A Look At Leggett & Platt (LEG) Valuation After Recent Share Price Rebound

Leggett & Platt (LEG) has drawn fresh attention after a recent share price move, with the stock up 5.3% over the past day and 6.4% over the past week.

See our latest analysis for Leggett & Platt.

The recent 1-day share price return of 5.34% and 7-day return of 6.40% sit against a 90-day share price return of 30.79% and a 1-year total shareholder return of 20.93%. However, the 3 and 5-year total shareholder returns remain deeply negative, so recent momentum contrasts with a weaker long-term record.

If Leggett & Platt’s rebound has caught your eye, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

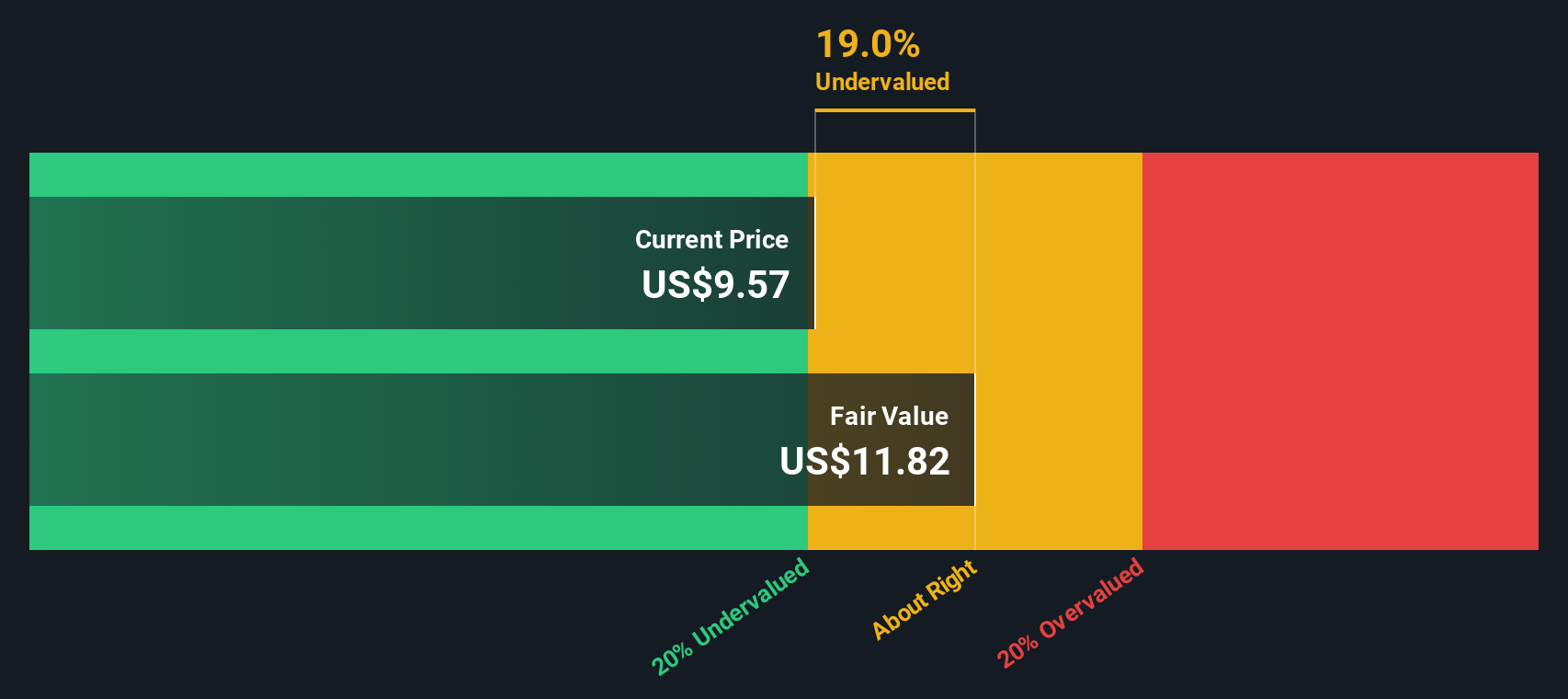

So, with the share price climbing recently and the stock sitting only around 7% below the average analyst target while trading above some intrinsic value estimates, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 6.9% Undervalued

The most followed narrative puts fair value for Leggett & Platt at about $12.50 per share, slightly above the last close of $11.64, and frames that gap around industry and margin assumptions rather than short term trading swings.

The fair value estimate has risen modestly to approximately $12.50 per share from about $11.00, reflecting slightly improved long-term assumptions.

The future P/E multiple has increased moderately to about 12.6x from roughly 11.1x, which implies a somewhat higher valuation placed on forward earnings.

Want to understand why flat revenue expectations can still support a higher value? The key ingredients are margin resilience and a future earnings multiple that sits below many peers. Curious which earnings path and discount rate connect those dots? The full narrative lays out the numbers behind that $12.50 figure.

Result: Fair Value of $12.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including ongoing weakness in bedding demand and a relatively high leverage ratio, which could limit financial flexibility.

Find out about the key risks to this Leggett & Platt narrative.

Another View: DCF Flags Less Upside

While the popular narrative suggests Leggett & Platt is about 6.9% undervalued at a fair value of roughly $12.50, our DCF model currently points the other way, with fair value at about $10.33, which would leave the shares trading at a premium to that estimate.

In other words, one approach sees some value left on the table, while the SWS DCF model implies more of the good news is already in the price, especially given forecasts for flat revenue and slightly declining earnings. Which set of assumptions feels closer to how you see the next few years playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leggett & Platt for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leggett & Platt Narrative

If you see the numbers differently, or prefer to test your own assumptions, you can build a custom Leggett & Platt view in minutes. To get started, use Do it your way.

A great starting point for your Leggett & Platt research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Leggett & Platt is on your radar, do not stop there. Use the screeners below to quickly spot other opportunities that might fit your style.

- Target potential bargains by scanning these 878 undervalued stocks based on cash flows that some investors may be overlooking right now.

- Spot emerging themes in artificial intelligence with these 25 AI penny stocks that are tied to real businesses on the market today.

- Strengthen your income watchlist by checking out these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報