Gentex (GNTX) Valuation Check As CES 2026 Tech Showcase Draws Fresh Investor Interest

Gentex (GNTX) is drawing fresh attention as it prepares to showcase its Full Display Mirror with Dynamic View Assist and mirror integrated monitoring systems at CES 2026, alongside a push into smart home and biometrics.

See our latest analysis for Gentex.

While Gentex is rolling out new CES showcases around digital mirrors and monitoring systems, the share price tells a mixed story. The recent 7 day share price return is 3.9%, and the 1 year total shareholder return shows a 9.41% decline from a base of $24.48. This suggests that short term momentum has picked up even as longer term returns have been weaker.

If you are looking beyond Gentex for other auto suppliers and manufacturers, this could be a useful moment to review auto manufacturers as potential additions to your watchlist.

With Gentex shares around $24.48, a value score of 3, and the stock at roughly a 24% discount to one intrinsic estimate and a 22% discount to analyst targets, the key question is whether this signals a genuine opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 17.9% Undervalued

With Gentex last closing at $24.48 against a narrative fair value of $29.81, the valuation depends heavily on how future products and margins develop.

Gentex is investing heavily in next-generation technologies such as large area dimmable devices and advanced driver monitoring systems, both of which are closely aligned with the growing demand for vehicle electrification, safety, and in-cabin monitoring, representing significant medium-term growth drivers for revenue and profitability.

This raises the question of what kind of revenue path and margin profile could support that higher fair value. The narrative centers on steady cash generation, a richer product mix, and a future earnings multiple that reflects Gentex maintaining its role in automaker dashboards.

Result: Fair Value of $29.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture can change quickly if decontenting in China and any integration setbacks at VOXX weigh more heavily on Gentex’s margins and revenue mix.

Find out about the key risks to this Gentex narrative.

Another View: What The Market Multiple Is Saying

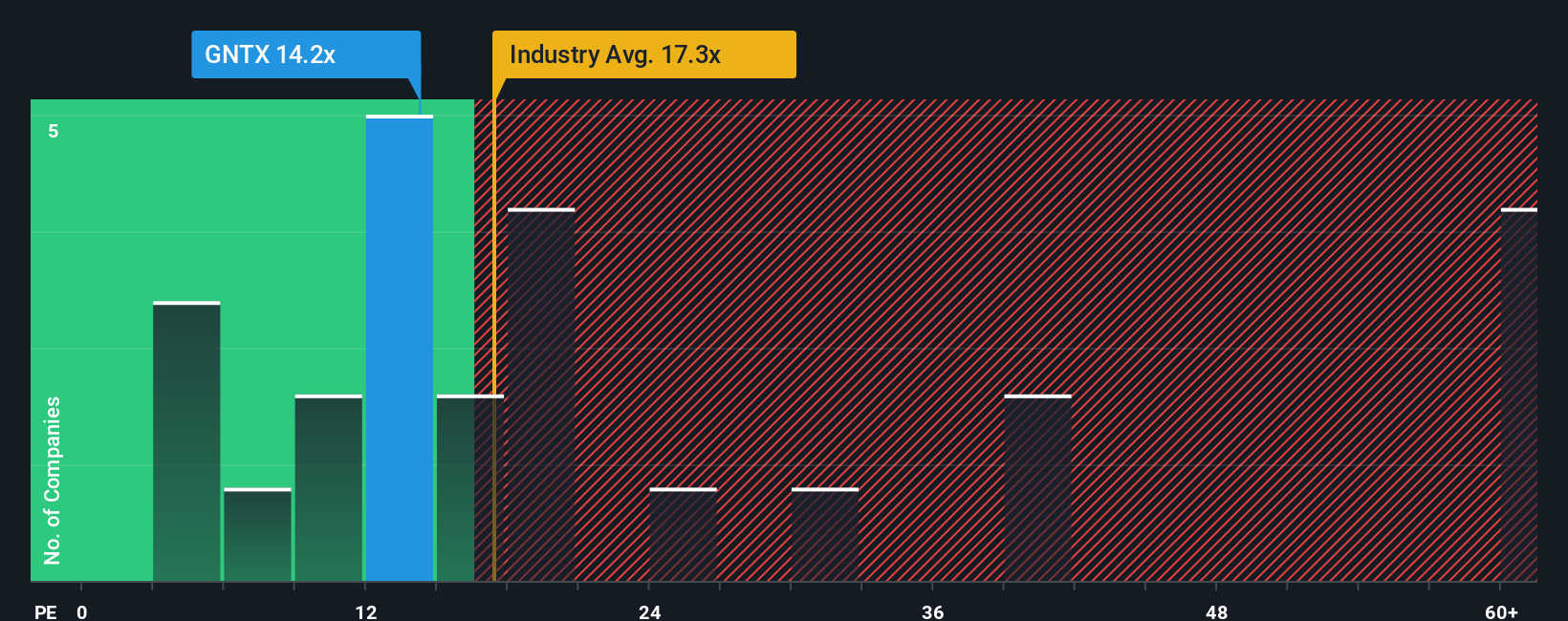

While the narrative fair value and DCF work suggest Gentex is undervalued, the current P/E of 14.3x is slightly above both its fair ratio of 14.2x and peer average of 13.4x, even though it sits below the wider US Auto Components average of 19x. That mix of small premium and discount raises a simple question for you: is this more of a valuation cushion or a sign that the easy upside has already been taken?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gentex Narrative

If you see Gentex differently, or prefer to weigh the numbers yourself, you can build a full narrative in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Gentex.

Ready For Your Next Investing Move?

If Gentex has sharpened your thinking, do not stop here. Use focused screeners to spot ideas that match your goals before others move first.

- Target high potential price shifts with these 3556 penny stocks with strong financials that already show stronger balance sheets and cash flow support than many expect from lower priced shares.

- Position your portfolio for structural tech change by reviewing these 25 AI penny stocks tied to artificial intelligence themes across hardware, software, and data infrastructure.

- Concentrate on valuation discipline by scanning these 877 undervalued stocks based on cash flows that screen as cheap relative to their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報