Netflix (NFLX) Valuation Check After Recent Share Pullback And Mixed P/E Signals

Netflix (NFLX) is back in focus after a recent share pullback. The stock closed at US$90.65 and posted negative returns over the past week, month and past 3 months.

See our latest analysis for Netflix.

Beyond the recent pullback, Netflix’s share price return over the past 90 days shows weaker momentum compared with its modest year to date share price return. However, longer term total shareholder returns over 3 and 5 years remain much stronger.

If Netflix’s recent softness has you reassessing your watchlist, this could be a useful moment to see what else is moving across tech and media, including high growth tech and AI stocks.

So, with Netflix shares down over the past quarter but still backed by growing revenue and net income, is the current price hinting at undervaluation, or has the market already priced in the platform’s next chapter of growth?

Most Popular Narrative: 33% Undervalued

Netflix’s most followed narrative points to a fair value of US$134.44, above the last close of US$90.65, framing the recent pullback in a different light.

The analysts have a consensus price target of $1350.316 for Netflix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1600.0, and the most bearish reporting a price target of just $750.0.

Want to see what kind of earnings ramp, margin profile, and future P/E this narrative is banking on? The full set of assumptions may surprise you.

Result: Fair Value of $134.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real watchpoints here, including rising content and advertising build out costs, as well as the risk that ad tier monetization falls short of bullish expectations.

Find out about the key risks to this Netflix narrative.

Another View: Earnings Multiple Sends a Different Signal

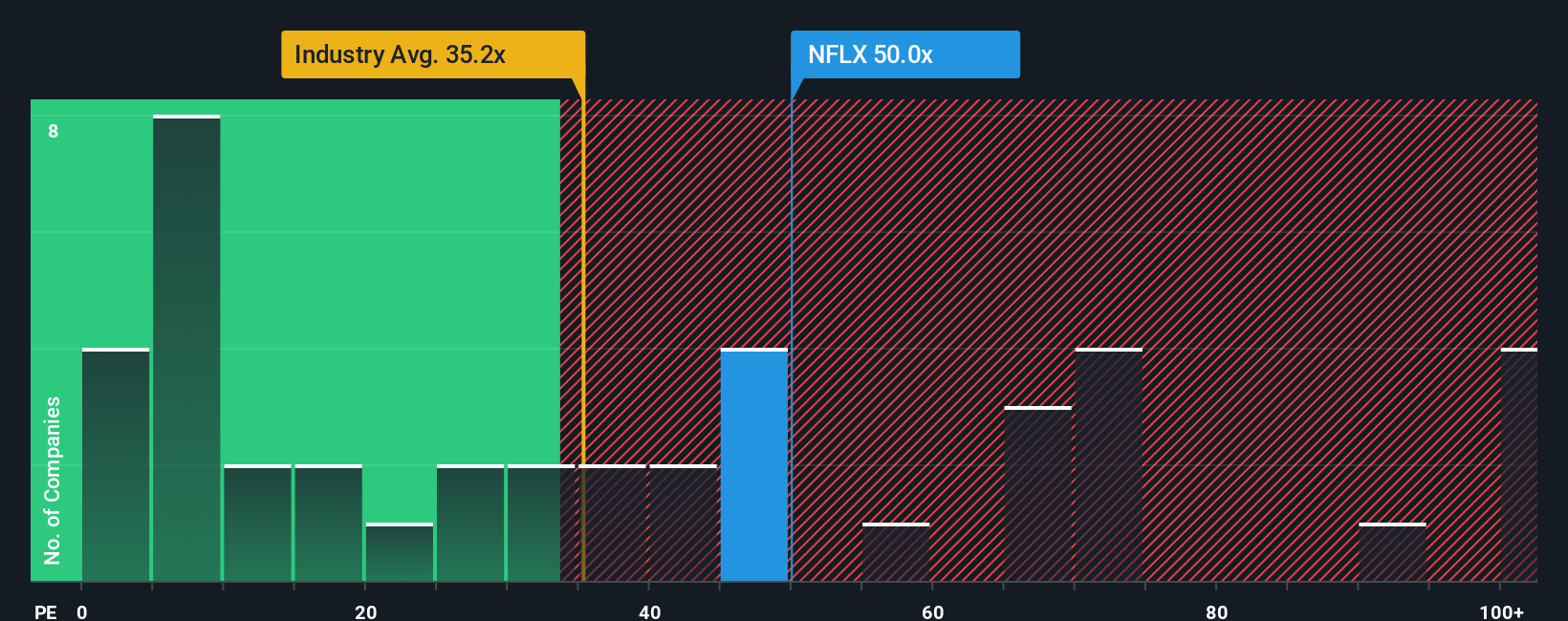

While the popular narrative sees Netflix as about 33% undervalued at a fair value of US$134.44, the current P/E of 39.7x tells a more cautious story. It is higher than the US Entertainment industry at 18x and also above the fair ratio of 34.4x that our model suggests the market could move toward.

At the same time, that 39.7x P/E sits well below the 84.4x peer average. This points to a very different risk reward balance than the industry comparison alone implies. If the share price eventually leans closer to the fair ratio instead of the peer group, what does that mean for how you size a position or set expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to work from your own assumptions, you can spin up a custom Netflix view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Ready for your next investing idea?

If Netflix is on your radar, do not stop there. A few minutes with targeted stock ideas can sharpen your watchlist and help you spot opportunities earlier.

- Spot potential value setups by checking out these 877 undervalued stocks based on cash flows that might align with your return and risk expectations.

- Explore cutting edge growth stories through these 25 AI penny stocks if you want exposure to companies building with artificial intelligence at their core.

- Look for income ideas using these 11 dividend stocks with yields > 3% that may suit a portfolio focused on regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報