Starbucks (SBUX) Valuation In Focus As MrBeast Tie Up And Disney Return Spark Fresh Interest

Why Starbucks is back in focus

Starbucks (SBUX) is drawing fresh attention after a flurry of consumer facing moves, including a MrBeast marketing tie up, renewed inclusion in Disney park dining plans, and an ongoing overhaul of its North American store footprint.

See our latest analysis for Starbucks.

The recent MrBeast tie in, Disney Dining Plan return and North American store reshaping come as Starbucks’ 90 day share price return of 11.77% outpaces its 1 year total shareholder return decline of 1.08%. This hints at improving short term momentum after a softer multi year period.

If this kind of brand driven story appeals to you, it could be a good moment to see what else is brewing among fast growing stocks with high insider ownership.

With Starbucks shares up over the last 90 days but showing a negative 3 year and 5 year total return, alongside annual revenue and net income growth, is the market offering a value opportunity or already pricing in the next leg of growth?

Most Popular Narrative: 5% Undervalued

The most followed narrative pegs Starbucks fair value at about US$94, slightly above the last close of US$89.46, which frames the current debate around its turnaround.

The analysts have a consensus price target of $99.379 for Starbucks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of just $73.0.

Want to see what kind of revenue ramp, margin rebuild and future P/E multiple this narrative leans on to support that fair value? The projections are more aggressive than the current financial snapshot suggests, and they rest heavily on how the turnaround filters into earnings power. Curious which assumption does the heavy lifting in that model and how sensitive the value is if it falls short?

Result: Fair Value of $94.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story depends heavily on smoother execution. Labor disputes, along with rising build out and renovation costs, could easily keep margins and traffic under pressure for longer.

Find out about the key risks to this Starbucks narrative.

Another View: Rich P/E Puts Pressure On The Story

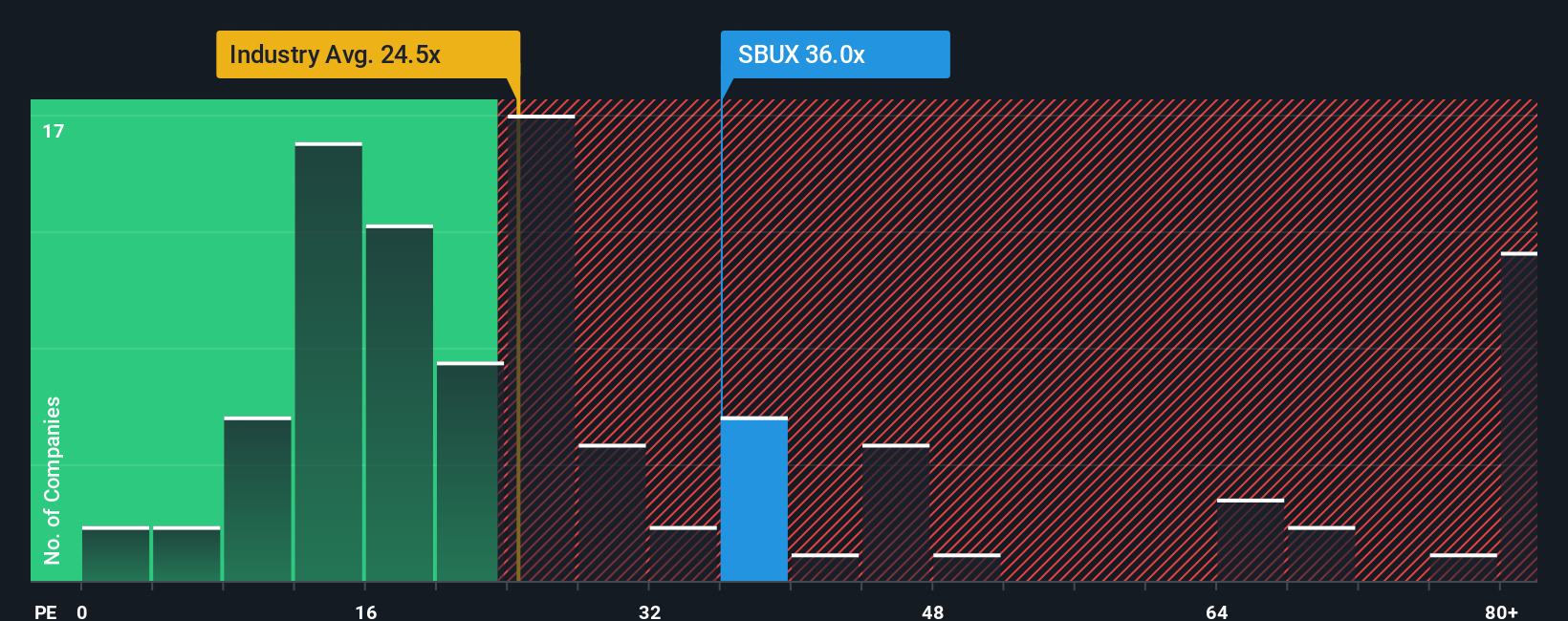

The analyst narrative suggests Starbucks is about 5% undervalued around a fair value of US$94. Yet on earnings, the current P/E of 54.8x sits above the US Hospitality industry at 22x, the peer average at 50.6x, and even our fair ratio of 38.9x.

That gap effectively prices Starbucks on a richer multiple than both peers and the level our fair ratio points to as a place the market could move toward. This raises the question of how much execution room is left before sentiment shifts toward that lower P/E anchor.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Starbucks Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a custom Starbucks valuation in just a few minutes: Do it your way.

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Starbucks has you thinking harder about where you put your money next, do not stop here. The screener can surface other angles you might otherwise miss.

- Explore potential income options by reviewing these 11 dividend stocks with yields > 3% that focus on meaningful cash returns to shareholders.

- Explore longer term themes by checking out these 25 AI penny stocks linked to artificial intelligence adoption across sectors.

- Look for potential value opportunities by scanning these 877 undervalued stocks based on cash flows that trade below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報