Assessing Twist Bioscience (TWST) Valuation After Recent Share Price Strength

Recent trading in Twist Bioscience (TWST) has drawn attention after the share price closed at US$36.87, with returns over the past month and the past 3 months both in positive territory.

See our latest analysis for Twist Bioscience.

That sharp 7 day share price return of 16.24% and 30 day share price return of 14.43% sit against a 1 year total shareholder return decline of 18.28%. The 3 year total shareholder return of 37.99% points to momentum that has emerged over a longer stretch, even as the 5 year total shareholder return is still down 78.11%.

If Twist Bioscience’s recent move has you looking at other opportunities in healthcare, this could be a good time to scan healthcare stocks for more ideas.

With shares around US$36.87 and the average analyst price target close by, recent gains and mixed long term returns raise a key question for you: is Twist Bioscience undervalued here or already pricing in future growth?

Most Popular Narrative Narrative: 3.5% Overvalued

The most followed narrative puts Twist Bioscience’s fair value at about US$35.63 per share, slightly below the recent close around US$36.87, which frames a modest premium.

Cost, speed, and scale advantages from Twist’s silicon based manufacturing process are viewed as key structural differentiators that can sustain above market revenue growth and support a higher long term valuation range.

Curious what kind of revenue ramp, margin shift, and future earnings multiple are included in that slight premium to fair value? The full narrative lays out specific growth rates, profitability targets, and a future P/E assumption that together underpin this valuation view.

Result: Fair Value of $35.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still meaningful risks related to heavy customer concentration in NGS and the ongoing net loss of US$77.67 million, which could challenge this upside case.

Find out about the key risks to this Twist Bioscience narrative.

Another Angle On Valuation

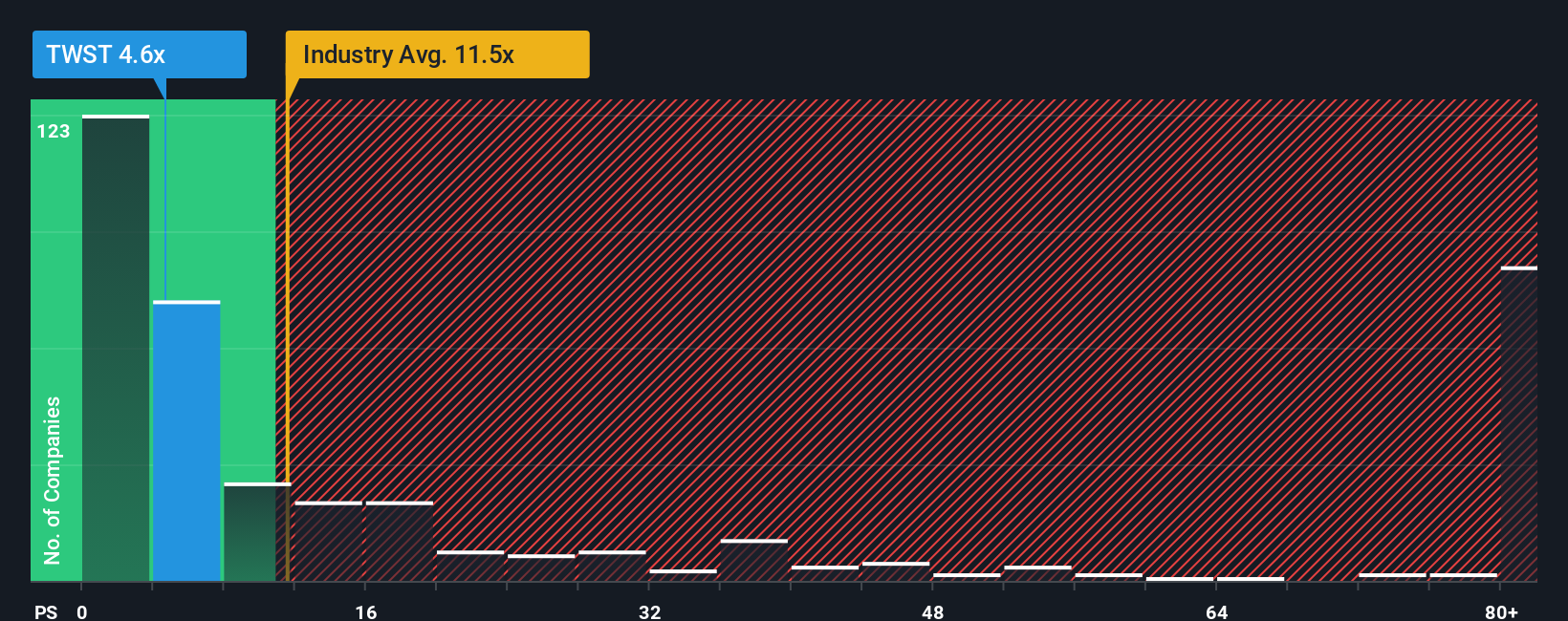

The fair value narrative suggests Twist Bioscience trades about 3.5% above its US$35.63 fair value, yet its current P/S of 6x tells a more mixed story. That multiple is lower than the US Biotechs average of 11.7x but higher than peers at 5.8x and the 3.9x fair ratio the market could move towards, which leaves you weighing more room for upside or more room for compression.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Twist Bioscience Narrative

If you see the numbers differently or simply prefer to dig into the details yourself, you can build a custom Twist Bioscience view in minutes: Do it your way.

A great starting point for your Twist Bioscience research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Twist Bioscience has sparked your interest, do not stop here. Use targeted screeners to quickly surface a shortlist of stocks that better match your goals.

- Spot potential high return opportunities early by checking out these 3556 penny stocks with strong financials with fundamentals that may be stronger than many expect from lower priced names.

- Target the intersection of medicine and machine learning by scanning these 29 healthcare AI stocks that are applying data and algorithms to real clinical problems.

- Focus on income and stability by reviewing these 11 dividend stocks with yields > 3% that might fit a yield oriented watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報