3 ASX Stocks Estimated To Be Trading Up To 46.1% Below Intrinsic Value

As the Australian market navigates a period of uncertainty with mixed signals from inflation data and potential rate hikes, investors are keenly observing sectors like IT and materials which have shown resilience amidst fluctuating conditions. In this environment, identifying undervalued stocks can be particularly rewarding, as these equities may offer significant upside potential once the broader economic landscape stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tasmea (ASX:TEA) | A$4.13 | A$8.25 | 49.9% |

| Smart Parking (ASX:SPZ) | A$1.22 | A$2.26 | 46.1% |

| LGI (ASX:LGI) | A$4.10 | A$7.60 | 46.1% |

| Kogan.com (ASX:KGN) | A$3.91 | A$6.88 | 43.2% |

| Guzman y Gomez (ASX:GYG) | A$21.08 | A$38.32 | 45% |

| Cromwell Property Group (ASX:CMW) | A$0.46 | A$0.85 | 45.8% |

| Betmakers Technology Group (ASX:BET) | A$0.185 | A$0.34 | 45.1% |

| Atturra (ASX:ATA) | A$0.67 | A$1.15 | 41.8% |

| Alkane Resources (ASX:ALK) | A$1.37 | A$2.38 | 42.5% |

| Airtasker (ASX:ART) | A$0.33 | A$0.63 | 47.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

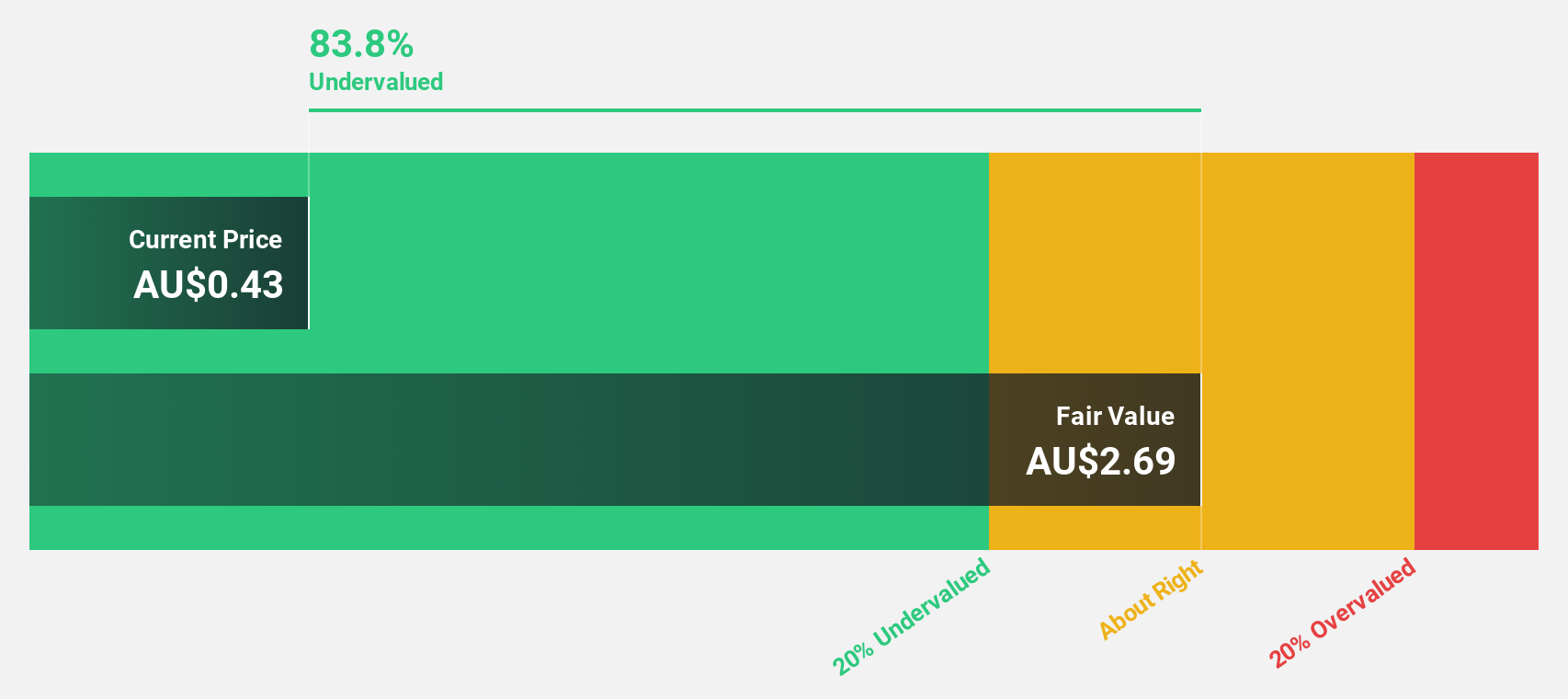

Fenix Resources (ASX:FEX)

Overview: Fenix Resources Limited operates in Western Australia, offering mining, logistics, and port services with a market cap of A$383.66 million.

Operations: The company generates revenue from its mining segment, amounting to A$316.09 million.

Estimated Discount To Fair Value: 35.7%

Fenix Resources is trading at A$0.52, significantly below its estimated fair value of A$0.80, suggesting it may be undervalued based on cash flows. The company has secured hedging contracts for 840,000 tonnes of iron ore through December 2026 at an average price of A$152.08/t, ensuring positive cash flow margins while maintaining exposure to spot prices. Despite a decline in profit margins from last year, earnings are forecast to grow substantially over the next three years.

- Our growth report here indicates Fenix Resources may be poised for an improving outlook.

- Take a closer look at Fenix Resources' balance sheet health here in our report.

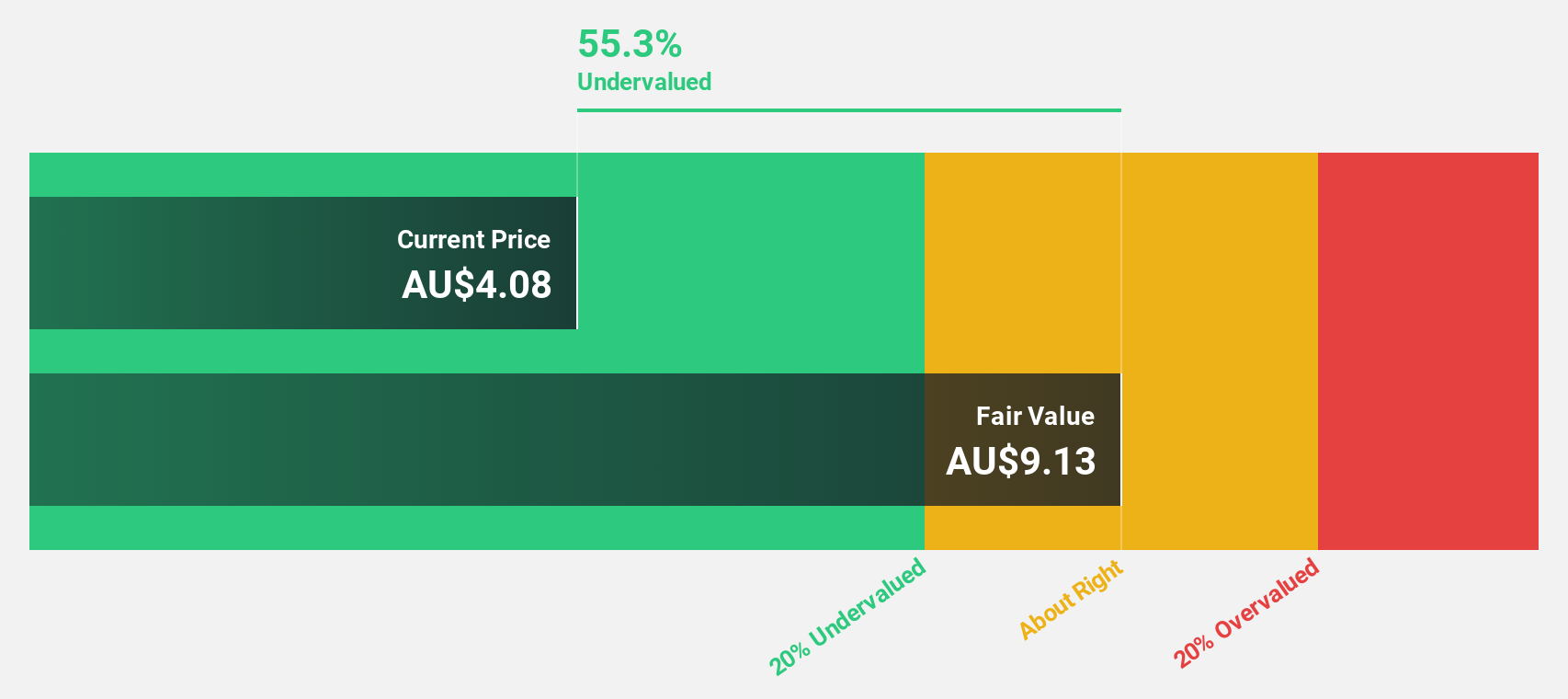

LGI (ASX:LGI)

Overview: LGI Limited focuses on carbon abatement and renewable energy solutions using biogas from landfill in Australia, with a market cap of A$424.11 million.

Operations: The company's revenue segments include Carbon Abatement at A$17.29 million, Renewable Energy at A$17.08 million, and Infrastructure Construction and Management at A$2.37 million.

Estimated Discount To Fair Value: 46.1%

LGI is trading at A$4.10, well below its estimated fair value of A$7.60, highlighting potential undervaluation based on cash flow analysis. Despite recent shareholder dilution due to equity offerings totaling approximately A$56 million, LGI's earnings are projected to grow significantly at 28.6% annually over the next three years, surpassing market expectations. However, its forecasted return on equity remains modest at 13.5%. Recent constitutional amendments aim to enhance shareholder engagement through virtual meetings.

- Insights from our recent growth report point to a promising forecast for LGI's business outlook.

- Get an in-depth perspective on LGI's balance sheet by reading our health report here.

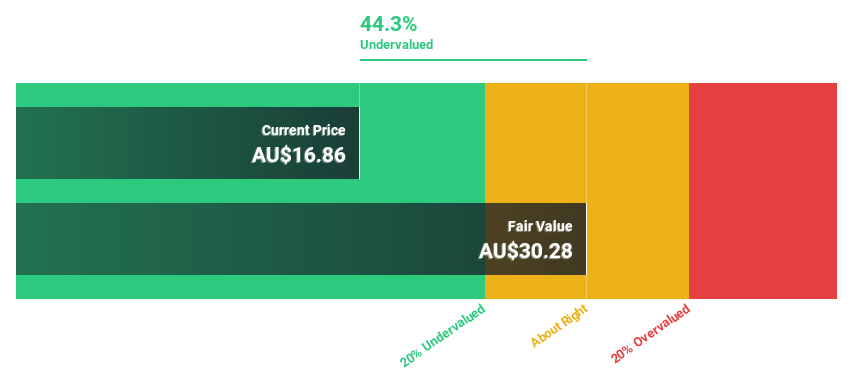

Nick Scali (ASX:NCK)

Overview: Nick Scali Limited, with a market cap of A$1.99 billion, is involved in sourcing and retailing household furniture and accessories across Australia, New Zealand, and the United Kingdom.

Operations: The company's revenue is primarily derived from the retailing of furniture, amounting to A$495.28 million.

Estimated Discount To Fair Value: 24.8%

Nick Scali, trading at A$23.35, is undervalued with a fair value estimate of A$31.07 based on cash flow analysis. Revenue and earnings are projected to grow faster than the Australian market at 9% and 15.5% per year respectively, though profit margins have decreased from 17.2% to 11.6%. The dividend yield of 2.7% lacks full earnings coverage, while leadership changes include Anthony Scali becoming Executive Chair post-AGM in October 2025.

- Upon reviewing our latest growth report, Nick Scali's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Nick Scali with our detailed financial health report.

Where To Now?

- Delve into our full catalog of 36 Undervalued ASX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報