A Look At Builders FirstSource (BLDR) Valuation After Renewed Analyst Buy Attention

Builders FirstSource (BLDR) drew fresh attention after a 5.4% share price move that aligned with upbeat Wall Street commentary, as 19 covering analysts maintained a consensus Buy rating on the stock.

See our latest analysis for Builders FirstSource.

The recent 5.4% intraday move and 1-day share price return of 2.6% sit against a 90-day share price return decline of 14.1%. The 3-year total shareholder return of 65.22% and 5-year total shareholder return of 181.67% highlight a longer track record that contrasts with the 22.37% decline in 1-year total shareholder return. This suggests momentum has been fading recently despite historically strong compounding for longer term holders.

If this analyst driven move has you looking beyond one stock, it could be a good moment to scan for building sector peers or other fast growing stocks with high insider ownership.

With shares down over the past year but still showing strong multi-year returns, and with a roughly 18% gap to analyst targets alongside a slight premium to one intrinsic estimate, the key question is whether there is still an opportunity for investors or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 16% Undervalued

Against the last close of US$111.26, the most followed narrative points to a fair value of about US$132.52, framing the current discount through detailed earnings and margin assumptions.

The company is investing heavily in digital transformation and value-added solutions (e.g., digital tools, ERP integration, prefabricated components). These initiatives are expected to drive higher-margin growth, increase operating efficiency, and strengthen customer relationships as the market recovers, improving both future revenue and net margins. Investments in automation and offsite construction capacity, combined with industry-wide labor shortages, position BFS to benefit as builders increasingly adopt prefabricated and digitally optimized solutions. This is expected to support both revenue growth and operational margin improvement over the long term.

Want to see how modest revenue growth, compressed margins and a higher future P/E all add up to that fair value gap? The full narrative lays out the earnings path, the margin reset and the valuation multiple needed to bridge today’s price and that target. The tension between cautious top line assumptions and a richer future P/E is where it gets interesting.

Result: Fair Value of $132.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on housing demand not remaining weak and on commodity price volatility, especially in lumber and OSB, not putting renewed pressure on margins.

Find out about the key risks to this Builders FirstSource narrative.

Another Angle On Valuation

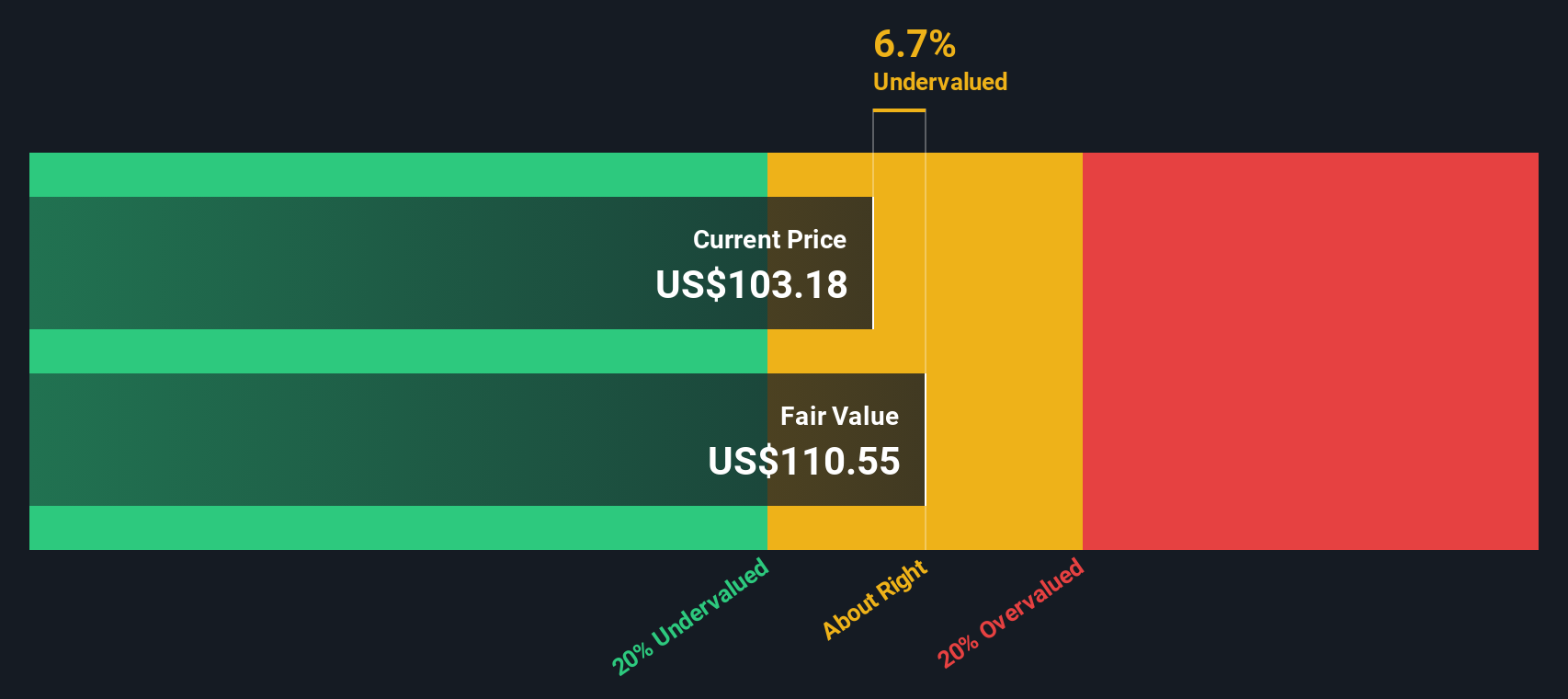

Simply Wall St's DCF model points to a fair value of about US$110.43 per share, very close to the current US$111.26 price. This suggests Builders FirstSource is roughly fully priced rather than clearly undervalued. If the cash flow view is this tight, how much weight do you put on the more optimistic narrative based targets?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Builders FirstSource for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Builders FirstSource Narrative

If you see the numbers differently or prefer to test your own assumptions, you can create a fully custom view in minutes, Do it your way.

A great starting point for your Builders FirstSource research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you like what you have seen here, do not stop at one company, the right screener can surface ideas you might otherwise miss.

- Spot potential value by scanning these 877 undervalued stocks based on cash flows that align with your return expectations and risk tolerance.

- Lean into future tech trends with these 25 AI penny stocks that focus on artificial intelligence themes you want exposure to.

- Target income focused opportunities by reviewing these 11 dividend stocks with yields > 3% that may fit a yield oriented portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報