Assessing Bruker (BRKR) Valuation After A Sharp Short Term Share Price Rebound

Bruker (BRKR) is back on many investors’ screens after recent share price moves, with the stock showing double digit returns over the past week and the past 3 months, prompting fresh interest in its scientific instruments business.

See our latest analysis for Bruker.

The recent 10.86% 7 day share price return and 52.09% 90 day share price return suggest momentum has picked up again, even though the 1 year total shareholder return of a 13.58% decline and 5 year total shareholder return of a 9.40% decline show a tougher longer term journey for investors.

If Bruker’s rebound has you thinking about similar names, this could be a good moment to look at healthcare stocks for other stocks in the broader medical and life sciences space.

Short term momentum, mixed longer term returns and a share price sitting slightly above analyst targets raise a key question for Bruker: is this rebound leaving limited upside, or is the market still underpricing future growth potential?

Most Popular Narrative Narrative: 0.6% Overvalued

Bruker’s most followed narrative places fair value at about US$52.36 per share, almost on top of the latest close at US$52.67, framing a very tight valuation gap.

The analysts have a consensus price target of $46.727 for Bruker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $38.0.

Curious how a company with recent losses, a higher implied future P/E, and only modest revenue assumptions still reaches that fair value range? The narrative leans heavily on a sharp earnings ramp, firmer margins and a specific discount rate to tie today’s price to those future cash flows.

Result: Fair Value of $52.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including weaker organic revenue guidance for 2025 and concerns that prolonged funding headwinds could weigh on future orders and margins.

Find out about the key risks to this Bruker narrative.

Another View: Market Ratios Point to a Different Story

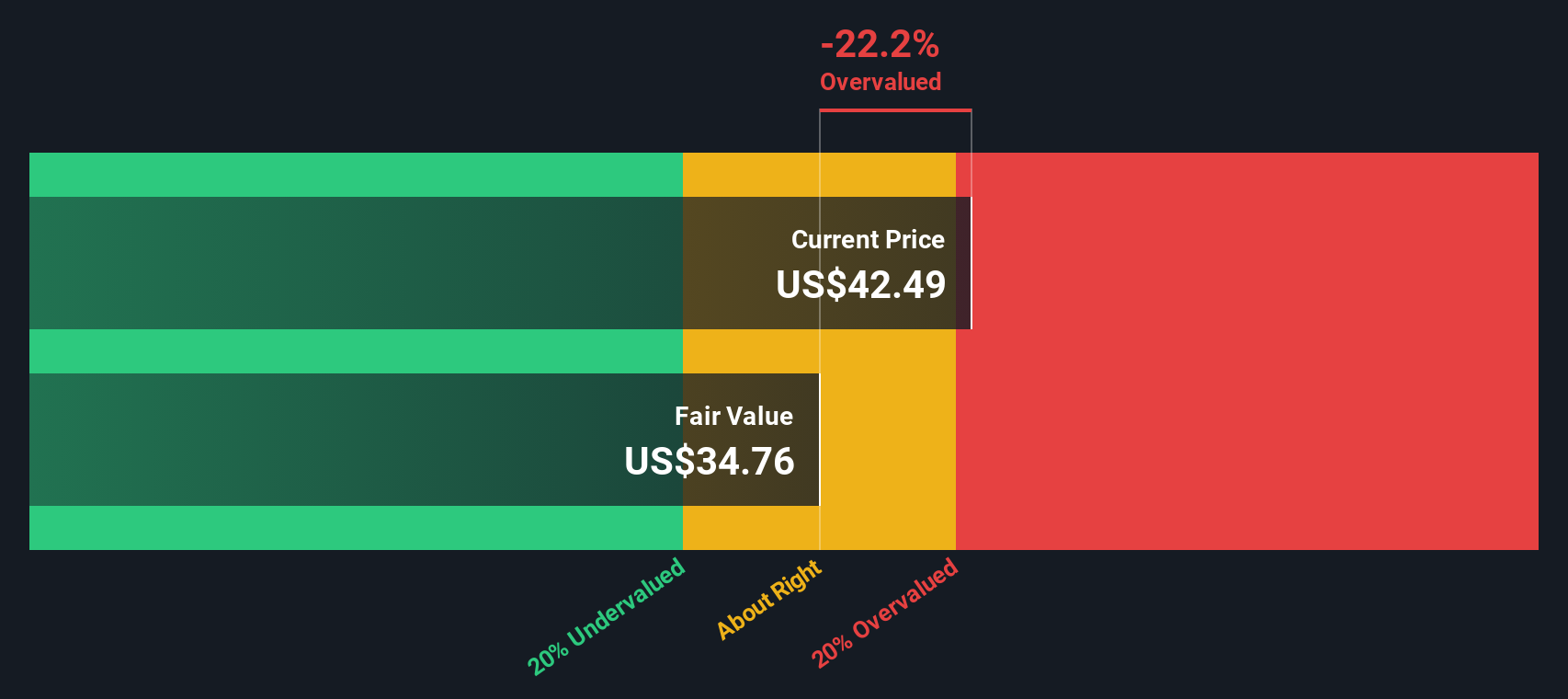

Our DCF model flags a clear mismatch, with Bruker’s current price of US$52.67 sitting well above an estimated fair value of US$37.01. That suggests the recent rebound could already be baking in a lot of optimism. Are you being paid enough for that gap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bruker Narrative

If you see the numbers differently or prefer to piece together your own view from the data, you can build a fresh Bruker story in just a few minutes, starting with Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for more investment ideas?

If Bruker has caught your attention, do not stop there. Widen your watchlist with focused screeners that surface very different types of opportunities in minutes.

- Target potential value gaps by scanning these 877 undervalued stocks based on cash flows where prices and cash flows sit side by side for quick comparison.

- Tap into cutting edge growth themes by filtering for these 25 AI penny stocks that are tied to real business models, not just hype.

- Lock in income-focused ideas by zeroing in on these 11 dividend stocks with yields > 3% that may offer yield alongside fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報