How Investors May Respond To Marqeta (MQ) As CES 2026 Rekindles AI Payments Optimism

- At the recent CES 2026 conference in Las Vegas, investor attention to artificial intelligence and broader technology themes boosted sentiment toward payments software provider Marqeta, highlighting its role in the digital finance ecosystem.

- This renewed focus on AI-driven innovation contrasts with Marqeta’s recent revenue contraction and margin pressure, raising questions about how tech optimism aligns with its current business trajectory.

- We’ll now examine how this AI-focused interest from CES 2026 might influence Marqeta’s investment narrative, particularly around its technology platform.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Marqeta Investment Narrative Recap

To own Marqeta, you need to believe its card issuing platform can stay central to digital payments and embedded finance, even as growth has recently stalled and margins compressed. The CES 2026 AI enthusiasm lifted sentiment but does not materially change the near term catalyst of stabilizing revenue trends or the key risk that concentrated customers, like Block, could reduce volumes or move away.

The Klarna Card expansion into 15 European markets stands out here, because it directly links Marqeta’s technology to a large BNPL player at a time when investors are refocusing on AI enabled, flexible credentials. This type of international program scale up can matter more for Marqeta’s story than a short term CES driven share price move, as it speaks to the platform’s relevance for large enterprise clients.

Yet against renewed AI optimism, investors should still be aware of Marqeta’s dependence on a small group of major customers and...

Read the full narrative on Marqeta (it's free!)

Marqeta's narrative projects $900.6 million revenue and $47.9 million earnings by 2028. This requires 17.6% yearly revenue growth and a $112.6 million earnings increase from -$64.7 million today.

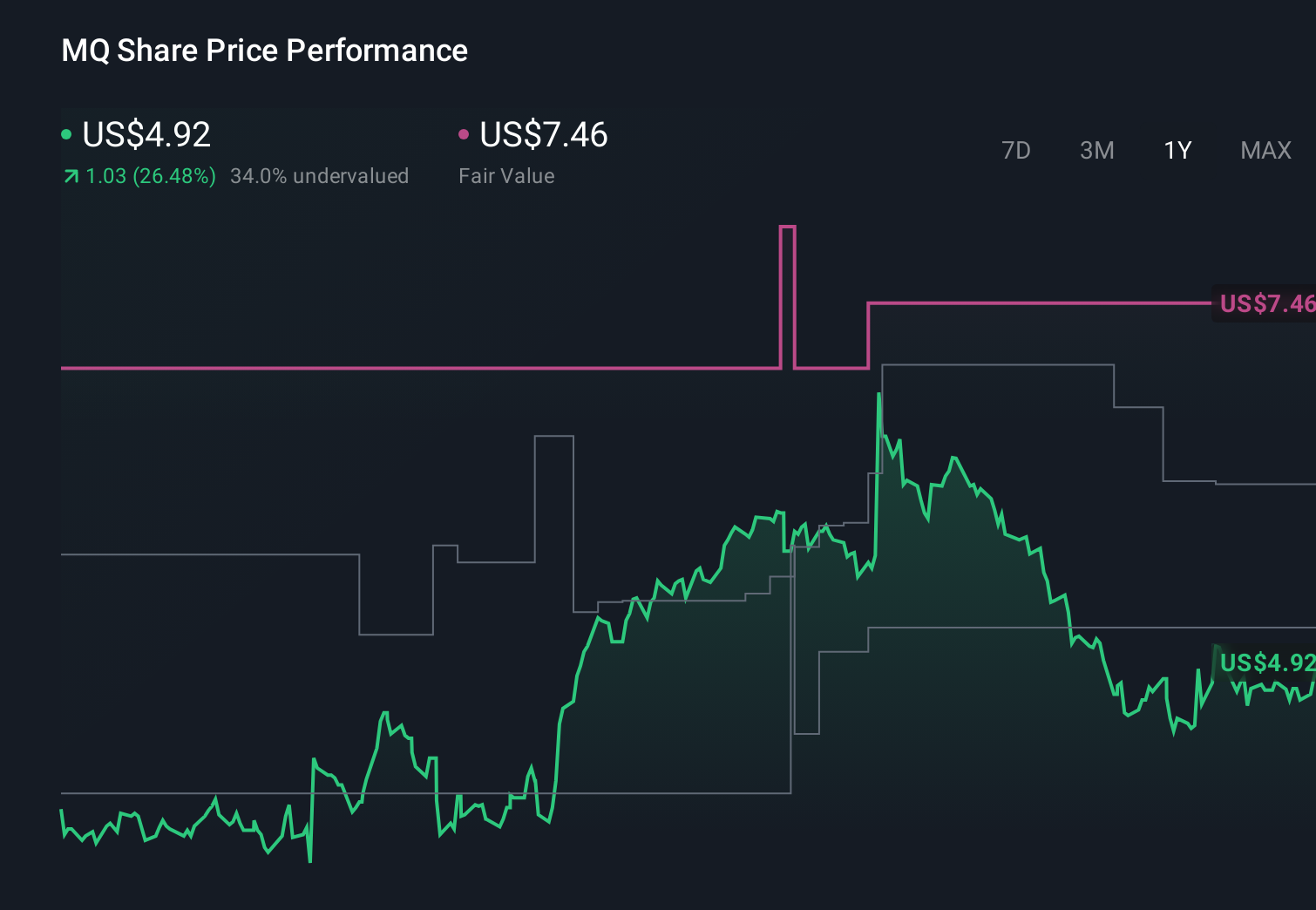

Uncover how Marqeta's forecasts yield a $6.18 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for Marqeta span roughly US$3.70 to US$8.00, showing how far apart individual views can be. As you weigh those perspectives, keep in mind the concentration risk around key customers that could influence how Marqeta’s payment volumes and economics evolve over time.

Explore 6 other fair value estimates on Marqeta - why the stock might be worth 24% less than the current price!

Build Your Own Marqeta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Marqeta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marqeta's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報