Moody’s (MCO) Valuation Check After Analyst Upgrades And 2026 Debt Issuance Expectations

Moody's (MCO) is back in focus after multiple analyst upgrades, including from Stifel and Goldman Sachs, tied to expectations that heavier debt issuance in 2026 could support revenue and earnings.

See our latest analysis for Moody's.

The recent analyst upgrades come as Moody's share price trades at $532.9, with a 30 day share price return of 7.33% and a year to date share price return of 6.80%. Its 1 year total shareholder return of 15.72% and 5 year total shareholder return of 102.75% point to momentum that has been building over a longer period.

If moves in Moody's have caught your attention, this can be a handy moment to look at fast growing stocks with high insider ownership as you think about what to research next.

With Moody's trading close to analyst targets and already posting solid multi year returns, the key question now is simple: is there still upside left for new investors, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 2.3% Undervalued

Moody's last close at $532.9 sits just below the narrative fair value of $545.5, putting the focus squarely on what is built into those forecasts.

The company's investment in advanced analytics, AI, and machine learning, including 40% of Moody's Analytics products now featuring GenAI enablement and GenAI-related spending growing at twice the rate of MA overall, positions Moody's to capture a larger share of the data-driven risk management market, resulting in higher recurring revenues and improved net margins through automation and operational efficiency.

Curious what kind of revenue growth, margin lift and earnings power are embedded here. The narrative leans on rich profitability and a future earnings multiple that stands well above the sector. The full set of assumptions shows how those ingredients combine to reach that fair value line.

Result: Fair Value of $545.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can wobble if tighter rules on private credit or rising AI competition begin to chip away at Moody's pricing power and margins.

Find out about the key risks to this Moody's narrative.

Another View: Rich Multiples Signal Less Cushion

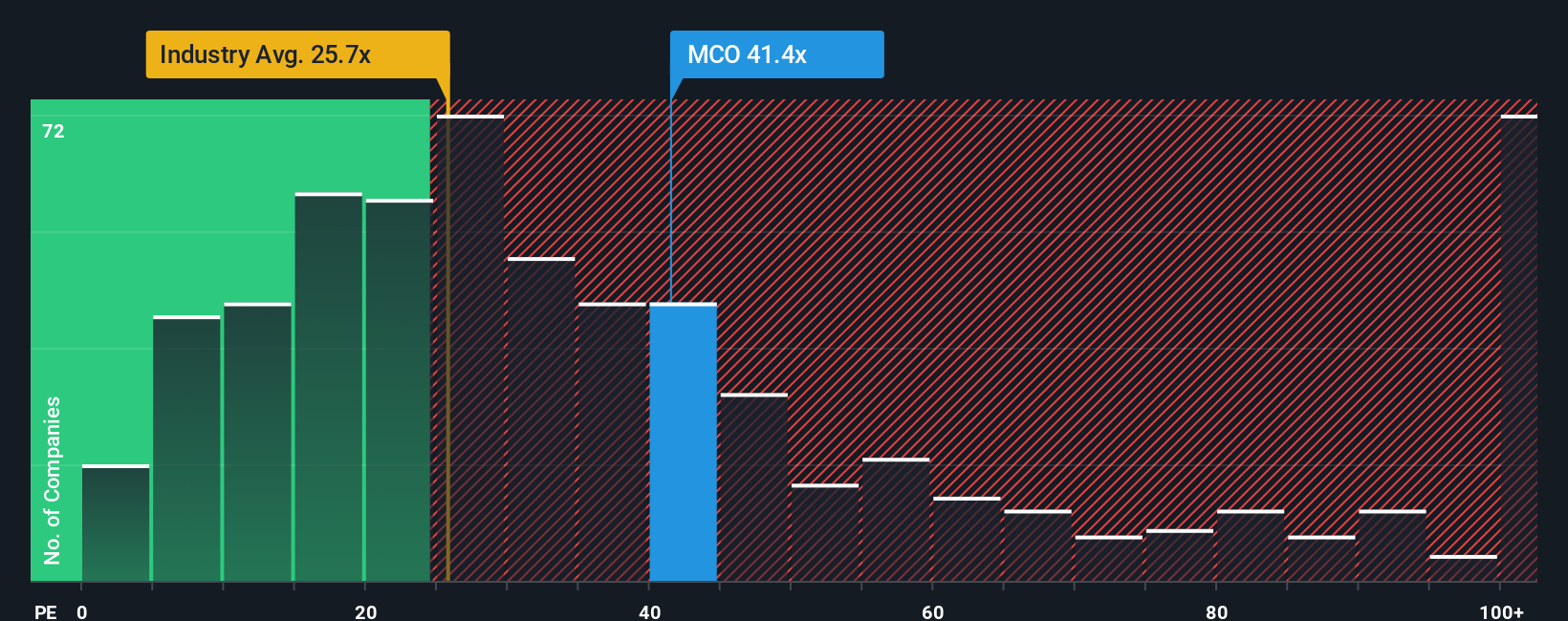

While the narrative fair value points to modest undervaluation, the P/E story is tougher. Moody's trades on 42.4x earnings versus a fair ratio of 18.3x, the US Capital Markets average of 25.7x, and a 32.5x peer average. That gap limits margin for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moody's Narrative

If you look at the numbers and come to a different conclusion, or just want to test your own assumptions, you can quickly build a full narrative yourself: Do it your way.

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Moody's is already on your radar, this is the perfect time to widen your watchlist with a few focused stock ideas tailored to different themes.

- Spot potential mispricings by zeroing in on these 877 undervalued stocks based on cash flows that could offer more appealing entry points for your next idea.

- Tap into growth stories at the intersection of medicine and machine learning with these 29 healthcare AI stocks shaping the future of data driven care.

- Get ahead of what traders are watching in digital assets by scanning these 79 cryptocurrency and blockchain stocks linked to blockchain infrastructure and payment systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報