Reviewing HEICO (HEI) Valuation After Record Results And Growing Missile Defense Backlog

HEICO (HEI) has been drawing attention after reporting record results across multiple recent quarters. These results have been supported by organic growth, acquisitions in its Flight Support and Electronic Technologies groups, and a growing missile defense order backlog.

See our latest analysis for HEICO.

At a share price of $347.7, HEICO has seen firm upward momentum recently, with a 30-day share price return of 11.37% and a 1-year total shareholder return of 54.06%, pointing to strong longer term compounding.

If recent aerospace gains have caught your eye, it may be a good moment to scan other aerospace and defense stocks that could fit a similar thesis.

With HEICO trading at $347.7 and only a modest 1.5% intrinsic discount indicated, plus a small 5.2% gap to analyst targets, it raises the key question: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 1.5% Undervalued

With HEICO’s fair value estimate at $353 versus a $347.70 last close, the most followed narrative sees only a slim valuation gap and ties it directly to specific growth and margin assumptions.

The worldwide trend of aging commercial and military aircraft fleets, combined with increasing pressure for cost-effective maintenance solutions, strongly favors HEICO's business model; as airlines and governments seek alternatives to expensive OEM parts, HEICO's FAA-approved PMA parts and repairs continue to gain market share and drive margin expansion, as reflected in rising operating and EBITA margins.

Curious how this modest discount lines up with future revenue growth, margin expansion, and a premium P/E multiple? The narrative rests on specific growth rates, rising profitability, and a valuation multiple that leans closer to high growth names than the broader Aerospace & Defense group.

Result: Fair Value of $353 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on HEICO continuing to fend off OEM competition in the aftermarket and successfully integrating acquisitions without eroding margins or earnings quality.

Find out about the key risks to this HEICO narrative.

Another View: Rich Multiples Keep Expectations High

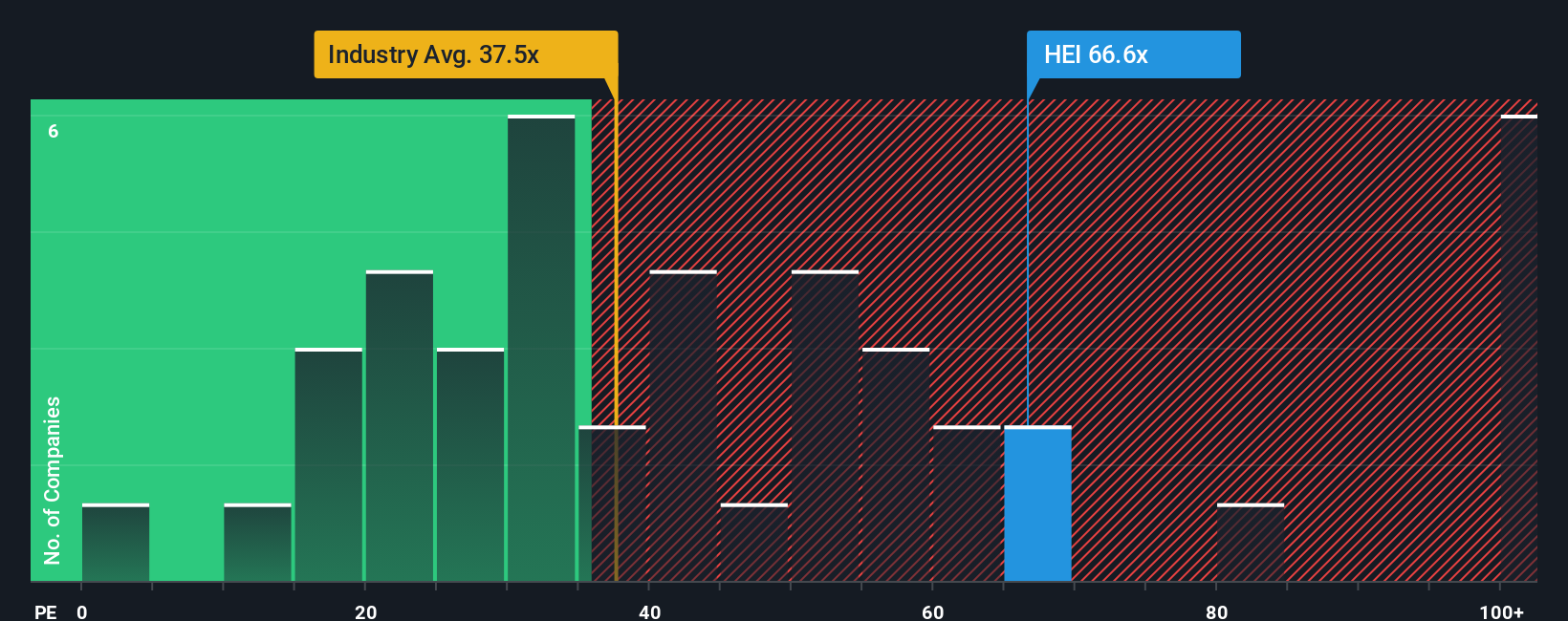

That 1.5% discount to fair value looks small once you zoom out to the current P/E of 70.2x. The wider US Aerospace & Defense group sits at 40.7x, and our fair ratio for HEICO comes in at 29.7x, which suggests the market is already pricing in a lot of good news. If sentiment cools or growth assumptions change, how much of that gap could realistically close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HEICO Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom HEICO view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding HEICO.

Looking for more investment ideas?

If HEICO has sparked your interest, do not stop here; broaden your watchlist with fresh ideas that match your own risk, income, and growth preferences.

- Spot early-stage opportunities with potential by scanning these 3556 penny stocks with strong financials that pair smaller market caps with solid underlying financials.

- Ride the AI wave more deliberately by checking out these 26 AI penny stocks focused on companies building real products around artificial intelligence.

- Target value driven ideas by reviewing these 877 undervalued stocks based on cash flows where prices sit below cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報