After Strong Recent Share Price Momentum

Herbalife (HLF) has caught investor attention after recent trading, with the share price at $14.24 and an intrinsic discount estimate of about 38%. This raises questions about how its fundamentals line up with current market expectations.

See our latest analysis for Herbalife.

The recent rebound has been strong, with a 57.9% 90 day share price return and a 114.5% 1 year total shareholder return, suggesting momentum has picked up even as longer term total returns remain negative.

If Herbalife’s move has you rethinking your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Herbalife trading near analysts’ price target yet screening on a roughly 38% intrinsic discount estimate, you have to ask: is this a genuine value gap, or are markets already baking in future growth potential?

Most Popular Narrative: 18.7% Overvalued

The most followed narrative pegs Herbalife’s fair value at US$12.00 per share, which sits below the recent US$14.24 close. This creates a valuation gap that hinges on how its recovery story plays out.

The analysts are assuming Herbalife's revenue will grow by 4.4% annually over the next 3 years.

Analysts assume that profit margins will shrink from 6.6% today to 2.7% in 3 years time.

Want to see how modest growth, thinner margins and a higher future earnings multiple can still justify today’s price? The full narrative lays out the math behind that tension.

Result: Fair Value of $12.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a chance that Herbalife’s push into personalized wellness and new tech platforms could gain traction faster than expected and challenge this cautious view.

Find out about the key risks to this Herbalife narrative.

Another View: Market Multiple Points the Other Way

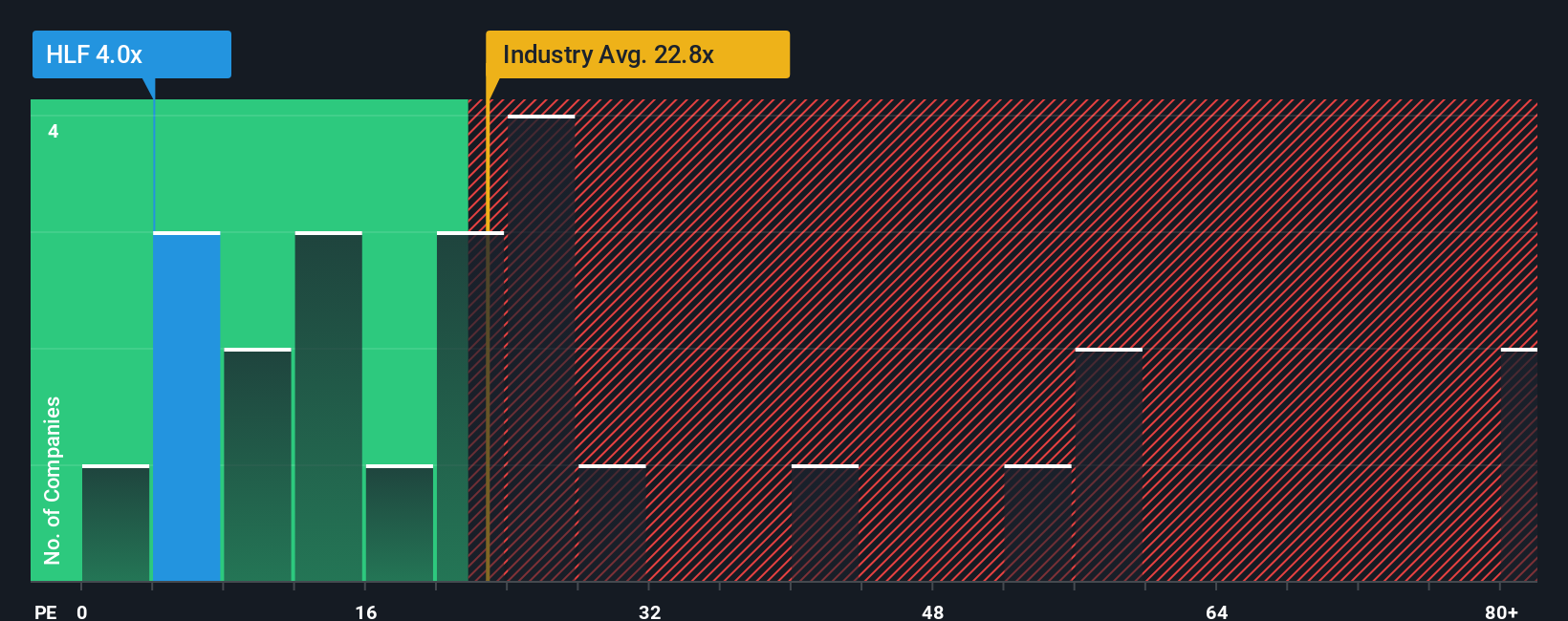

While the most popular narrative flags Herbalife as 18.7% overvalued at US$14.24 versus a US$12.00 fair value, the current P/E of 4.6x tells a different story. It sits well below both peers at 18.2x and the North American Personal Products industry at 21x, and also below a fair ratio of 11.9x that the market could move towards over time.

That sizeable gap can cut both ways, either as a cushion if expectations cool further or as a sign the market is pricing in business and balance sheet risk quite heavily. Which explanation makes more sense to you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Herbalife Narrative

If you look at these numbers and reach different conclusions, or just want to stress test the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Herbalife has sparked your curiosity, do not stop here. Broaden your opportunity set now by scanning other themes and sectors that might suit your approach.

- Target value focused ideas by checking out these 885 undervalued stocks based on cash flows that currently screen on attractive cash flow based metrics.

- Explore growth themes at the frontier of technology with these 26 AI penny stocks that tie artificial intelligence to real business models.

- Find potential income ideas by screening these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報