Assessing Tower Semiconductor (TSEM) Valuation After New Silicon Photonics FMCW LiDAR Partnership

Tower Semiconductor (NasdaqGS:TSEM) and LightIC Technologies have agreed to work together on Frequency Modulated Continuous Wave LiDAR using Tower’s silicon photonics platform, linking the foundry’s AI centric photonics capabilities to automotive and robotics sensing.

See our latest analysis for Tower Semiconductor.

The LightIC agreement lands at a time when Tower Semiconductor’s shares trade at $122.28, with a 30-day share price return of 7.25% and a strong 90-day share price return of 64.89%. Over longer periods, total shareholder return has been substantial, with a 1-year total shareholder return of 136.11% and a 5-year total shareholder return of 335.94%. This points to momentum that has recently accelerated rather than faded.

If this LiDAR news has you thinking beyond a single name, it could be a good moment to see which other chip and AI names are moving by scanning high growth tech and AI stocks.

With the shares at $122.28 after a very strong 1 year and 5 year run, plus only a small 5% gap to the average analyst price target, you have to ask: is there still upside here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 5.2% Undervalued

Compared with the last close at $122.28, the most followed narrative points to a fair value of $129, which frames the current debate around upside expectations.

The proliferation of IoT, edge computing, and electrification across industrial, automotive, and consumer sectors strengthens multiyear demand for analog, mixed-signal, and specialty nodes, core Tower offerings, supporting a sustained long-term revenue growth trajectory and resilience in earnings.

Curious what kind of revenue ramp, margin profile and future P/E this view leans on, and how that ties back to today’s share price? The narrative lays out specific growth and profitability targets that have to line up for that $129 fair value to make sense.

Result: Fair Value of $129 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on heavy CapEx commitments and a concentrated SiPho and SiGe exposure, so weaker demand or faster tech shifts could quickly challenge that $129 fair value argument.

Find out about the key risks to this Tower Semiconductor narrative.

Another Angle: Multiples Point to Expensive Territory

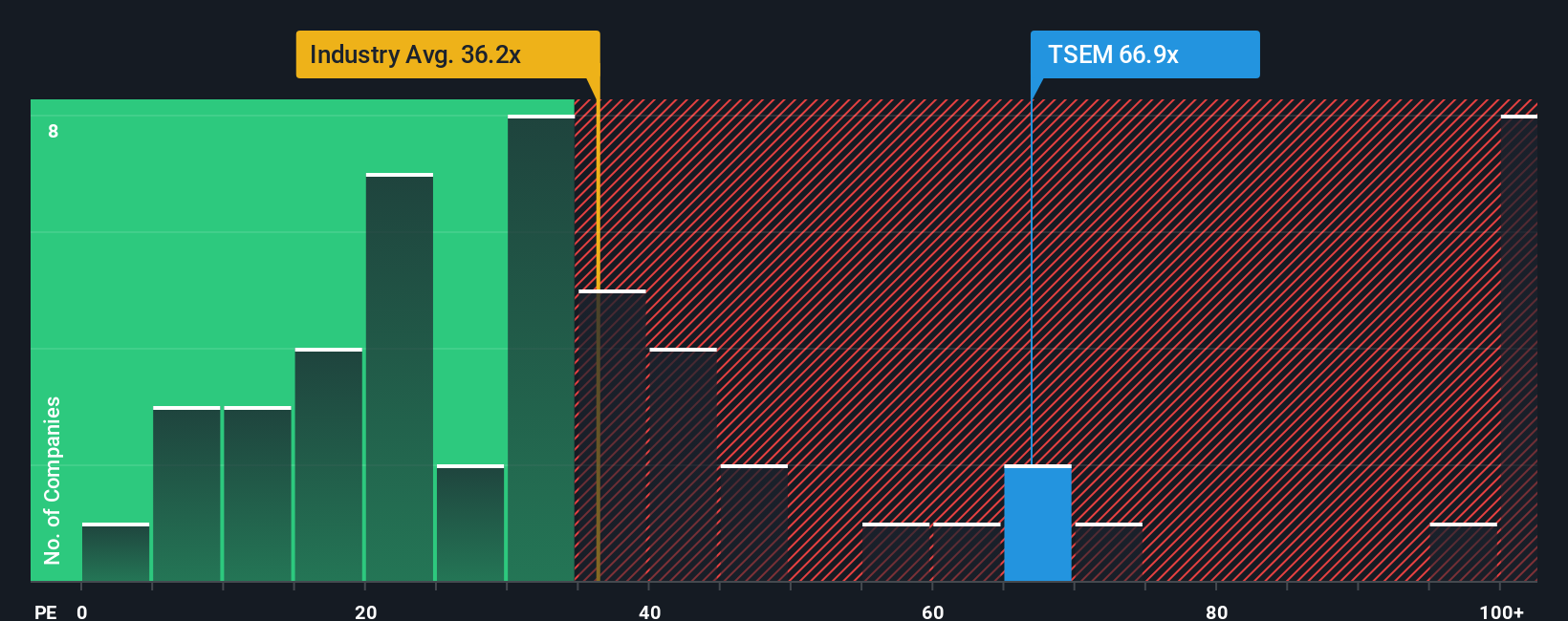

While the most popular narrative points to about 5.2% upside to a fair value of $129, the current P/E of 70.2x tells a very different story. That multiple is well above the US Semiconductor industry at 38.7x, the peer average at 45.4x, and even our fair ratio of 45.6x.

In practical terms, that gap suggests the market is already paying a high price for Tower Semiconductor’s growth story. This can leave less room for error if earnings or margins fall short. The question for you is whether that premium feels earned or stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tower Semiconductor Narrative

If you see the numbers differently or simply prefer to work through the data on your own terms, you can build a fresh view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tower Semiconductor.

Ready For More Investment Ideas?

If Tower Semiconductor has caught your attention, do not stop here. Use this momentum to line up your next few stock ideas with focused screeners.

- Target potential mispricings by scanning these 877 undervalued stocks based on cash flows that align with your preferred balance between quality, earnings power, and price.

- Zero in on fast moving themes by checking out these 25 AI penny stocks tied to real business models, not just hype.

- Add a different growth engine by assessing these 79 cryptocurrency and blockchain stocks that connect listed companies to digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報