Texas Pacific Land (TPL) Valuation Check As Data Center Deal And Stock Split Draw Attention

Texas Pacific Land’s data center move and stock split draw investor focus

Texas Pacific Land (TPL) is drawing fresh attention after agreeing to develop large-scale data center campuses with Bolt Data & Energy, tied to a $50 million investment and equity stake on its land holdings.

See our latest analysis for Texas Pacific Land.

These data center and stock split announcements come after a softer period for Texas Pacific Land’s shares, with the latest share price at $293.81 and a 1-year total shareholder return of about a 30% loss. However, the 5-year total shareholder return of roughly 219% still reflects substantial long-term gains, so recent momentum looks weaker than the longer-term record.

If you are looking beyond TPL’s data center angle, this is a good moment to widen your search and check out fast growing stocks with high insider ownership for other ideas catching investor interest.

With TPL now trading at $293.81 after a 30% 1-year total return decline but a roughly 219% 5-year gain, the key question is whether today’s valuation reflects a discount or if markets already price in future growth.

Most Popular Narrative: 65.1% Undervalued

Compared to the last close at $293.81, the most followed narrative points to a much higher fair value, using detailed forecasts for growth, margins and valuation multiples.

Beneficial reuse and desalination initiatives, combined with advancing transmission and data center infrastructure in the Permian, provide exposure to future monetization avenues (industrial water supply, renewable energy, land leases), enhancing potential for diversified long-term revenue and asset value growth.

Curious what earnings path and margin profile need to hold for that outcome? The narrative leans on steady double digit growth and a premium future P/E. To see how those moving parts line up year by year and what kind of multiple is included in the 2030s, the full narrative breaks those assumptions out clearly so you can test them against your own view of TPL.

Result: Fair Value of $842.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story could be knocked off course if long term decarbonization trends pressure Permian drilling or if tighter water regulation reshapes TPL’s high margin services business.

Find out about the key risks to this Texas Pacific Land narrative.

Another View: Rich P/E Keeps Expectations High

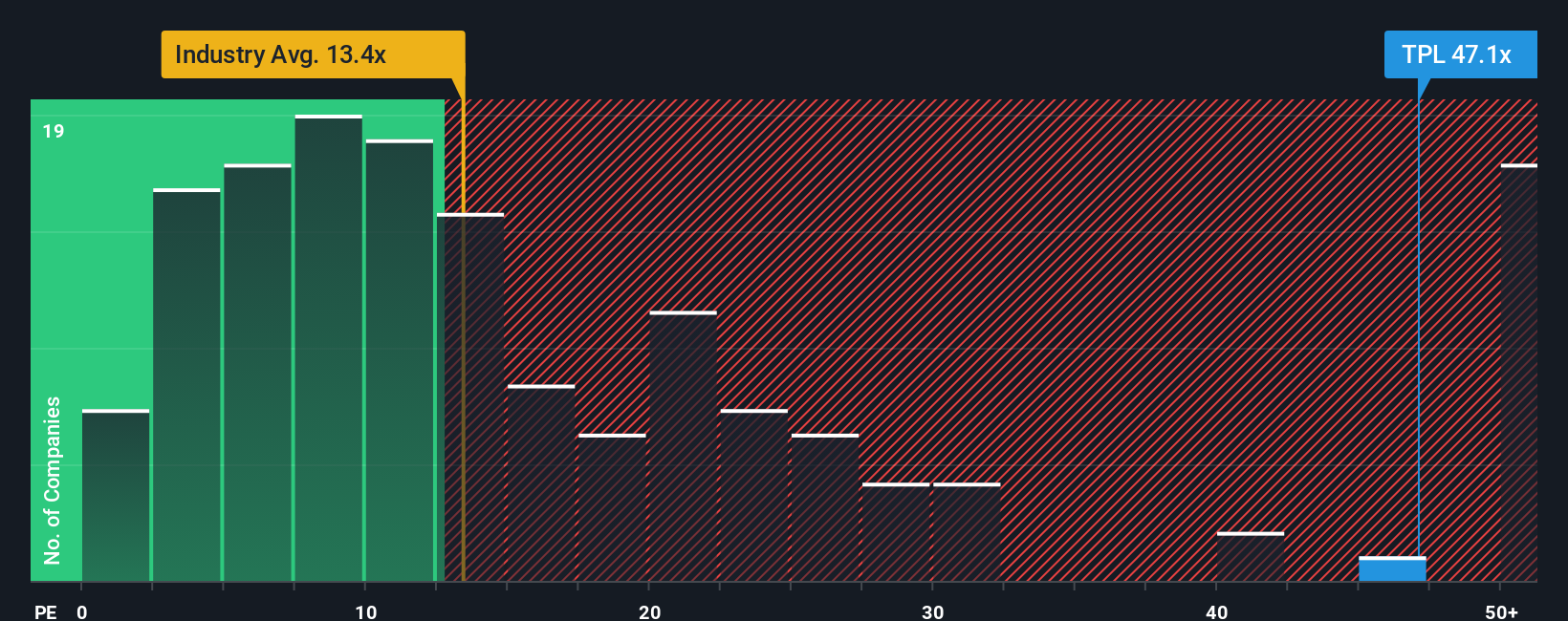

That 65.1% undervalued narrative sits awkwardly next to TPL’s current P/E of 42.5x, which is far above the US Oil and Gas industry average of 13.1x and its peer average of 13.4x, as well as our fair ratio of 18.6x that the market could move toward over time.

This gap suggests investors are already paying a rich price for TPL’s earnings. The risk is less about today’s story and more about what happens if sentiment cools or earnings do not keep pace with those expectations. Which side of that trade do you want to be on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Pacific Land Narrative

If you look at these numbers and reach a different conclusion, or want to stress test every assumption yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Texas Pacific Land research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If TPL has your attention, do not stop here. Broaden your watchlist with focused stock ideas that match different return profiles, risk levels and themes.

- Spot potential value ahead of the crowd by checking out these 877 undervalued stocks based on cash flows that stand out on cash flow based pricing.

- Back cutting edge automation and data trends by scanning these 26 AI penny stocks shaping how software and hardware handle intelligence at scale.

- Target higher income potential by reviewing these 11 dividend stocks with yields > 3% that may appeal if regular cash returns matter to you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報