TSX Penny Stocks To Watch In January 2026

As 2026 begins, investors are encouraged to reassess their portfolios in light of recent economic trends and the shifting landscape of interest rates. With a focus on diversification and strategic cash deployment, the Canadian market offers opportunities for those willing to explore beyond traditional investments. Penny stocks, despite their outdated name, remain a relevant area for potential growth; they can offer surprising value when backed by solid financials, making them an intriguing option for investors seeking hidden gems in smaller or newer companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.18 | CA$55.36M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.36 | CA$251.64M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.29 | CA$131.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.41 | CA$3.59M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.34 | CA$884.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.39 | CA$173.98M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.06 | CA$31.5M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.93 | CA$183.29M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 380 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Captiva Verde Wellness (CNSX:PWR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Captiva Verde Wellness Corp. operates as a real estate company with a market cap of CA$13.57 million.

Operations: Captiva Verde Wellness Corp. has not reported any revenue segments.

Market Cap: CA$13.57M

Captiva Verde Wellness Corp., with a market cap of CA$13.57 million, is a pre-revenue company in the real estate sector. Despite its lack of significant revenue, the company has recently become profitable and boasts an outstanding Return on Equity at 96.8%. It operates debt-free, eliminating concerns over interest payments or long-term liabilities. However, its short-term assets (CA$1.8M) fall short of covering short-term liabilities (CA$2.5M). The stock's volatility remains high compared to peers, and its board lacks seasoned experience with an average tenure of 2.2 years. The Price-To-Earnings ratio stands attractively low at 8.5x against the market average.

- Click here and access our complete financial health analysis report to understand the dynamics of Captiva Verde Wellness.

- Learn about Captiva Verde Wellness' historical performance here.

Covalon Technologies (TSXV:COV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Covalon Technologies Ltd. focuses on the research, development, manufacturing, and marketing of medical products related to infection management, advanced wound care, and surgical procedures across multiple regions including the United States and internationally, with a market cap of CA$50.99 million.

Operations: The company's revenue primarily comes from its Biotechnology (Startups) segment, generating CA$32.82 million.

Market Cap: CA$51M

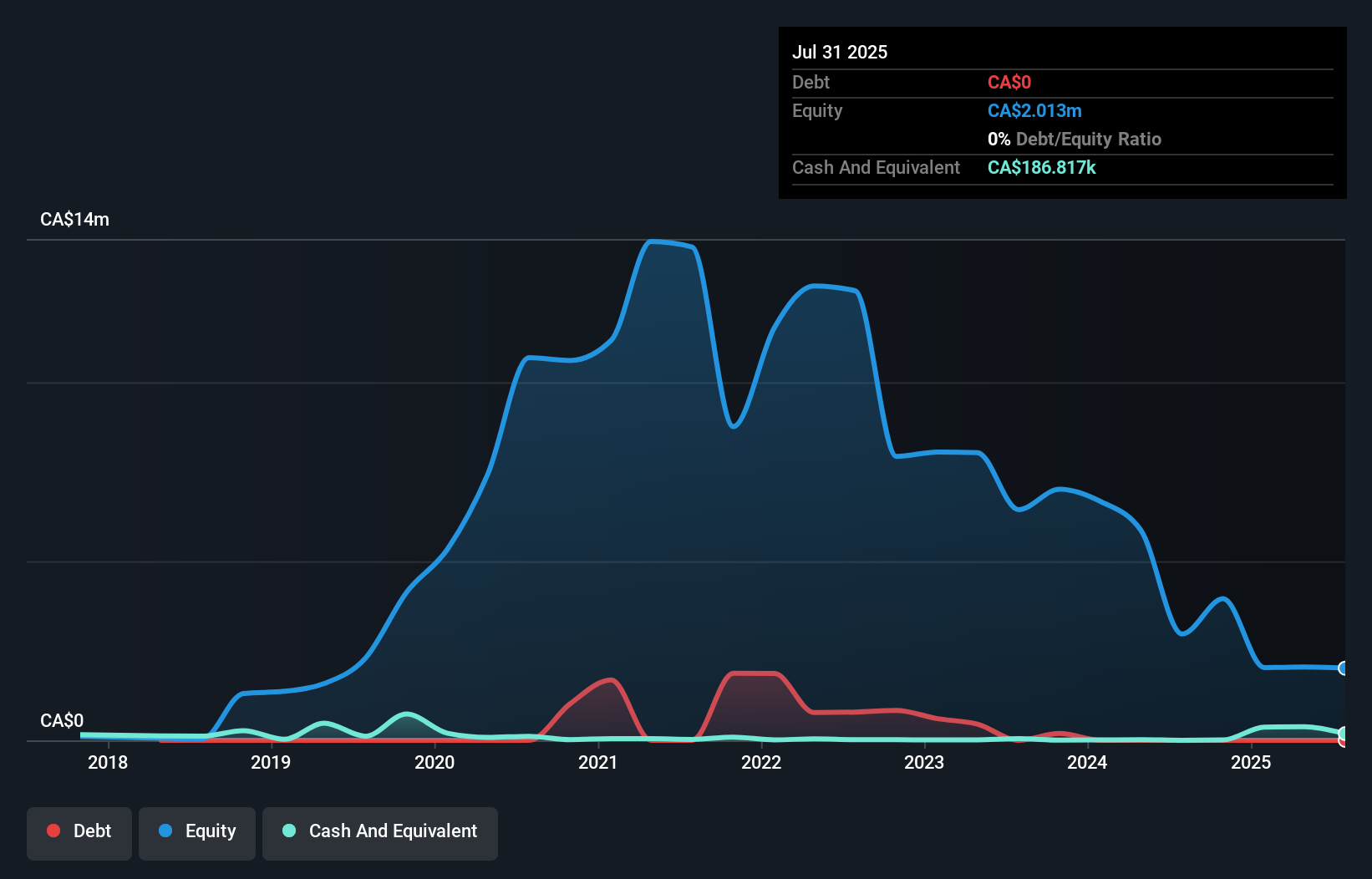

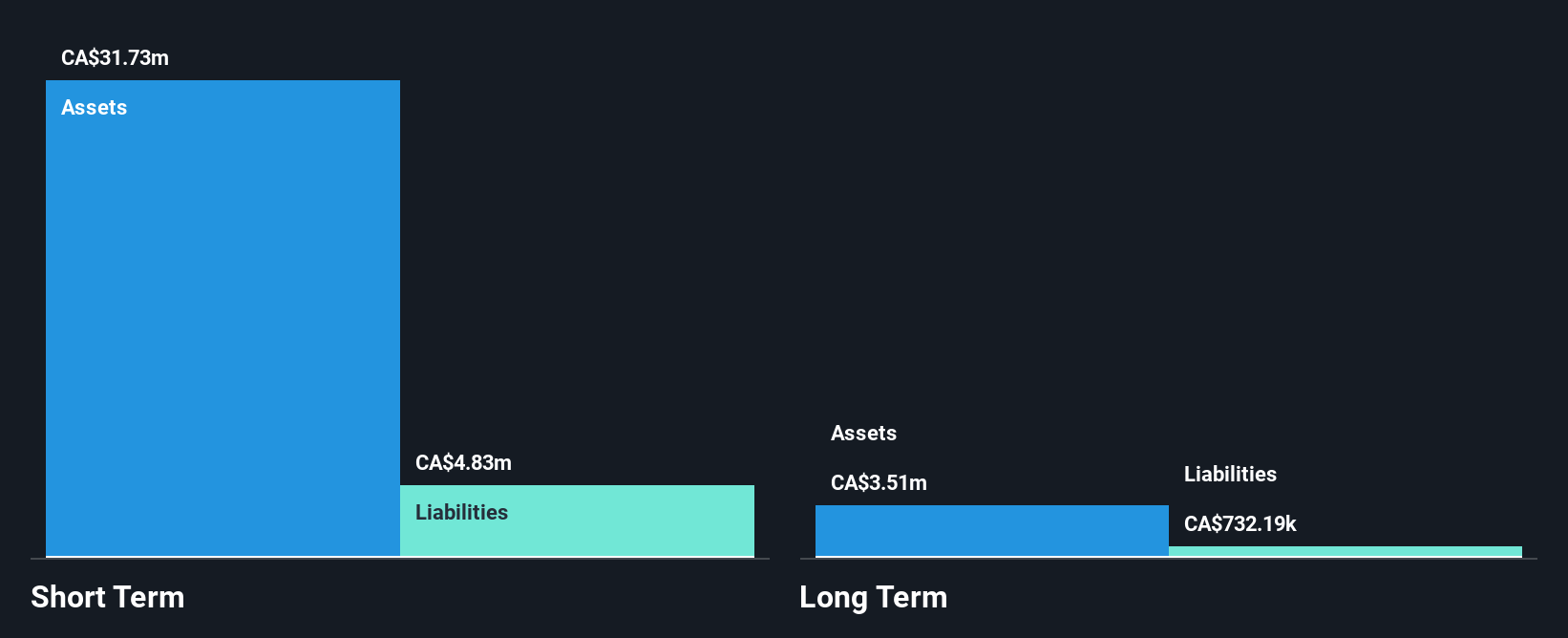

Covalon Technologies Ltd., with a market cap of CA$50.99 million, operates debt-free, which is a significant advantage for investors wary of financial leverage. The company reported revenue of CA$32.82 million for the year ending September 2025, indicating stable income generation in its Biotechnology segment. Despite a decrease in net income from the previous year, Covalon has maintained high-quality earnings and has not significantly diluted shareholders' equity recently. Its short-term assets comfortably cover both short and long-term liabilities, providing financial stability despite recent negative earnings growth compared to industry peers.

- Jump into the full analysis health report here for a deeper understanding of Covalon Technologies.

- Gain insights into Covalon Technologies' outlook and expected performance with our report on the company's earnings estimates.

DMG Blockchain Solutions (TSXV:DMGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DMG Blockchain Solutions Inc. is a North American blockchain and data center technology company with a market cap of CA$54.41 million.

Operations: The company generates revenue from its data processing segment, which amounts to CA$47.34 million.

Market Cap: CA$54.41M

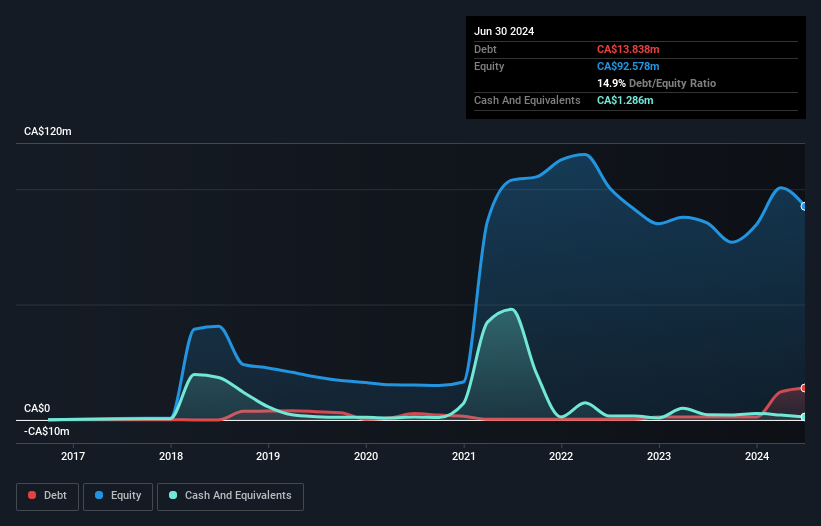

DMG Blockchain Solutions, with a market cap of CA$54.41 million, has shown resilience in its financial structure by maintaining more cash than total debt and reducing its debt to equity ratio over the past five years. Despite being unprofitable with increasing losses, DMG's revenue reached CA$47.34 million for the year ending September 2025. The company is expanding its data center capabilities through strategic partnerships and infrastructure investments in North America, including a significant joint venture with Malahat Nation to develop AI data centers. This positions DMG well for potential growth in high-performance computing markets despite current profitability challenges.

- Click here to discover the nuances of DMG Blockchain Solutions with our detailed analytical financial health report.

- Review our growth performance report to gain insights into DMG Blockchain Solutions' future.

Next Steps

- Discover the full array of 380 TSX Penny Stocks right here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報