Fresh Look At D.R. Horton (DHI) Valuation After Recent Share Price Weakness

Fresh look at D.R. Horton after recent share performance

D.R. Horton (DHI) has drawn fresh investor attention after a period in which the stock slipped around 9% over both the past month and the past 3 months, inviting a closer look at its fundamentals.

See our latest analysis for D.R. Horton.

The recent 30 day share price return shows a decline of around 9%, and similar 90 day weakness contrasts with D.R. Horton’s 1 year total shareholder return of about 6%. This suggests momentum has faded even as longer term holders remain ahead.

If you are comparing D.R. Horton with other housing related names, it can also help to broaden your search and check out fast growing stocks with high insider ownership for fresh ideas.

So with recent short term weakness set against a 1 year total return of about 6% and multi year gains, plus analyst targets sitting above the current $144.50 price, is there a genuine opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 12.8% Undervalued

With the narrative fair value sitting near US$165.70 against the recent US$144.50 close, the story focuses on how housing demand and margins could support that gap.

The company's continued strategic expansion of entry-level and affordable home offerings enables it to address affordability concerns, tap into a wider buyer pool, and maintain high absorption rates, mitigating cyclical margin compression and sustaining revenue even in softer market conditions.

Curious how steady revenue growth, firm margins and a lower future P/E are all expected to work together here? The narrative stitches these moving parts into one detailed earnings and valuation path that sits behind that fair value estimate.

Result: Fair Value of $165.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh affordability pressures that could squeeze margins, as well as the company’s reliance on entry level buyers if conditions turn less supportive.

Find out about the key risks to this D.R. Horton narrative.

Another View: What Earnings Ratios Are Saying

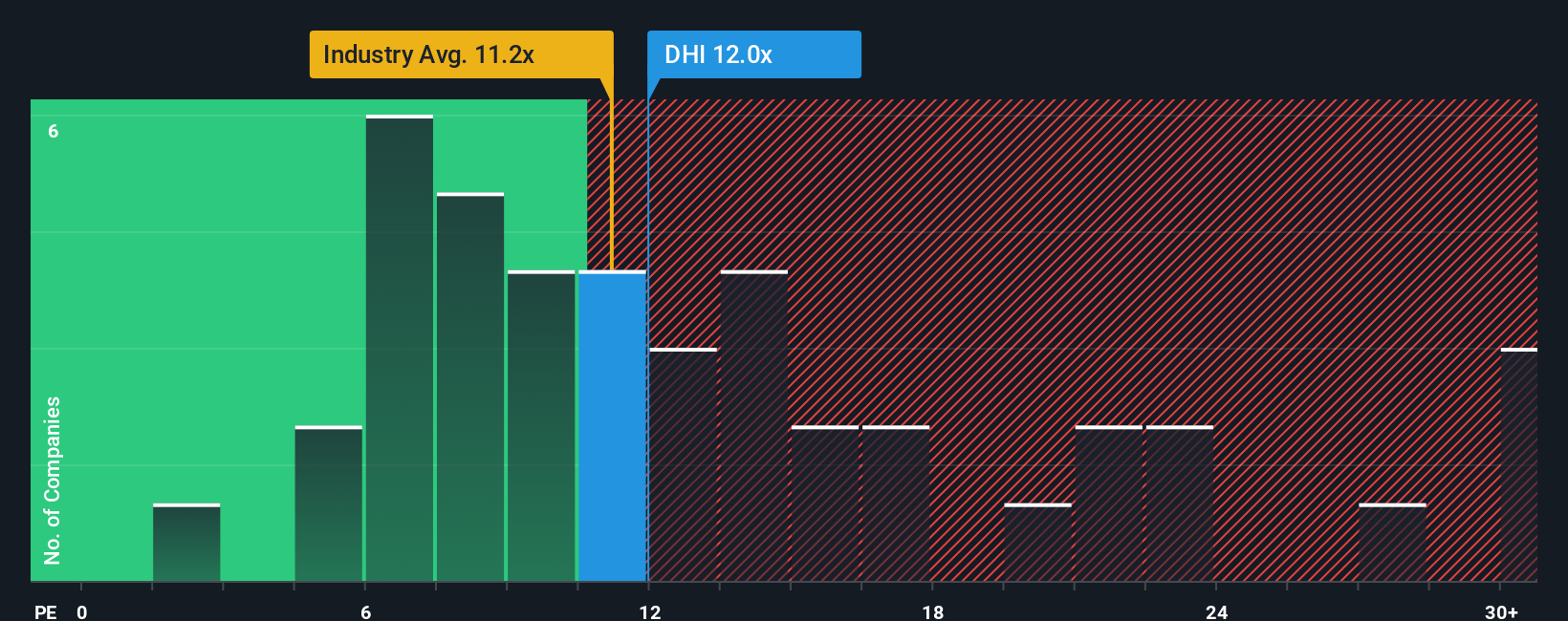

While the narrative fair value of about US$165.70 points to D.R. Horton being undervalued, the current P/E of 11.8x tells a different story. It is higher than both the US market at 19.1x and the Consumer Durables industry at 10.2x, yet still sits below a fair ratio of 20.6x that our model suggests the market could move toward over time.

This mix of an 11.8x P/E that looks expensive against peers, but low versus that 20.6x fair ratio, leaves you weighing valuation risk against possible upside if sentiment improves. Are you more persuaded by the peer comparison or by the idea that the multiple could drift closer to the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own D.R. Horton Narrative

If you look at this and feel differently, or prefer to weigh the data yourself, you can build a tailored view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding D.R. Horton.

Looking for more investment ideas?

If D.R. Horton has you thinking more broadly about opportunities, do not stop here. Use focused stock screens to surface other ideas that fit your style and goals.

- Target dependable income by checking out these 11 dividend stocks with yields > 3% that may offer more consistent cash returns alongside potential capital gains.

- Capture growth themes at an early stage through these 25 AI penny stocks positioned around artificial intelligence trends across different parts of the market.

- Hunt for mispriced opportunities by reviewing these 877 undervalued stocks based on cash flows that currently trade below what their cash flows might suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報