IPO News | Xinmai Semiconductor Announces Hong Kong Stock Exchange Adopts Fab-Lite Integrated Device Manufacturer (IDM) Business Model

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 7, Xinmai Semiconductor Technology (Hangzhou) Co., Ltd. (abbreviation: Xinmai Semiconductor) submitted a listing application to the main board of the Hong Kong Stock Exchange, and Huatai International is its sole sponsor. The company submitted a listing application to the Hong Kong Stock Exchange on June 30, 2025. According to the prospectus, Xinmai Semiconductor is a power semiconductor company that provides efficient power management solutions through its own process technology. The company uses the Fab-Lite Integrated Device Manufacturer (IDM) business model.

Company profile

The prospectus mentioned that according to Frost & Sullivan data, the semiconductor industry generally recognizes four mainstream business models: no fab, virtual IDM, Fab-Lite IDM, and IDM. Non-wafer factories and virtual IDM companies do not invest substantial capital in the wafer manufacturing process, so they lack structural capacity guarantees and are unable to exert substantial influence on process nodes. In contrast, although Fab-Lite IDM does not build or operate its own fab, it will make structured arrangements such as leasing a dedicated production line, deploying the company's own equipment at the foundry, or making partial equity or capital expenditure investments. Under the Fab-Lite IDM business model, Xinmai Semiconductor makes targeted capital investments at key points in the value chain while continuing to outsource front-end wafer manufacturing to foundry partners.

In 2019, Xinmai Semiconductor established Fushin Semiconductor as its sole shareholder, then increased its capital and introduced an independent third-party investor in 2021. Since then, Xinmai Semiconductor has held a minority interest in Fidelity Semiconductor. As of the last practical date, the company held approximately 16.76% of Fuxin Semiconductor's shares, which is equivalent to a paid-in capital contribution of RMB 1.5 billion. In addition to this strategic investment in key foundry partners, Xinmai Semiconductor is also expanding to back-end manufacturing through its own high-power module manufacturing, packaging and testing facilities operated by its wholly-owned subsidiary Hangzhou Xintong. Overall, Xinmai Semiconductor has made huge capital commitments at the foundry partner level (through investment in Fuxin Semiconductor) and at the back-end module level (through Hangzhou Xintong), and has established structured capacity planning and process development collaborations with key manufacturing partners. These promises provide Xinmai Semiconductor with real production capacity guarantees and process customization capabilities, thereby ensuring the reliable implementation of R&D and production.

Xinmai Semiconductor's core business covers research, development and sales of power management integrated circuits (ICs) and power devices in the field of power semiconductors. With its own process technology, the company provides customers with highly efficient power solutions. Xinmai Semiconductor's products cover three major technology fields: mobile technology, display technology, and power devices.

In the PMIC field, Xinmai Semiconductor focuses on customized power management ICs (PMICs) in mobile and display applications, providing comprehensive one-stop power management solutions for leading global customers in the smartphone industry, display panel industry, and automotive industry. According to Frost & Sullivan, in terms of revenue in 2024, Xinmai Semiconductor's share of the global PMIC market is about 0.42%, and the share of the global power device market is about 0.14%.

Using the Fab-Lite IDM business model, Xinmai Semiconductor has established a comprehensive supply system including Chinese and overseas supply chains. The company's products focus on providing customized solutions and high performance for leading customers. The core focus is on innovative IC and device design and the development of its own process platform. With approximately 16.76% of the shares in its long-term strategic foundry partner Fidelity Semiconductor and the company's position as one of its most important customers, Xinmai Semiconductor has received priority in terms of its production capacity and technical resources.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately RMB 1,688 billion, RMB 1.64 billion, RMB 1,574 billion, and RMB 1,458 billion, respectively.

Losses during the year/period

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded year/period losses of 172 million yuan, 506 million yuan, 697 million yuan, and 236 million yuan respectively.

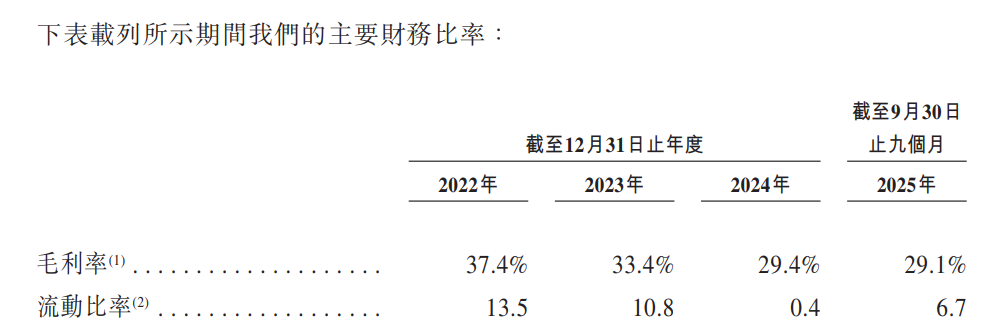

gross profit margin

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company's gross margins were 37.4%, 33.4%, 29.4%, 30.7%, and 29.1%, respectively.

Industry Overview

Over the past few years, the global power semiconductor market has shown strong resilience and continued growth momentum. The market size increased from 411.5 billion yuan in 2020 to 595.3 billion yuan in 2024. Despite macroeconomic challenges, demand in various terminal application areas remains strong. The consumer electronics, industrial applications, and automotive sectors make up the majority of downstream demand, and together account for more than 70% of total applications.

Looking ahead, the power semiconductor industry will continue to expand. The global market is expected to grow at a CAGR of 7.1% and is estimated to reach RMB 802.9 billion by 2029. As far as downstream applications are concerned, according to Frost & Sullivan, the scale of the automotive sector is expected to reach RMB 232.7 billion by 2029, making it the biggest contributor to the growth of the power semiconductor industry. Furthermore, emerging application fields such as AI servers, industrial applications, and service robots are expected to be the main growth drivers in the next five years.

Board Information

The board of directors of Xinmai Semiconductor will be composed of seven directors, including two executive directors, two non-executive directors, and three independent non-executive directors.

Shareholding structure

As of the last practical date, Hangzhou Model Core, Zhiyi and Zhifu (all are employee share incentive plan platforms) directly held a total of about 13.29% of the company's total issued share capital. As the general partner of Hangzhou Mocin, Hangzhou Qinxin has the right and authority to manage and execute Hangzhou Moxin's affairs. Hangzhou Qinxin is 80% owned by Dr. Ren Remote. Bright Shine is a general partner of Intellect and SmartWealth, and has the right and authority to manage and execute the affairs of Intellect and SmartWealth. Bright Shine is wholly owned by Dr So Wai Lun.

On June 19, 2025, Hangzhou Modex, Zhiyi, Zhifu, Hangzhou Qinxin, Bright Shine, Dr. Ren, and Dr. Su (collectively, the “Concerted Action Agreement”) entered into a concerted action agreement (“concerted action agreement”), according to which the concerted actors agreed and confirmed that from the date they became direct and/or indirect shareholders until (i) any party no longer holds any shares (in which case, the concerted action agreement will terminate only for that party, and the remaining parties will continue to be bound by the concerted action agreement), or (ii) all parties mutually agree to terminate the arrangement (to compare (Whichever comes first), they have acted and will continue to act in concert to exercise shareholders' rights in relation to the company. This includes the right to submit resolutions and vote at shareholders' meetings. If the concerted actors are unable to reach a consensus or disagree, the decisions of Hangzhou Model Core and Dr. Ren shall prevail.

Intermediary team

Sole sponsor: Huatai Financial Holdings (Hong Kong) Limited

Company Legal Adviser: Hong Kong Law: Jia Yuan Law Firm; Related Chinese Law: Jia Yuan Law Firm; Related Korean Law: Legal Corporation (Limited) Pacific; Relevant Export Control and Sanctions Laws: Stephen Peepels, Esq.

Sole sponsor legal advisors: Haiwen Law Firm Limited Liability Partnership, Haiwen Law Firm

Auditor and reporting accountant: PricewaterhouseCoopers

Industry Advisor: Frost & Sullivan

Compliance Advisor: Huafu Construction Enterprise Finance Co., Ltd.

Nasdaq

Nasdaq 華爾街日報

華爾街日報