Assessing Regis Resources (ASX:RRL) Valuation After Strong Quarterly Gold Output And Sector Rally

Regis Resources (ASX:RRL) has drawn fresh attention after reporting second quarter fiscal 2026 gold production of 96,600 ounces. This comes alongside a broader gold sector rally supported by safe-haven demand and interest rate expectations.

See our latest analysis for Regis Resources.

The latest production update and sector tailwinds have come alongside a 27.1% 3 month share price return and a very large 1 year total shareholder return. This suggests momentum in investor expectations around Regis Resources and its exposure to higher gold prices.

If this gold move has your attention and you want to see what else is on the radar, now could be a good time to scan fast growing stocks with high insider ownership for other ideas.

With Regis Resources showing a very large 1 year total return, an intrinsic value estimate suggesting a sizeable discount, and a share price sitting above the average analyst target, are you looking at a genuine opportunity or a market already pricing in future growth?

Most Popular Narrative: 16% Overvalued

Compared with the A$7.65 last close, the most followed narrative sees fair value closer to A$6.61, which sets a more restrained valuation backdrop.

Recent research updates reflect a more balanced stance on Regis Resources, with higher gold prices and solid free cash flow supporting valuations even as cost pressures persist.

Curious what sits behind that fair value mark? Revenue expectations barely move, yet earnings, margins and the future P/E all shift in a very specific way. Want to see exactly which profit and discount rate assumptions hold this view together?

Result: Fair Value of A$6.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on McPhillamys approvals progressing and gold prices remaining supportive, while rising operating and capital costs continue to threaten margins.

Find out about the key risks to this Regis Resources narrative.

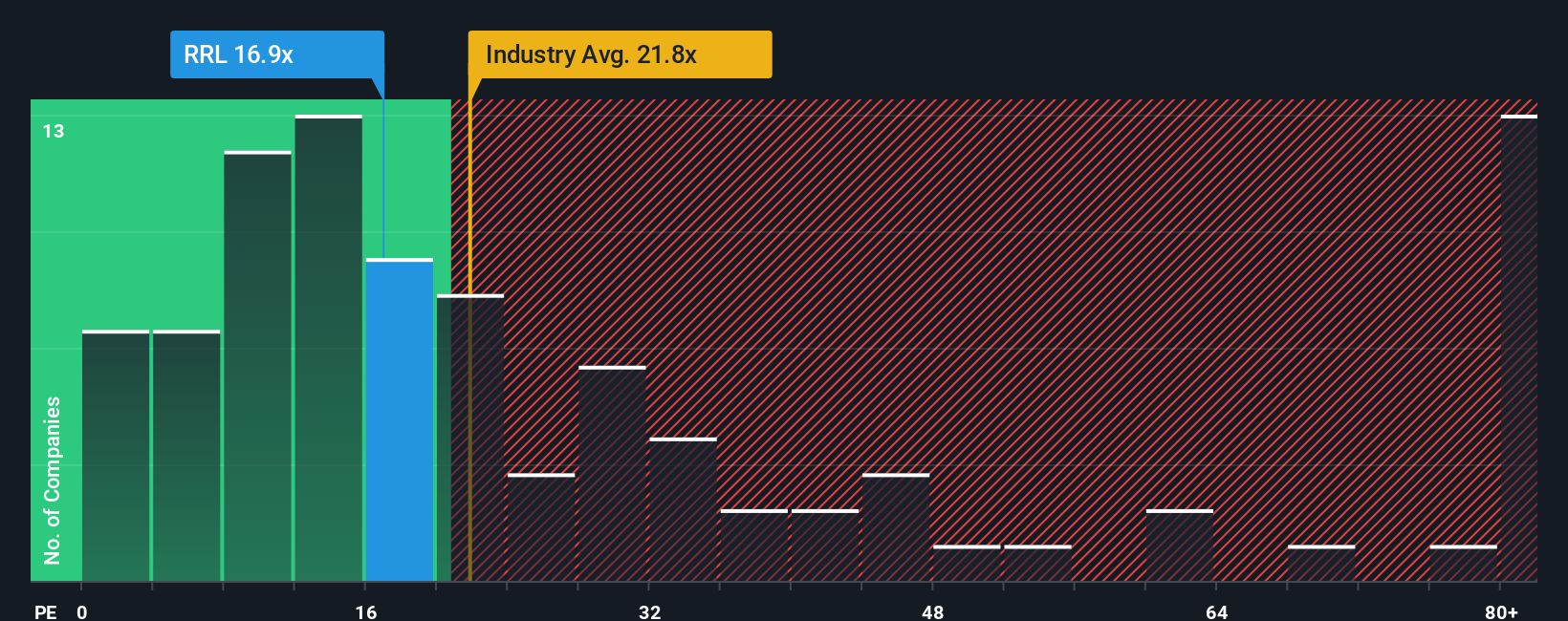

Another View: Market Ratios Tell a Different Story

The narrative based on fair value of A$6.61 points to Regis Resources being 16% overvalued. Yet on simple market ratios, the picture is almost the opposite.

On a P/E of 22.8x, Regis sits below its peer average of 70.6x and just under the Australian Metals and Mining industry at 24x. Our fair ratio estimate is 26.9x, which is higher than where the shares trade today.

That mix of an overvalued narrative price and comparatively low current P/E raises a practical question for you: is the risk in the story assumptions or in how long the market might take to close that gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regis Resources Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Regis Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Regis Resources has sparked your interest, do not stop there. Broaden your watchlist with a few targeted ideas that might suit different parts of your portfolio.

- Spot potential value by scanning these 877 undervalued stocks based on cash flows that line up current prices with underlying cash flows.

- Target future growth themes by checking out these 25 AI penny stocks tapping into advances in artificial intelligence.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報