A Look At Polestar (NasdaqGM:PSNY) Valuation After BBVA Stake And New US$600 Million Financing

Polestar Automotive Holding UK (NasdaqGM:PSNY) drew fresh attention after BBVA disclosed an 8.4% passive stake, along with updates on Geely backed financing and a finalized US$600 million term loan facility.

See our latest analysis for Polestar Automotive Holding UK.

Those financing headlines arrived after a choppy period for the stock. A 15.44% 1 month share price return and a 6.45% 7 day share price return contrast with a 25.39% 3 month share price decline and a 37.03% 1 year total shareholder return loss. This suggests near term momentum is improving while longer term performance remains weak.

If Polestar’s recent move has you looking more broadly across the sector, this could be a useful moment to size up other auto names using our auto manufacturers.

With Polestar still reporting a net loss of US$2,699.098 million on revenue of US$2,547.619 million, and trading about 44% below the consensus US$30.00 price target, you need to ask whether there is real upside here or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 30.7% Undervalued

With the narrative fair value at US$30.00 against a last close of US$20.78, the story assumes a meaningful gap between price and long term potential.

Persistent high cash burn, reliance on external funding, and a lack of clear path to sustainable profitability raise the risk of further shareholder dilution through equity issuance, potentially depressing EPS and constraining future investment.

Curious what kind of revenue trajectory and margin shift would need to offset that dilution risk and still justify a higher valuation? The narrative leans on aggressive top line expansion, a sizable swing in profitability, and a lower earnings multiple than many peers. The full story connects those pieces into one tight valuation case.

Result: Fair Value of $30.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real pressure points here, including ongoing losses and heavy funding needs that could mean more dilution if cash burn remains high.

Find out about the key risks to this Polestar Automotive Holding UK narrative.

Another View On Valuation

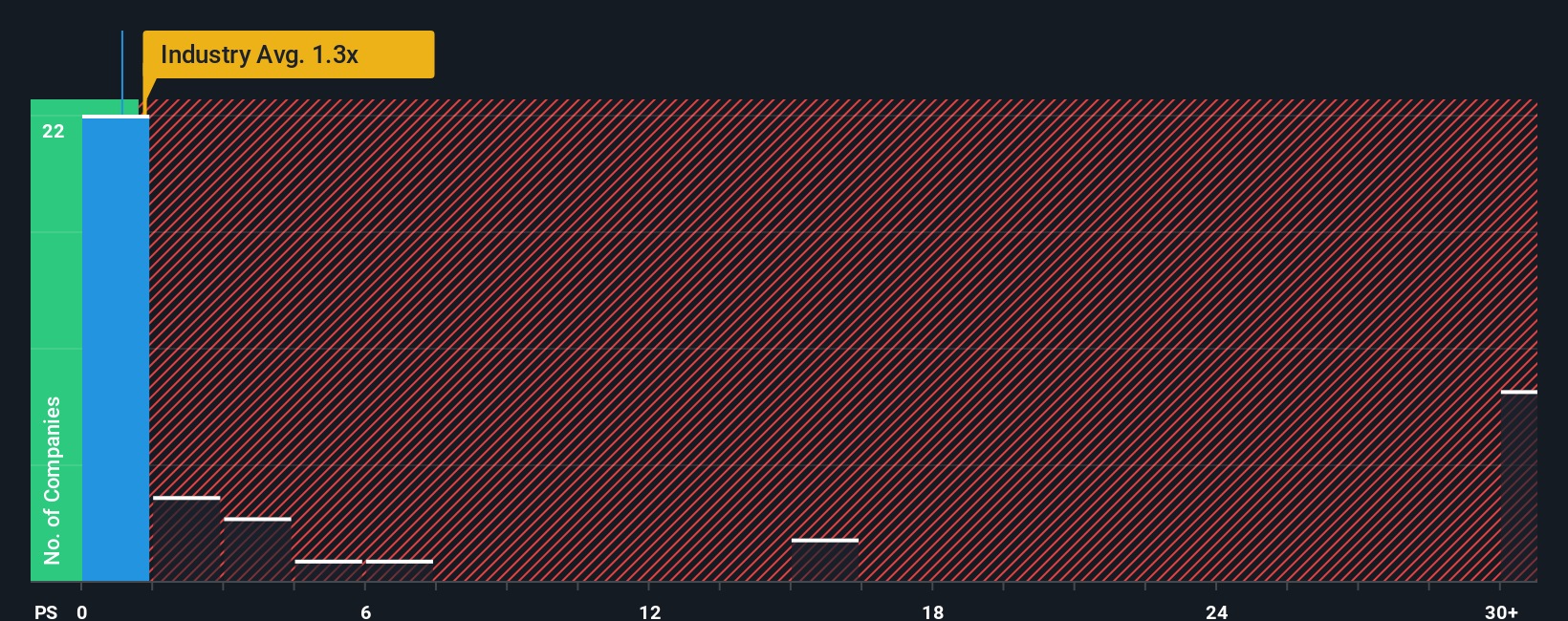

The narrative points to a fair value of US$30.00, yet Polestar currently trades on a P/S of 0.6x versus a fair ratio of 0.3x. That is in line with the US auto industry at 0.6x but well below peers at 1.5x, which hints at both downside risk and possible upside if sentiment shifts. Which side of that gap do you think is more realistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polestar Automotive Holding UK Narrative

If you are not fully on board with this view or simply prefer to stress test the numbers yourself, you can rebuild the story in minutes using Do it your way.

A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Polestar has you thinking more broadly about where you put your money next, this is the moment to widen your search and pressure test fresh ideas.

- Spot potential hidden value by scanning these 877 undervalued stocks based on cash flows that combine solid cash flow metrics with pricing that may not fully reflect their fundamentals.

- Ride emerging tech trends by checking out these 25 AI penny stocks focused on artificial intelligence themes that many investors are only starting to pay attention to.

- Target income focused opportunities through these 11 dividend stocks with yields > 3% that offer yields above 3% for investors who want cash returns alongside share price moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報