Corpay (CPAY) Valuation Check After Q3 Beat And Insider Share Purchase

Corpay (CPAY) has drawn fresh attention after reporting third quarter 2025 results that exceeded analyst expectations on both earnings and revenue, alongside a multimillion dollar insider share purchase by director Steven T. Stull.

See our latest analysis for Corpay.

The recent earnings beat and insider buying come after a period where momentum has cooled, with a 1-year total shareholder return of an 8.63% decline even as the 3-year total shareholder return of 65.49% points to a much stronger longer term story.

If Corpay’s latest move has you rethinking payment and fintech names, it could be a good moment to widen your radar with fast growing stocks with high insider ownership.

With Corpay trading at US$317.63 and sitting at a 37.67% discount to one intrinsic value estimate, plus about an 11% gap to the average analyst target, you have to ask: is this a genuine opening, or is the market already baking in future growth?

Most Popular Narrative: 10.1% Undervalued

With Corpay last closing at US$317.63 against a narrative fair value of US$353.46, the story centers on whether its earnings power justifies that gap.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $5.7 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 8.2%. Given the current share price of $313.12, the analyst price target of $383.45 is 18.3% higher. You are encouraged to reach your own conclusions. Sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Curious what earnings, margins, and valuation multiple assumptions have to line up to support that higher value? The most followed narrative spells it out in detail. Result: Fair Value of $353.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture is not one way. Stablecoin related pressure on growth and margins, along with rising compliance and cybersecurity costs, are both capable of challenging this upside story.

Find out about the key risks to this Corpay narrative.

Another Angle On Value

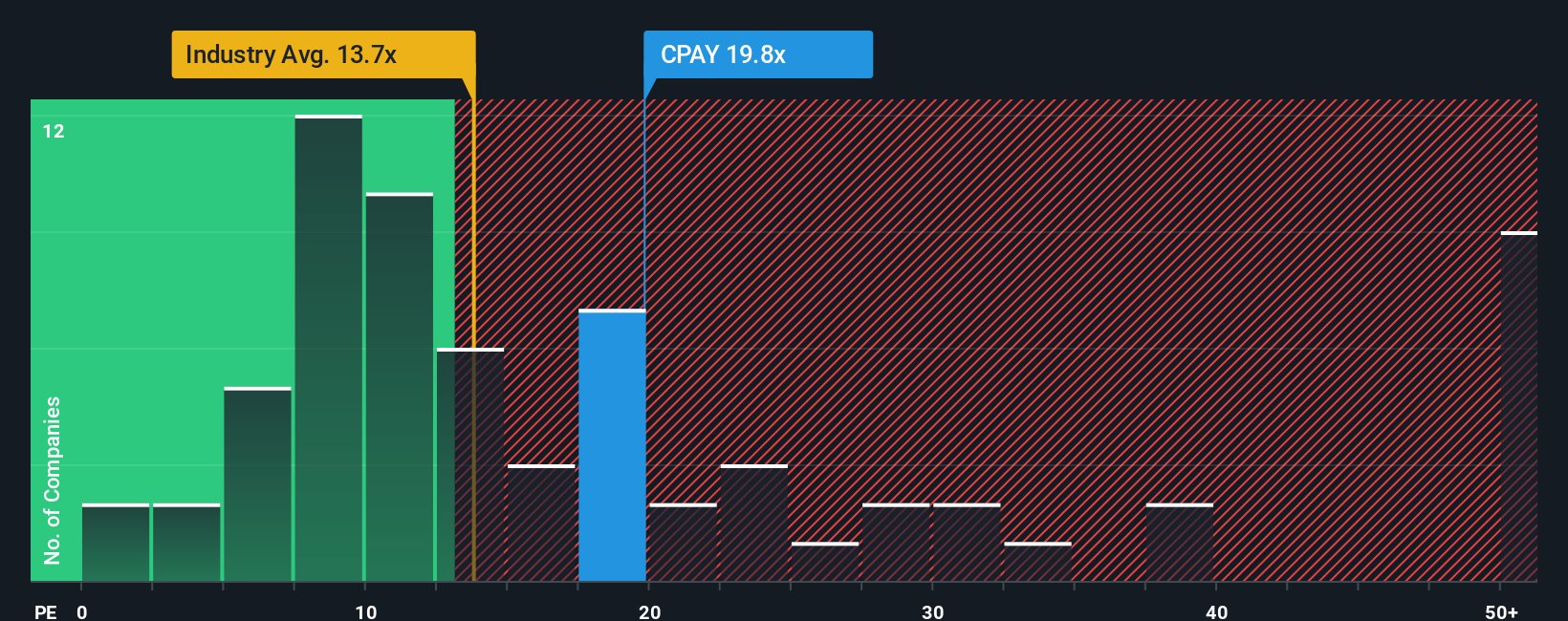

That 10.1% narrative undervaluation sits alongside a more mixed picture when you look at earnings multiples. Corpay trades on a P/E of 21.1x, which is higher than the US Diversified Financial industry at 14x and above its own fair ratio of 19x, yet below the peer average at 31.8x. Is this a margin of safety, or a premium that needs more proof?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corpay Narrative

If this story does not quite fit your view, or you prefer to stress test the numbers yourself, you can build a personalised thesis in minutes with Do it your way

A great starting point for your Corpay research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Corpay has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas built from clear numbers and consistent criteria.

- Spot potential value in future-focused themes by checking out these 29 quantum computing stocks that could reshape entire industries.

- Zero in on cash flow driven opportunities through these 877 undervalued stocks based on cash flows and see which companies line up with your return and risk preferences.

- Strengthen your income watchlist by scanning these 11 dividend stocks with yields > 3% that pair higher yields with listed dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報